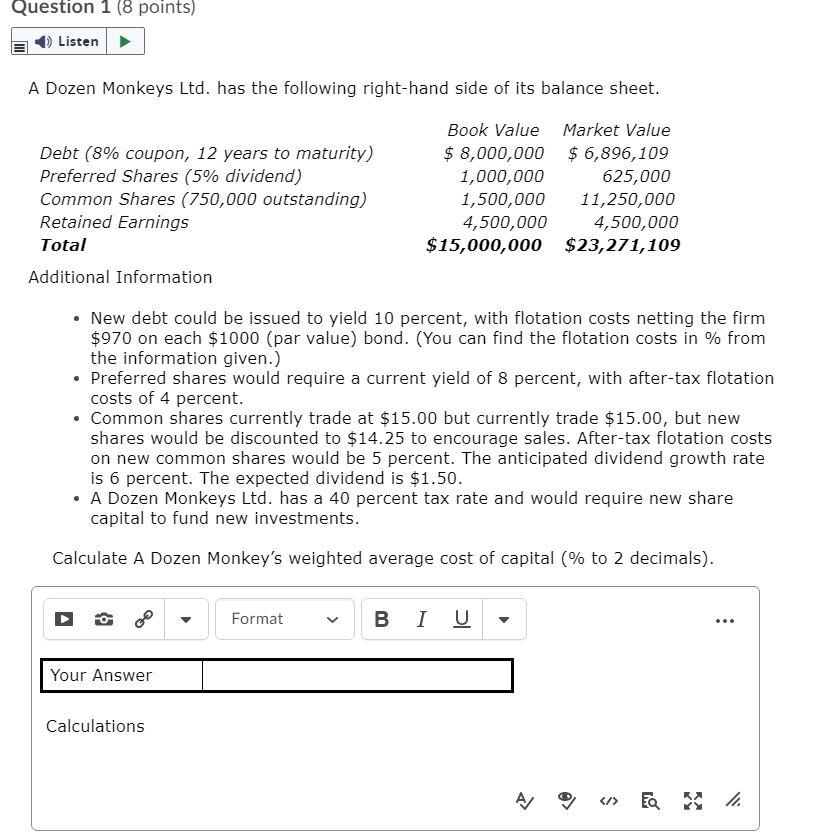

Question: Question 1 (8 points) Listen A Dozen Monkeys Ltd. has the following right-hand side of its balance sheet. Book Value Market Value Debt (8% coupon,

Question 1 (8 points) Listen A Dozen Monkeys Ltd. has the following right-hand side of its balance sheet. Book Value Market Value Debt (8% coupon, 12 years to maturity) $ 8,000,000 $6,896,109 Preferred Shares (5% dividend) 1,000,000 625,000 Common Shares (750,000 outstanding) 1,500,000 11,250,000 Retained Earnings 4,500,000 4,500,000 Total $15,000,000 $23,271,109 Additional Information New debt could be issued to yield 10 percent, with flotation costs netting the firm $970 on each $1000 (par value) bond. (You can find the flotation costs in % from the information given.) Preferred shares would require a current yield of 8 percent, with after-tax flotation costs of 4 percent. Common shares currently trade at $15.00 but currently trade $15.00, but new shares would be discounted to $14.25 to encourage sales. After-tax flotation costs on new common shares would be 5 percent. The anticipated dividend growth rate is 6 percent. The expected dividend is $1.50. A Dozen Monkeys Ltd. has a 40 percent tax rate and would require new share capital to fund new investments. Calculate A Dozen Monkey's weighted average cost of capital (% to 2 decimals). A Format BI U ... Your Answer Calculations /> Question 1 (8 points) Listen A Dozen Monkeys Ltd. has the following right-hand side of its balance sheet. Book Value Market Value Debt (8% coupon, 12 years to maturity) $ 8,000,000 $6,896,109 Preferred Shares (5% dividend) 1,000,000 625,000 Common Shares (750,000 outstanding) 1,500,000 11,250,000 Retained Earnings 4,500,000 4,500,000 Total $15,000,000 $23,271,109 Additional Information New debt could be issued to yield 10 percent, with flotation costs netting the firm $970 on each $1000 (par value) bond. (You can find the flotation costs in % from the information given.) Preferred shares would require a current yield of 8 percent, with after-tax flotation costs of 4 percent. Common shares currently trade at $15.00 but currently trade $15.00, but new shares would be discounted to $14.25 to encourage sales. After-tax flotation costs on new common shares would be 5 percent. The anticipated dividend growth rate is 6 percent. The expected dividend is $1.50. A Dozen Monkeys Ltd. has a 40 percent tax rate and would require new share capital to fund new investments. Calculate A Dozen Monkey's weighted average cost of capital (% to 2 decimals). A Format BI U ... Your Answer Calculations />

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts