Question: Question 1 A basic proposition is that exchange rates adjust so as to maintain the purchasing power parity (PPP): the price of a bundle

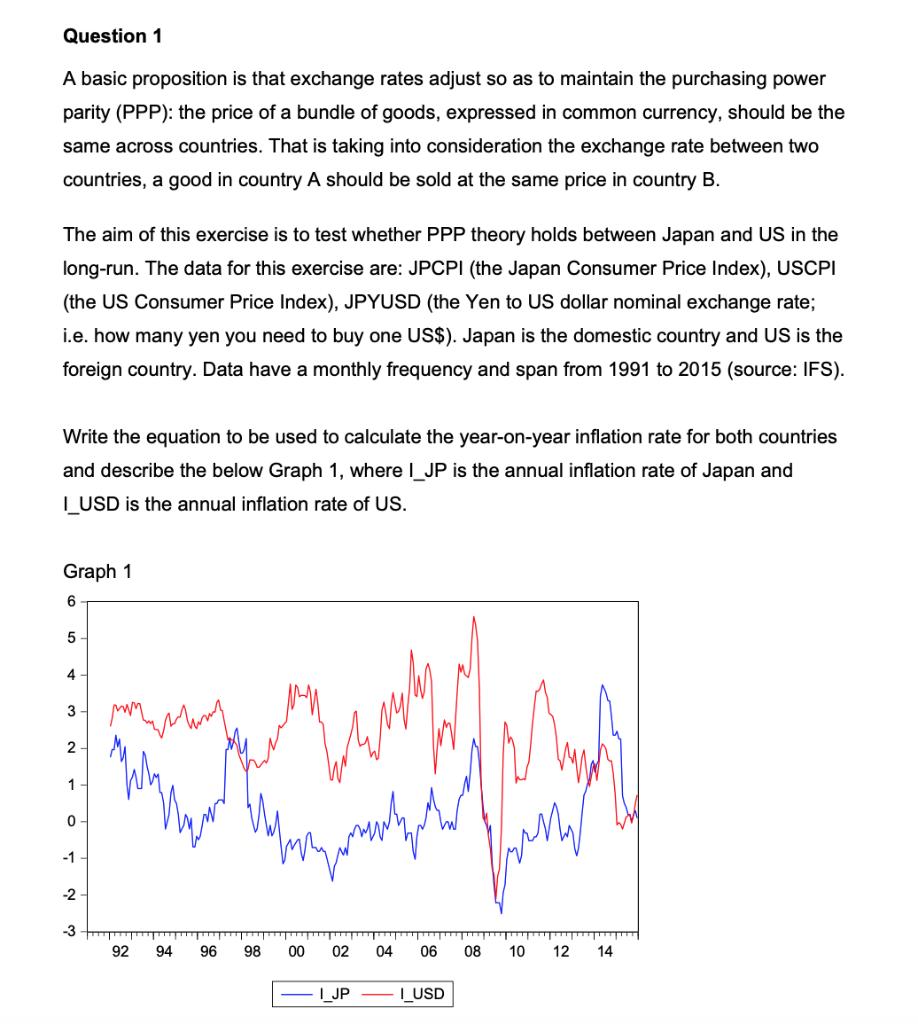

Question 1 A basic proposition is that exchange rates adjust so as to maintain the purchasing power parity (PPP): the price of a bundle of goods, expressed in common currency, should be the same across countries. That is taking into consideration the exchange rate between two countries, a good in country A should be sold at the same price in country B. The aim of this exercise is to test whether PPP theory holds between Japan and US in the long-run. The data for this exercise are: JPCPI (the Japan Consumer Price Index), USCPI (the US Consumer Price Index), JPYUSD (the Yen to US dollar nominal exchange rate; i.e. how many yen you need to buy one US$). Japan is the domestic country and US is the foreign country. Data have a monthly frequency and span from 1991 to 2015 (source: IFS). Write the equation to be used to calculate the year-on-year inflation rate for both countries and describe the below Graph 1, where I_JP is the annual inflation rate of Japan and I USD is the annual inflation rate of US. Graph 1 6 5 4 3 2- M 1 0 -1 -2 mm -3 Wy 92 94 96 98 Verwachen worthy 00 02 04 06 08 10 12 14 I JP I_USD

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

To calculate the yearonyear inflation rate for both countries the ... View full answer

Get step-by-step solutions from verified subject matter experts