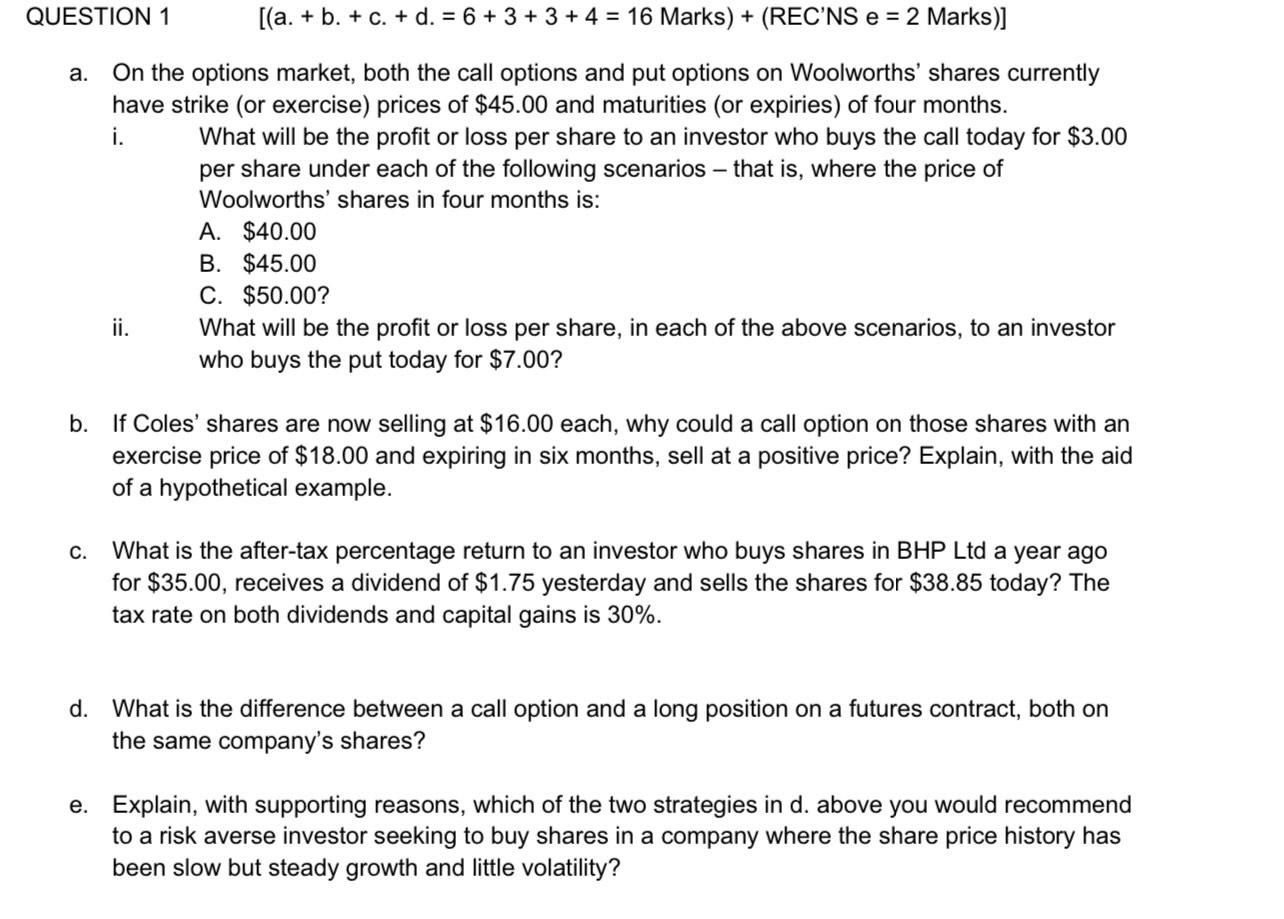

Question: QUESTION 1 [(a. + b. + C. + d. = 6 + 3 + 3 + 4 = 16 Marks) + (RECNS e = 2

QUESTION 1 [(a. + b. + C. + d. = 6 + 3 + 3 + 4 = 16 Marks) + (RECNS e = 2 Marks)] a. On the options market, both the call options and put options on Woolworths' shares currently have strike (or exercise) prices of $45.00 and maturities (or expiries) of four months. i. What will be the profit or loss per share to an investor who buys the call today for $3.00 per share under each of the following scenarios that is, where the price of Woolworths' shares in four months is: A. $40.00 B. $45.00 C. $50.00? ii. What will be the profit or loss per share, in each of the above scenarios, to an investor who buys the put today for $7.00? b. If Coles' shares are now selling at $16.00 each, why could a call option on those shares with an exercise price of $18.00 and expiring in six months, sell at a positive price? Explain, with the aid of a hypothetical example. C. What is the after-tax percentage return to an investor who buys shares in BHP Ltd a year ago for $35.00, receives a dividend of $1.75 yesterday and sells the shares for $38.85 today? The tax rate on both dividends and capital gains is 30%. d. What is the difference between a call option and a long position on a futures contract, both on the same company's shares? e. Explain, with supporting reasons, which of the two strategies in d. above you would recommend to a risk averse investor seeking to buy shares in a company where the share price history has been slow but steady growth and little volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts