Question: QUESTION 1 (a) Using a diagram, explain the difference between industry-specific and market risk. (6 marks) (b) The risk free rate is 10%, the average

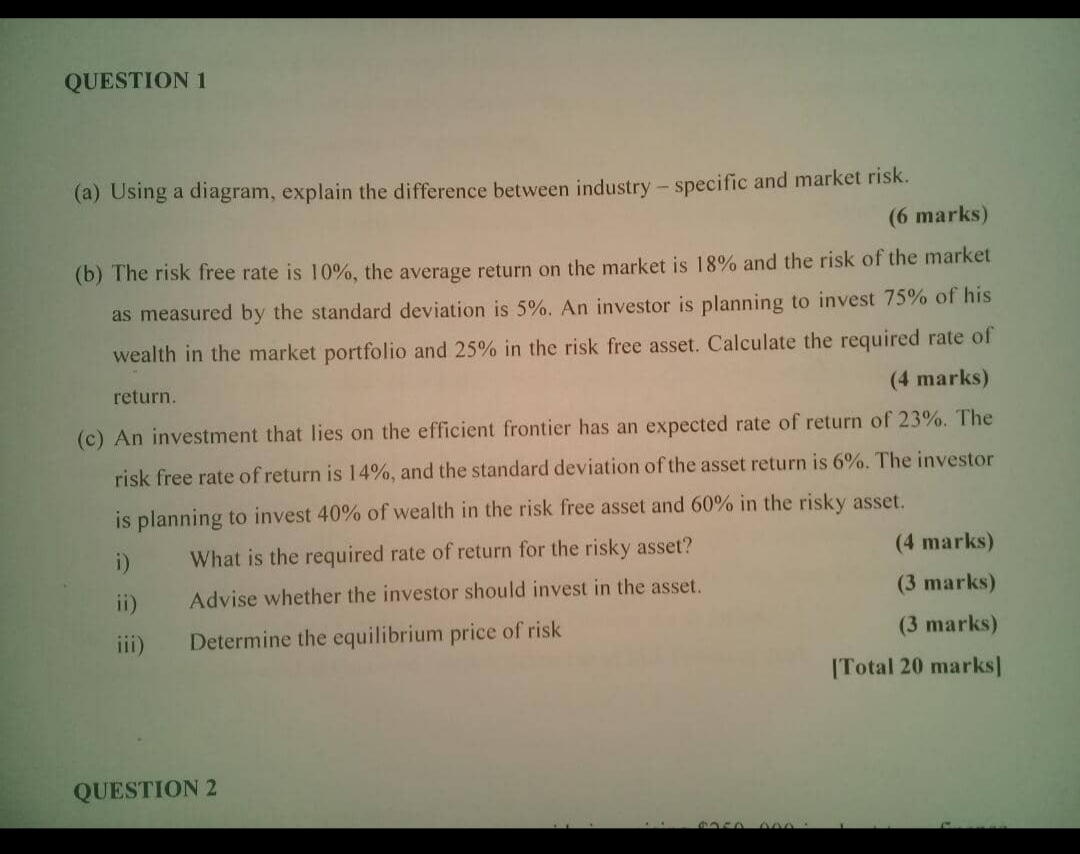

QUESTION 1 (a) Using a diagram, explain the difference between industry-specific and market risk. (6 marks) (b) The risk free rate is 10%, the average return on the market is 18% and the risk of the market as measured by the standard deviation is 5%. An investor is planning to invest 75% of his wealth in the market portfolio and 25% in the risk free asset. Calculate the required rate of return. (4 marks) (c) An investment that lies on the efficient frontier has an expected rate of return of 23%. The risk free rate of return is 14%, and the standard deviation of the asset return is 6%. The investor is planning to invest 40% of wealth in the risk free asset and 60% in the risky asset. i) What is the required rate of return for the risky asset? (4 marks) ii) Advise whether the investor should invest in the asset. (3 marks) iii) Determine the equilibrium price of risk (3 marks) [Total 20 marks) QUESTION 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts