Question: Question 1 ( a ) and 2 ( a ) are related to Ace Innovathon Sdn . Bhd . Ace Innovathon Sdn . Bhd .

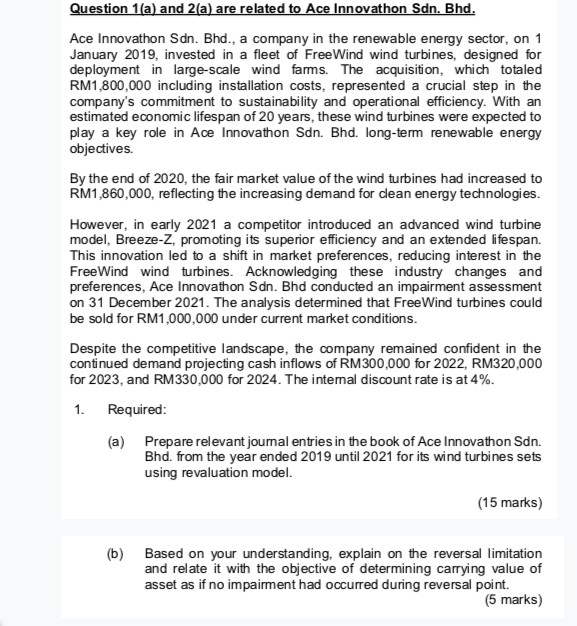

Question a and a are related to Ace Innovathon Sdn Bhd Ace Innovathon Sdn Bhd a company in the renewable energy sector, on January invested in a fleet of FreeWind wind turbines, designed for deployment in largescale wind farms. The acquisition, which totaled RM including installation costs, represented a crucial step in the company's commitment to sustainability and operational efficiency. With an estimated economic lifespan of years, these wind turbines were expected to play a key role in Ace Innovathon Sdn Bhd longterm renewable energy objectives. By the end of the fair market value of the wind turbines had increased to RM reflecting the increasing demand for clean energy technologies. However, in early a competitor introduced an advanced wind turbine model, BreezeZ promoting its superior efficiency and an extended lifespan. This innovation led to a shift in market preferences, reducing interest in the FreeWind wind turbines. Acknowledging these industry changes and preferences, Ace Innovathon Sdn Bhd conducted an impairment assessment on December The analysis determined that FreeWind turbines could be sold for RM under current market conditions. Despite the competitive landscape, the company remained confident in the continued demand projecting cash inflows of RM for RM for and RM for The internal discount rate is at Required: a Prepare relevant journal entries in the book of Ace Innovathon Sdn Bhd from the year ended until for its wind turbines sets using revaluation model. b Based on your understanding, explain on the reversal limitation and relate it with the objective of determining carrying value of asset as if no impairment had occurred during reversal point.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock