Question: Question 1. a. Compute the composite rate. b. Compute the composite life. c. Prepare journal entry to record the depreciation for the current year following

Question 1.

a. Compute the composite rate.

b. Compute the composite life.

c. Prepare journal entry to record the depreciation for the current year following the composite method.

d . Prepare journal entry to record the retirement of the machinery at the end of the fifth year assuming the proceeds from retirement amount to P40,000 .

e. Prepare journal entry to record the depreciation for the sixth year following the composite method .

(please see the picture below ? for the compelete questions so that you will understand)

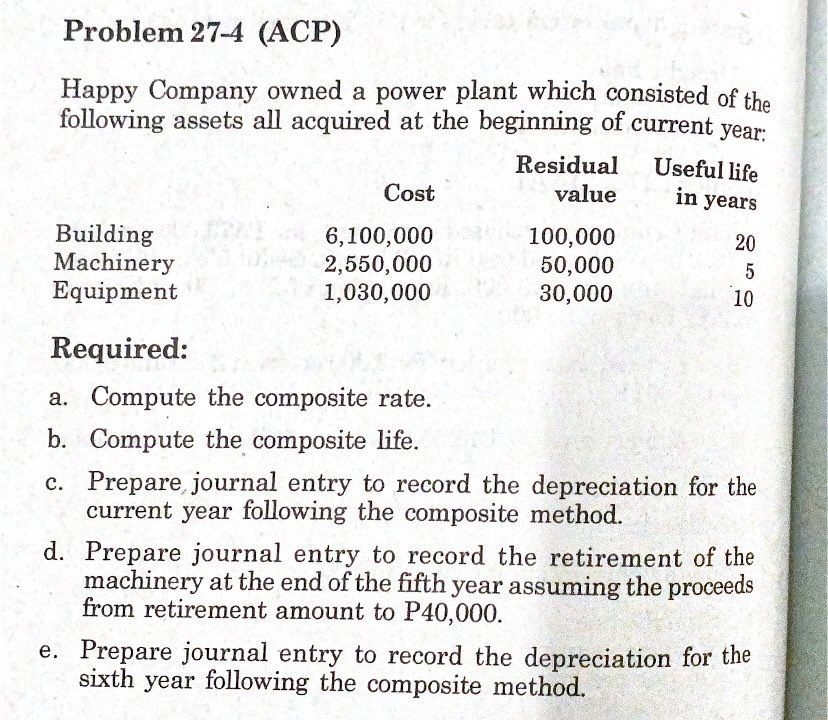

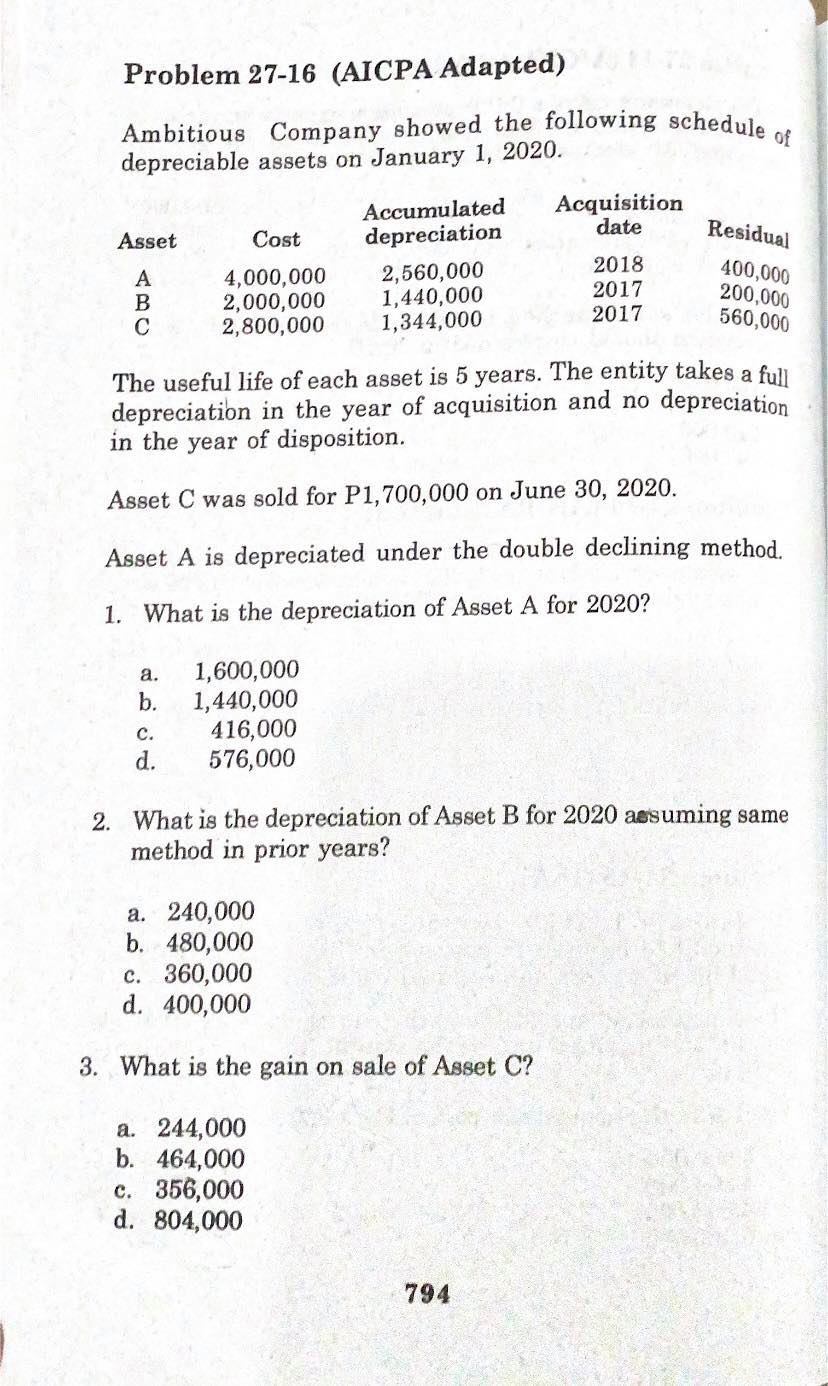

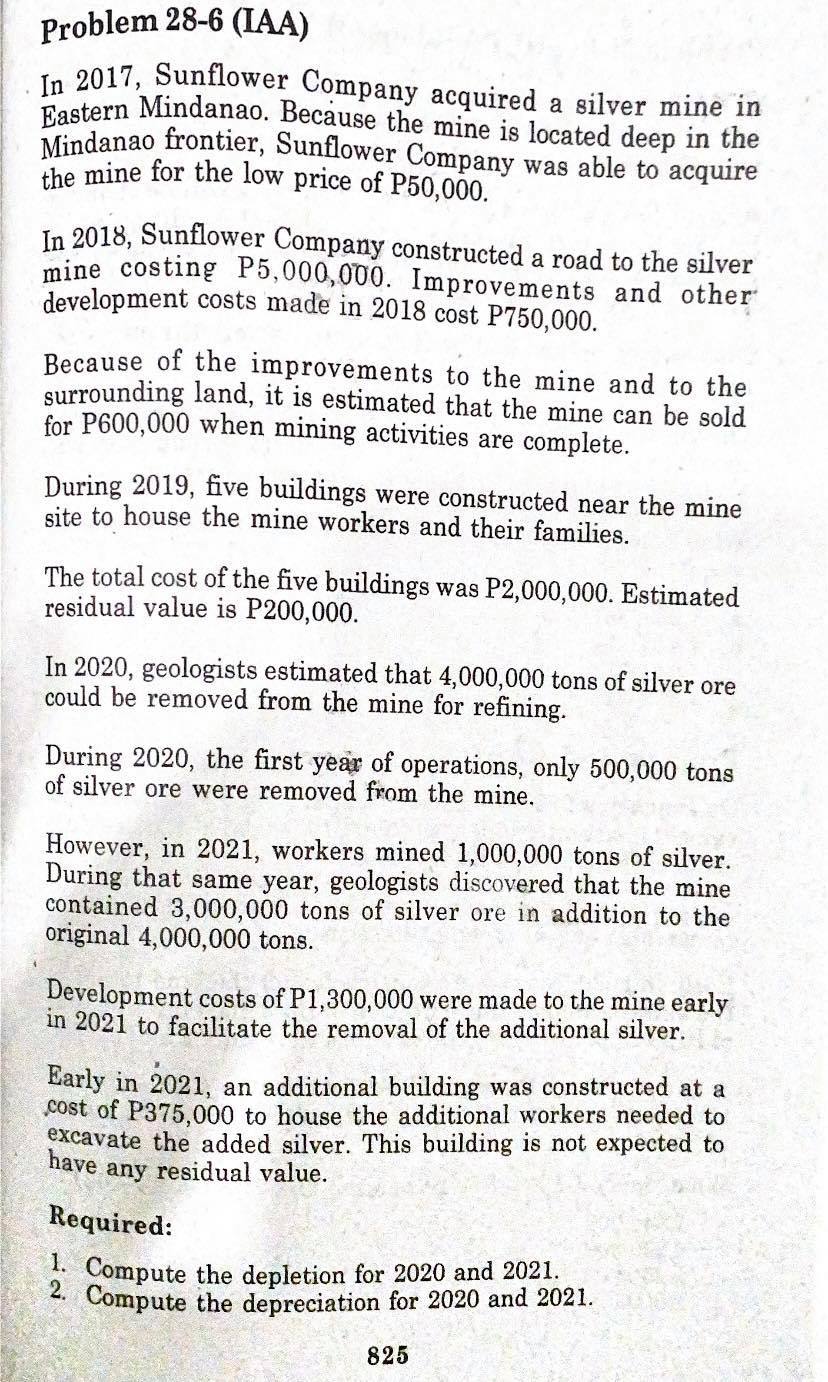

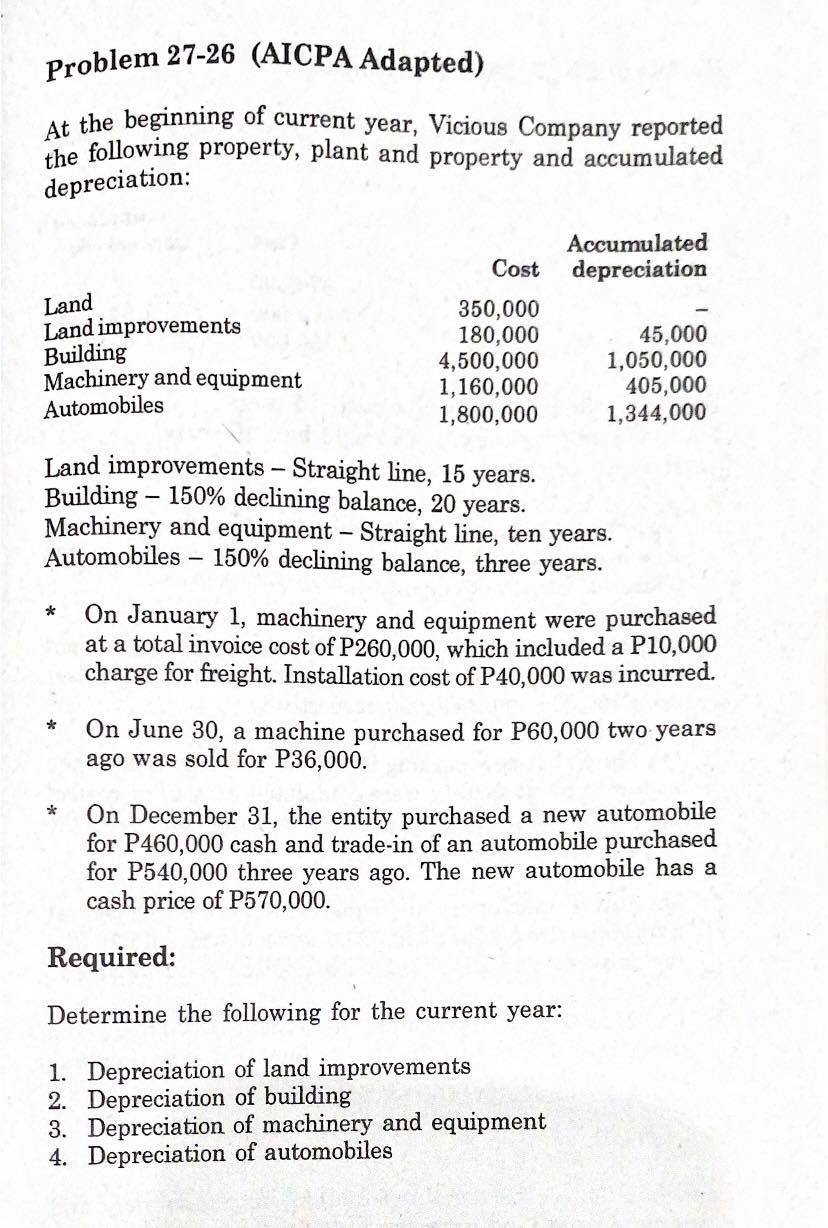

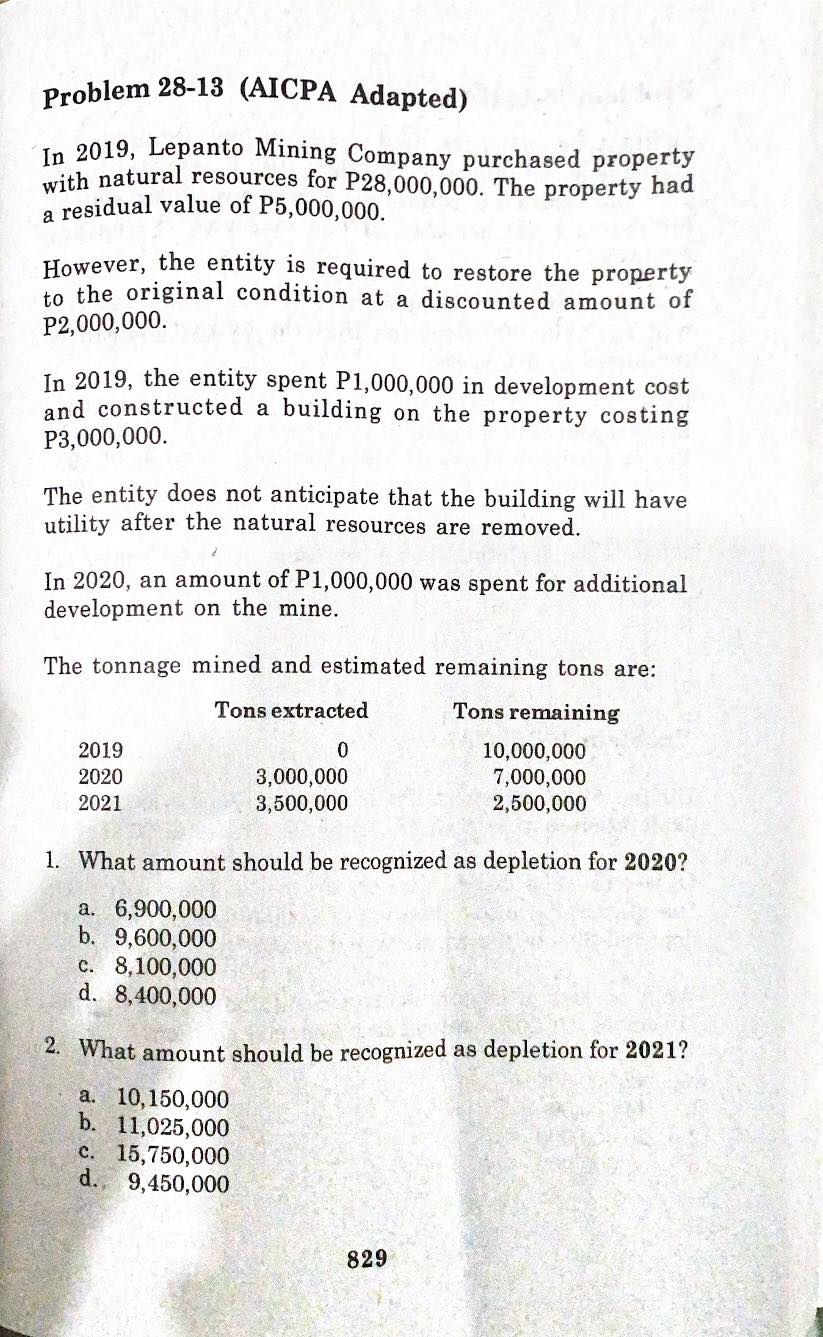

Problem 27-4 (ACP) Happy Company owned a power plant which consisted of the following assets all acquired at the beginning of current year: Residual Useful life Cost value in years Building 6, 100,000 100,000 20 Machinery 2,550,000 50,000 5 Equipment 1,030,000 30,000 10 Required: a. Compute the composite rate. b. Compute the composite life. c. Prepare journal entry to record the depreciation for the current year following the composite method. d. Prepare journal entry to record the retirement of the machinery at the end of the fifth year assuming the proceeds from retirement amount to P40,000. e. Prepare journal entry to record the depreciation for the sixth year following the composite method.Problem 27-16 (AICPA Adapted) Ambitious Company showed the following schedule of depreciable assets on January 1, 2020. Accumulated Acquisition Asset Cost depreciation date Residual A 4,000,000 2,560,000 2018 400,000 B 2,000,000 1,440,000 2017 200,000 2,800,000 1,344,000 2017 560,000 The useful life of each asset is 5 years. The entity takes a full depreciation in the year of acquisition and no depreciation in the year of disposition. Asset C was sold for P1, 700,000 on June 30, 2020. Asset A is depreciated under the double declining method. 1. What is the depreciation of Asset A for 2020? a. 1,600,000 b. 1,440,000 416,000 P 576,000 2. What is the depreciation of Asset B for 2020 assuming same method in prior years? a. 240,000 b. 480,000 c. 360,000 d. 400,000 3. What is the gain on sale of Asset C? a. 244,000 b. 464,000 c. 356,000 d. 804,000 794Problem 28-6 (IAA) In 2017, Sunflower Company acquired a silver mine in Eastern Mindanao. Because the mine is located deep in the Mindanao frontier, Sunflower Company was able to acquire the mine for the low price of P50,000. In 2018, Sunflower Company constructed a road to the silver mine costing P5,000,000. Improvements and other development costs made in 2018 cost P750,000. Because of the improvements to the mine and to the surrounding land, it is estimated that the mine can be sold for P600,000 when mining activities are complete. During 2019, five buildings were constructed near the mine site to house the mine workers and their families. The total cost of the five buildings was P2,000,000. Estimated residual value is P200,000. In 2020, geologists estimated that 4,000,000 tons of silver ore could be removed from the mine for refining. During 2020, the first year of operations, only 500,000 tons of silver ore were removed from the mine. However, in 2021, workers mined 1,000,000 tons of silver. During that same year, geologists discovered that the mine contained 3,000,000 tons of silver ore in addition to the original 4,000,000 tons. Development costs of P1,300,000 were made to the mine early in 2021 to facilitate the removal of the additional silver. Early in 2021, an additional building was constructed at a cost of P375,000 to house the additional workers needed to excavate the added silver. This building is not expected to have any residual value. Required: 1. Compute the depletion for 2020 and 2021. 2. Compute the depreciation for 2020 and 2021. 825Problem 27-26 (AICPA Adapted) At the beginning of current year, Vicious Company reported the following property, plant and property and accumulated depreciation: Accumulated Cost depreciation Land 350,000 Land improvements 180,000 45,000 Building 4,500,000 Machinery and equipment 1,050,000 1,160,000 405,000 Automobiles 1,800,000 1,344,000 Land improvements - Straight line, 15 years. Building - 150% declining balance, 20 years. Machinery and equipment - Straight line, ten years. Automobiles - 150% declining balance, three years. * On January 1, machinery and equipment were purchased at a total invoice cost of P260,000, which included a P10,000 charge for freight. Installation cost of P40,000 was incurred. On June 30, a machine purchased for P60,000 two years ago was sold for P36,000. On December 31, the entity purchased a new automobile for P460,000 cash and trade-in of an automobile purchased for P540,000 three years ago. The new automobile has a cash price of P570,000. Required: Determine the following for the current year: 1. Depreciation of land improvements 2. Depreciation of building 3. Depreciation of machinery and equipment 4. Depreciation of automobilesProblem 28-13 (AICPA Adapted) In 2019, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property had a residual value of P5,000,000. However, the entity is required to restore the property to the original condition at a discounted amount of P2,000,000. In 2019, the entity spent P1,000,000 in development cost and constructed a building on the property costing P3,000,000. The entity does not anticipate that the building will have utility after the natural resources are removed. In 2020, an amount of P1,000,000 was spent for additional development on the mine. The tonnage mined and estimated remaining tons are: Tons extracted Tons remaining 2019 0 10,000,000 2020 3,000,000 7,000,000 2021 3,500,000 2,500,000 1. What amount should be recognized as depletion for 2020? a. 6,900,000 b. 9,600,000 C. 8,100,000 d. 8,400,000 2. What amount should be recognized as depletion for 2021? a. 10, 150,000 b. 11,025,000 C. 15,750,000 d., 9,450,000 829