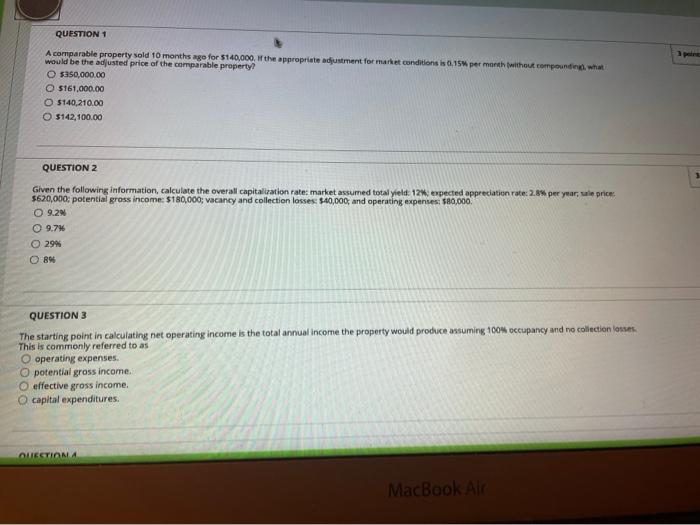

Question: QUESTION 1 A comparable property sold 10 months ago for $140,000. the appropriate adjustment for market conditions is 0.15 per month without compound what would

QUESTION 1 A comparable property sold 10 months ago for $140,000. the appropriate adjustment for market conditions is 0.15 per month without compound what would be the adjusted price of the comparable property? 5350,000.00 5161,000.00 O 5140,210.00 O $142,100.00 QUESTION 2 Given the following information, calculate the overall capitalization rate market assumed total yield: 12 expected appreciation rate:2.8 per year, ale price 5620,000, potential gross income: $180,000, vacancy and collection losses: $40,000, and operating expenses: $80,000 9.29 9.7* 29% B QUESTION 3 The starting point in calculating net operating income is the total annual income the property would produce assuming 100% occupancy and no collection one This is commonly referred to as O operating expenses. O potential gross income. effective gross income. O capital expenditures. LECTION MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts