Question: QUESTION 1 A new machine is to be purchased for $200,000. The company believes it will generate $75,000 annually in revenue due to the purchase

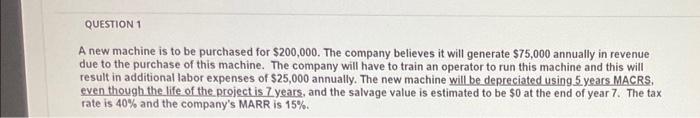

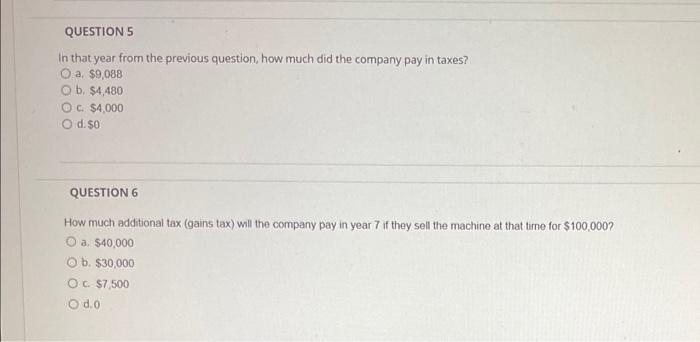

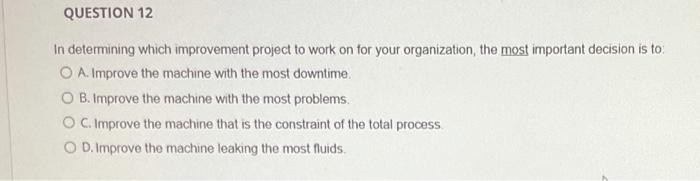

QUESTION 1 A new machine is to be purchased for $200,000. The company believes it will generate $75,000 annually in revenue due to the purchase of this machine. The company will have to train an operator to run this machine and this will result in additional labor expenses of $25,000 annually. The new machine will be depreciated using 5 years MACRS. even though the life of the project is 7 years, and the salvage value is estimated to be $0 at the end of year 7. The tax rate is 40% and the company's MARR is 15%. QUESTION 5 In that year from the previous question, how much did the company pay in taxes? O a. $9,088 O b. $4,480 OC. $4,000 O d. $0 QUESTION 6 How much additional tax (gains tax) will the company pay in year 7 if they sell the machine at that time for $100,000? O a. $40,000 b. $30,000 O c. $7,500 O d.o QUESTION 12 In determining which improvement project to work on for your organization, the most important decision is to: O A. Improve the machine with the most downtime. O B. Improve the machine with the most problems. O C. Improve the machine that is the constraint of the total process O D. Improve the machine leaking the most fluids

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts