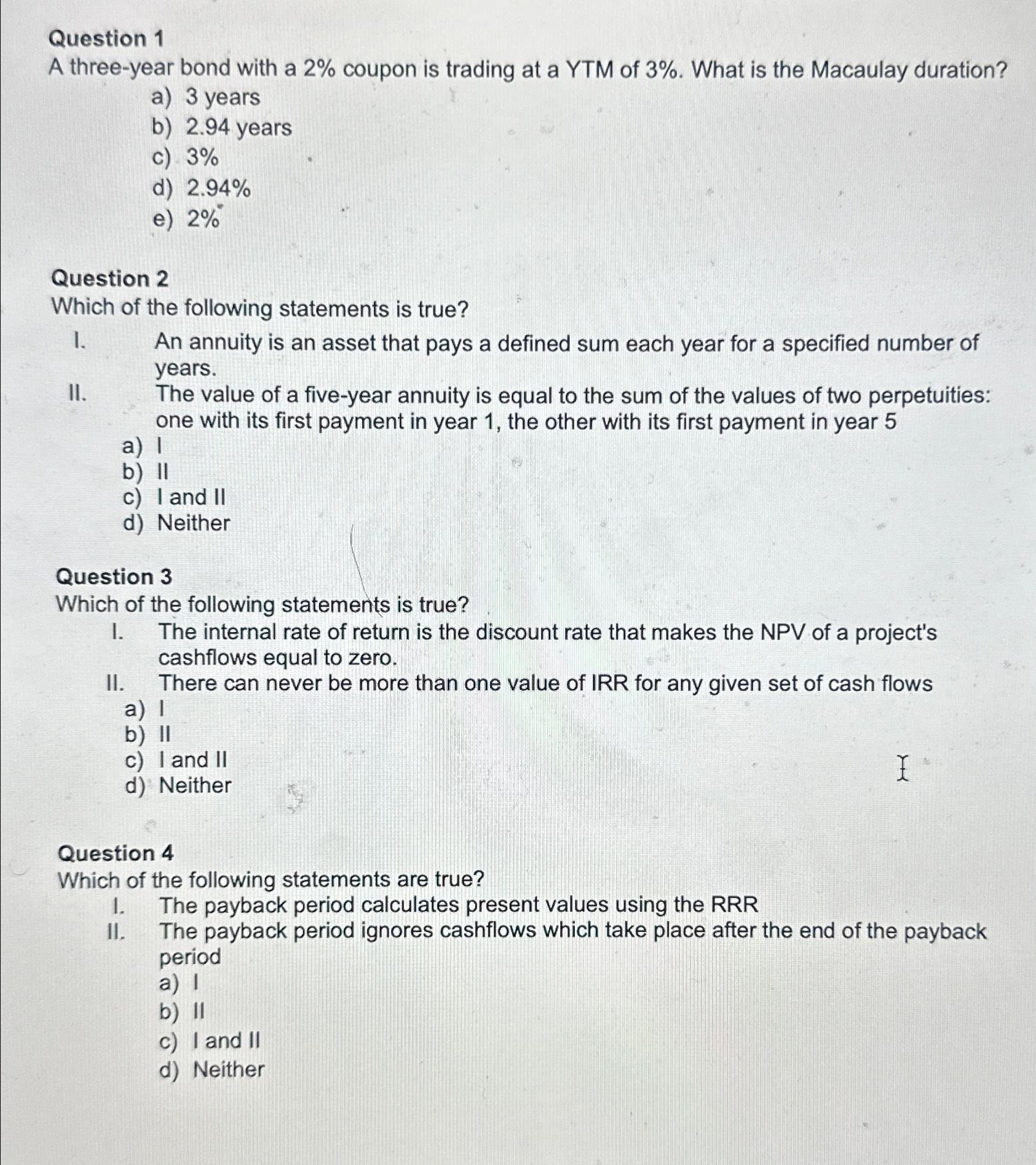

Question: Question 1 A three - year bond with a 2 % coupon is trading at a YTM of 3 % . What is the Macaulay

Question

A threeyear bond with a coupon is trading at a YTM of What is the Macaulay duration?

a years

b years

c

d

e

Question

Which of the following statements is true?

I. An annuity is an asset that pays a defined sum each year for a specified number of years.

II The value of a fiveyear annuity is equal to the sum of the values of two perpetuities: one with its first payment in year the other with its first payment in year

a

b II

c I and II

d Neither

Question

Which of the following statements is true?

I. The internal rate of return is the discount rate that makes the NPV of a project's cashflows equal to zero.

II There can never be more than one value of IRR for any given set of cash flows

a

b II

c I and II

d Neither

Question

Which of the following statements are true?

I. The payback period calculates present values using the RRR

II The payback period ignores cashflows which take place after the end of the payback period

a

b II

c I and II

d Neither

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock