Question: answer the question in english.. iv. Additional Information: QUESTION 1 (30 marks) En Adam, an accountant at Ehsan Manufacturing Sdn Bhd (EMSB). He is preparing

answer the question in english..

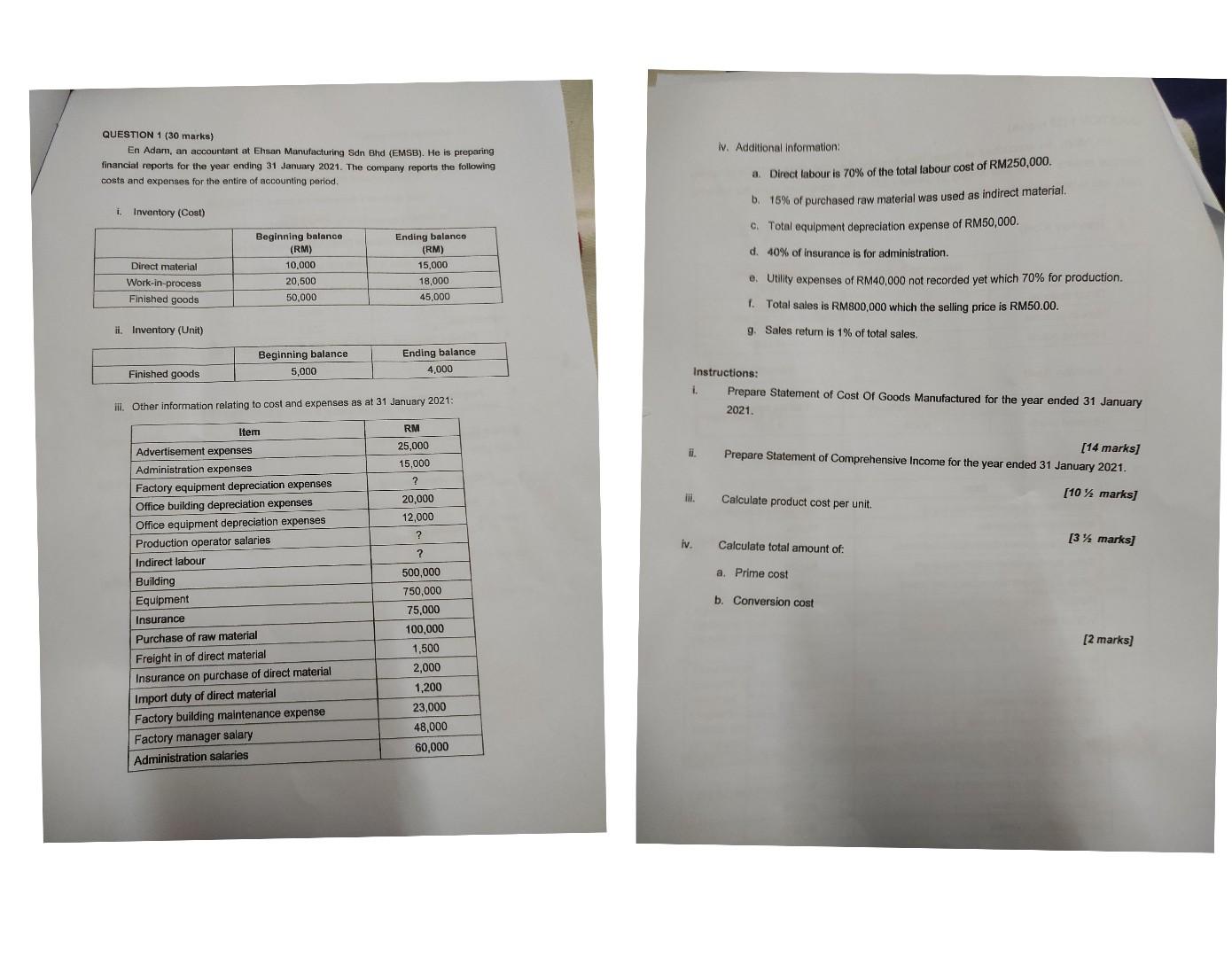

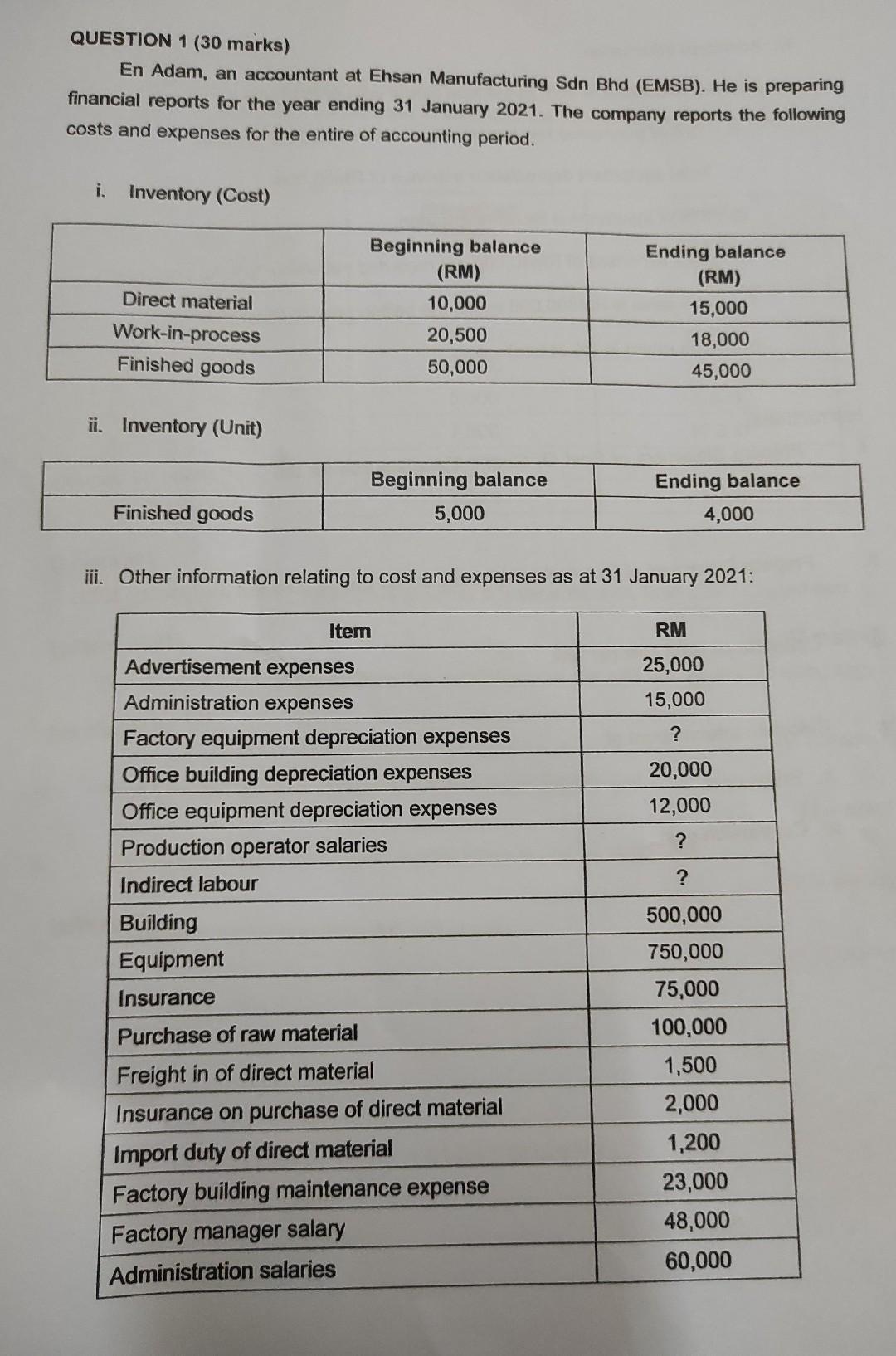

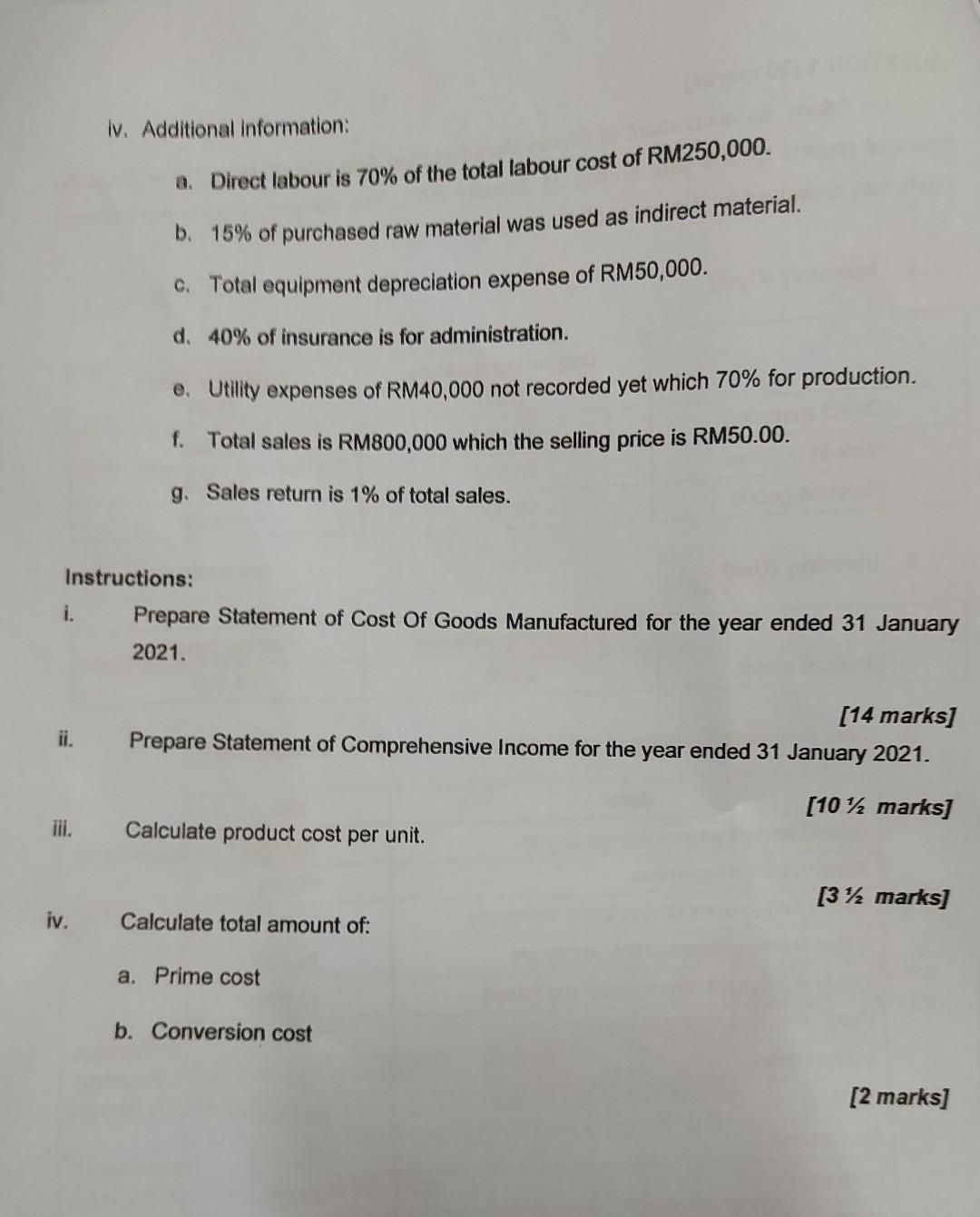

iv. Additional Information: QUESTION 1 (30 marks) En Adam, an accountant at Ehsan Manufacturing Sdn Bhd (EMSB). He is preparing financial reports for the year ending 31 January 2021. The company reports the following costs and expenses for the entire of accounting period a. Direct labour is 70% of the total labour cost of RM250,000. i. Inventory (Cost) b. 15% of purchased raw material was used as indirect material. c. Total equipment depreciation expense of RM50,000. d. 40% of insurance is for administration. Direct material Work-in-process Finished goods Beginning balance (RM) 10,000 20,500 50,000 Ending balance (RM) 15,000 18,000 45,000 e. Utility expenses of RM40,000 not recorded yet which 70% for production. 1. Total sales is RM800,000 which the selling price is RM50.00. il. Inventory (Unit) g. Sales return is 1% of total sales. Beginning balance 5,000 Ending balance 4.000 Finished goods Instructions: i. Prepare Statement of Cost Of Goods Manufactured for the year ended 31 January 2021. ill. Other information relating to cost and expenses as at 31 January 2021: RM ii. [14 marks] Prepare Statement of Comprehensive Income for the year ended 31 January 2021. Item Advertisement expenses Administration expenses Factory equipment depreciation expenses Office building depreciation expenses Office equipment depreciation expenses Production operator salaries Indirect labour 25,000 15,000 ? 20,000 12,000 ? ili. Calculate product cost per unit. (10% marks] [3% marks) iv. Calculate total amount of: ? 500,000 a. Prime cost Building b. Conversion cost [2 marks] Equipment Insurance Purchase of raw material Freight in of direct material Insurance on purchase of direct material Import duty of direct material Factory building maintenance expense Factory manager salary Administration salaries 750,000 75,000 100,000 1,500 2,000 1,200 23,000 48,000 60,000 QUESTION 1 (30 marks) En Adam, an accountant at Ehsan Manufacturing Sdn Bhd (EMSB). He is preparing financial reports for the year ending 31 January 2021. The company reports the following costs and expenses for the entire of accounting period. i. Inventory (Cost) Direct material Work-in-process Finished goods Beginning balance (RM) 10,000 20,500 50,000 Ending balance (RM) 15,000 18,000 45,000 ii. Inventory (Unit) Beginning balance 5,000 Finished goods Ending balance 4,000 iii. Other information relating to cost and expenses as at 31 January 2021: Item RM Advertisement expenses 25,000 15,000 ? 20,000 12,000 ? Administration expenses Factory equipment depreciation expenses Office building depreciation expenses Office equipment depreciation expenses Production operator salaries Indirect labour Building Equipment Insurance ? Purchase of raw material Freight in of direct material Insurance on purchase of direct material Import duty of direct material Factory building maintenance expense Factory manager salary Administration salaries 500,000 750,000 75,000 100,000 1,500 2,000 1,200 23,000 48,000 60,000 iv. Additional Information: a. Direct labour is 70% of the total labour cost of RM250,000. b. 15% of purchased raw material was used as indirect material. c. Total equipment depreciation expense of RM50,000. d. 40% of insurance is for administration. e. Utility expenses of RM40,000 not recorded yet which 70% for production. f. Total sales is RM800,000 which the selling price is RM50.00. g. Sales return is 1% of total sales. Instructions: i. Prepare Statement of Cost Of Goods Manufactured for the year ended 31 January 2021. [14 marks] Prepare Statement of Comprehensive Income for the year ended 31 January 2021. ii. (10 72 marks] iii. Calculate product cost per unit. [3/2 marks] iv. Calculate total amount of: a. Prime cost b. Conversion cost [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts