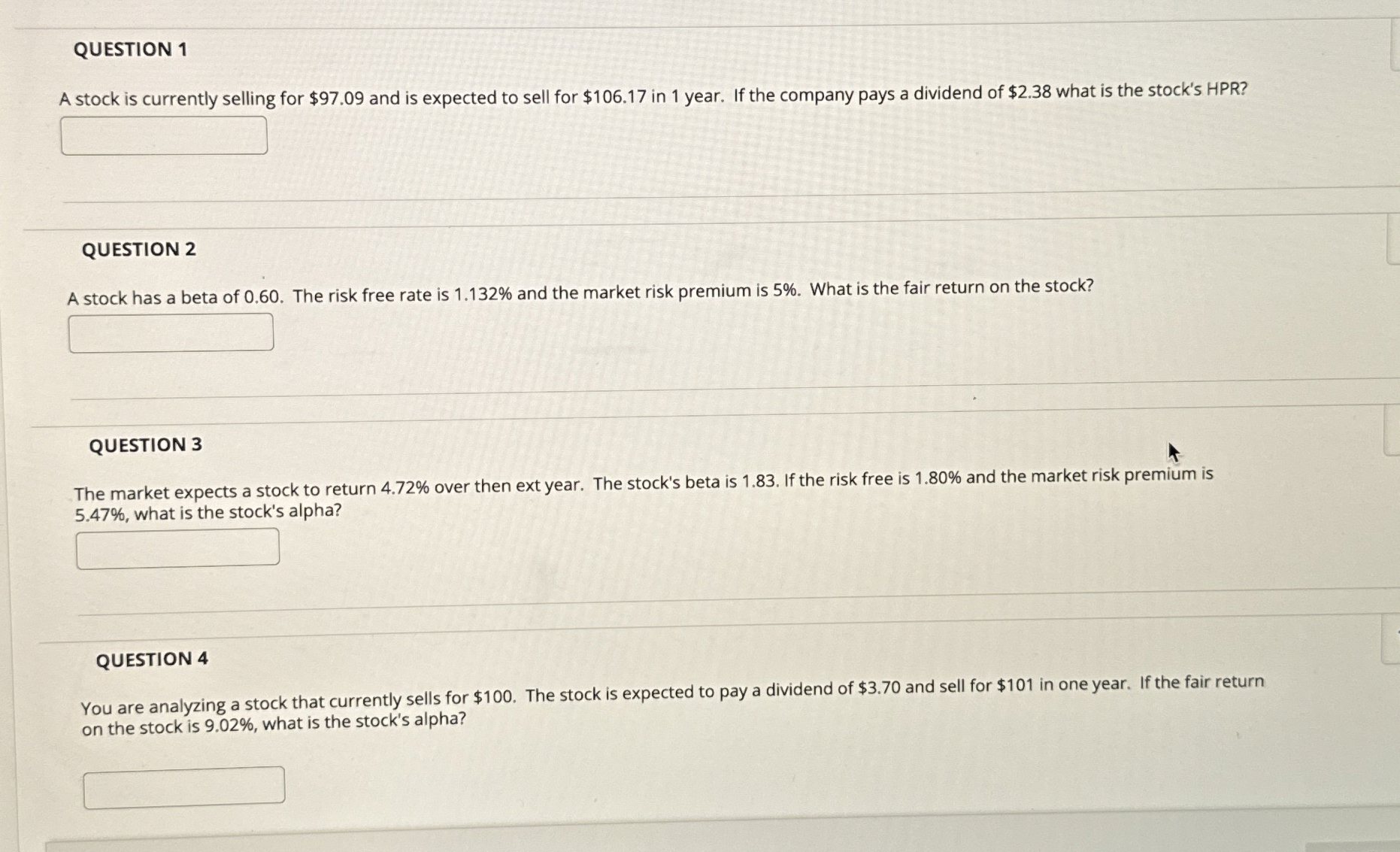

Question: QUESTION 1 A stock is currently selling for $ 9 7 . 0 9 and is expected to sell for $ 1 0 6 .

QUESTION

A stock is currently selling for $ and is expected to sell for $ in year. If the company pays a dividend of $ what is the stock's HPR

QUESTION

A stock has a beta of The risk free rate is and the market risk premium is What is the fair return on the stock?

QUESTION

The market expects a stock to return over then ext year. The stock's beta is If the risk free is and the market risk premium is

what is the stock's alpha?

QUESTION

You are analyzing a stock that currently sells for $ The stock is expected to pay a dividend of $ and sell for $ in one year. If the fair return

on the stock is what is the stock's alpha?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock