Question: Question 1 a) What are the two basic types of risks and their distinctions. (5 marks) b) A risk-averse investor is considering two possible assets

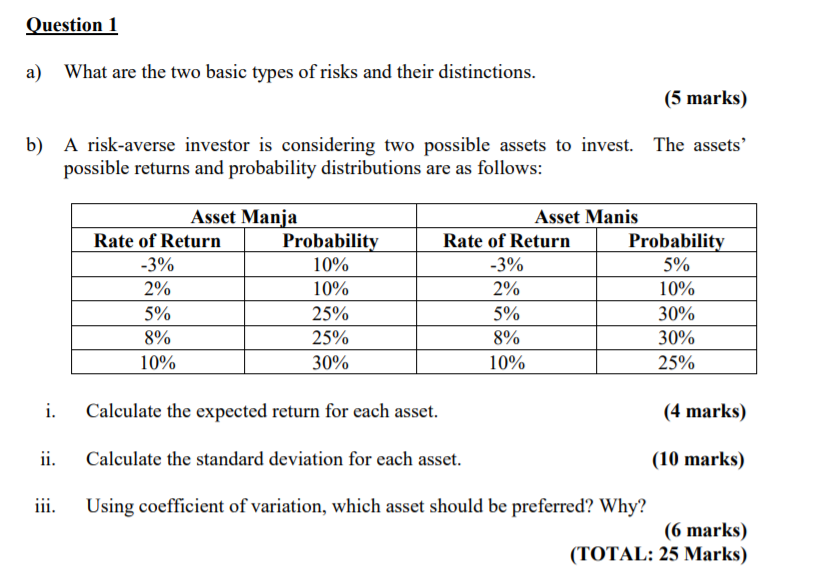

Question 1 a) What are the two basic types of risks and their distinctions. (5 marks) b) A risk-averse investor is considering two possible assets to invest. The assets' possible returns and probability distributions are as follows: Asset Manja Rate of Return Probability -3% 10% 2% 10% 5% 25% 8% 25% 10% 30% Asset Manis Rate of Return Probability -3% 5% 2% 10% 5% 30% 8% 30% 10% 25% i. Calculate the expected return for each asset. (4 marks) ii. Calculate the standard deviation for each asset. (10 marks) iii. Using coefficient of variation, which asset should be preferred? Why? (6 marks) (TOTAL: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts