Question: Question 1: According to the video, how do we define risk? - The fact that what actually happens may (and often does) differ from what

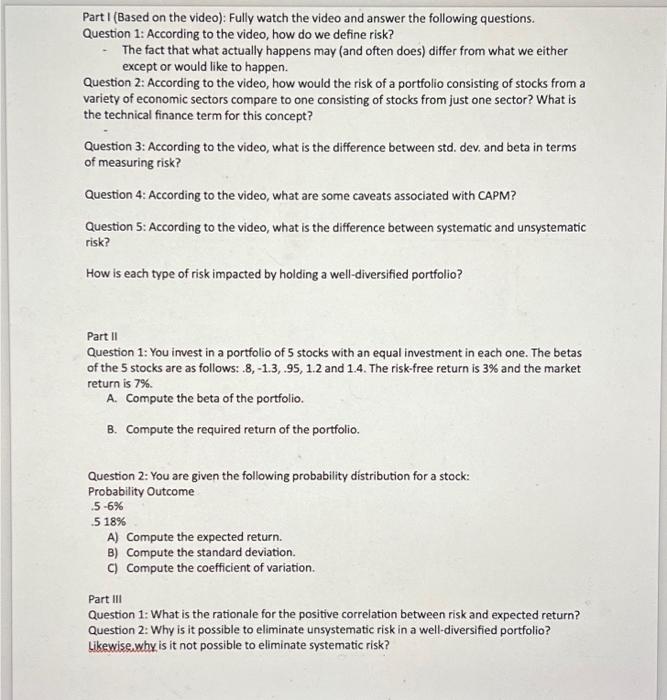

Question 1: According to the video, how do we define risk? - The fact that what actually happens may (and often does) differ from what we either except or would like to happen. Question 2: According to the video, how would the risk of a portfolio consisting of stocks from a variety of economic sectors compare to one consisting of stocks from just one sector? What is the technical finance term for this concept? Question 3: According to the video, what is the difference between std. dev. and beta in terms of measuring risk? Question 4: According to the video, what are some caveats associated with CAPM? Question 5: According to the video, what is the difference between systematic and unsystematic risk? How is each type of risk impacted by holding a well-diversified portfolio? Part II Question 1: You invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: 8,1.3,.95,1.2 and 1.4 . The risk-free return is 3% and the market return is 7%. A. Compute the beta of the portfolio. B. Compute the required return of the portfolio. Question 2: You are given the following probability distribution for a stock: Probability Outcome .56% .518% A) Compute the expected return. B) Compute the standard deviation. C) Compute the coefficient of variation. Part III Question 1: What is the rationale for the positive correlation between risk and expected return? Question 2: Why is it possible to eliminate unsystematic risk in a well-diversified portfolio? Likewise,why is it not possible to eliminate systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts