Question: Question 1. (a) Someone is using the discount yield to estimate the interest rate on a two-year coupon bond with 10% coupon paid annually. Will

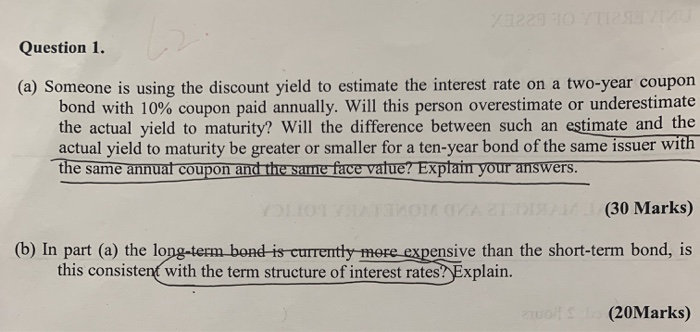

Question 1. (a) Someone is using the discount yield to estimate the interest rate on a two-year coupon bond with 10% coupon paid annually. Will this person overestimate or underestimate the actual yield to maturity? Will the difference between such an estimate and the actual yield to maturity be greater or smaller for a ten-year bond of the same issuer with the e same annuat coupon and the same face vatue? Exptaim your answers (30 Marks) (b) In part (a) the long-term bond is currently-mere expensive than the short-term bond, is this consistenf with the term structure of interest rates?Explain. (20Marks) Question 1. (a) Someone is using the discount yield to estimate the interest rate on a two-year coupon bond with 10% coupon paid annually. Will this person overestimate or underestimate the actual yield to maturity? Will the difference between such an estimate and the actual yield to maturity be greater or smaller for a ten-year bond of the same issuer with the e same annuat coupon and the same face vatue? Exptaim your answers (30 Marks) (b) In part (a) the long-term bond is currently-mere expensive than the short-term bond, is this consistenf with the term structure of interest rates?Explain. (20Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts