Question: Question 1 . [ Answer all parts showing all work, refrence formulas and solutions in The boards of company A and B are negotiating an

Question Answer all parts showing all work, refrence formulas and solutions in

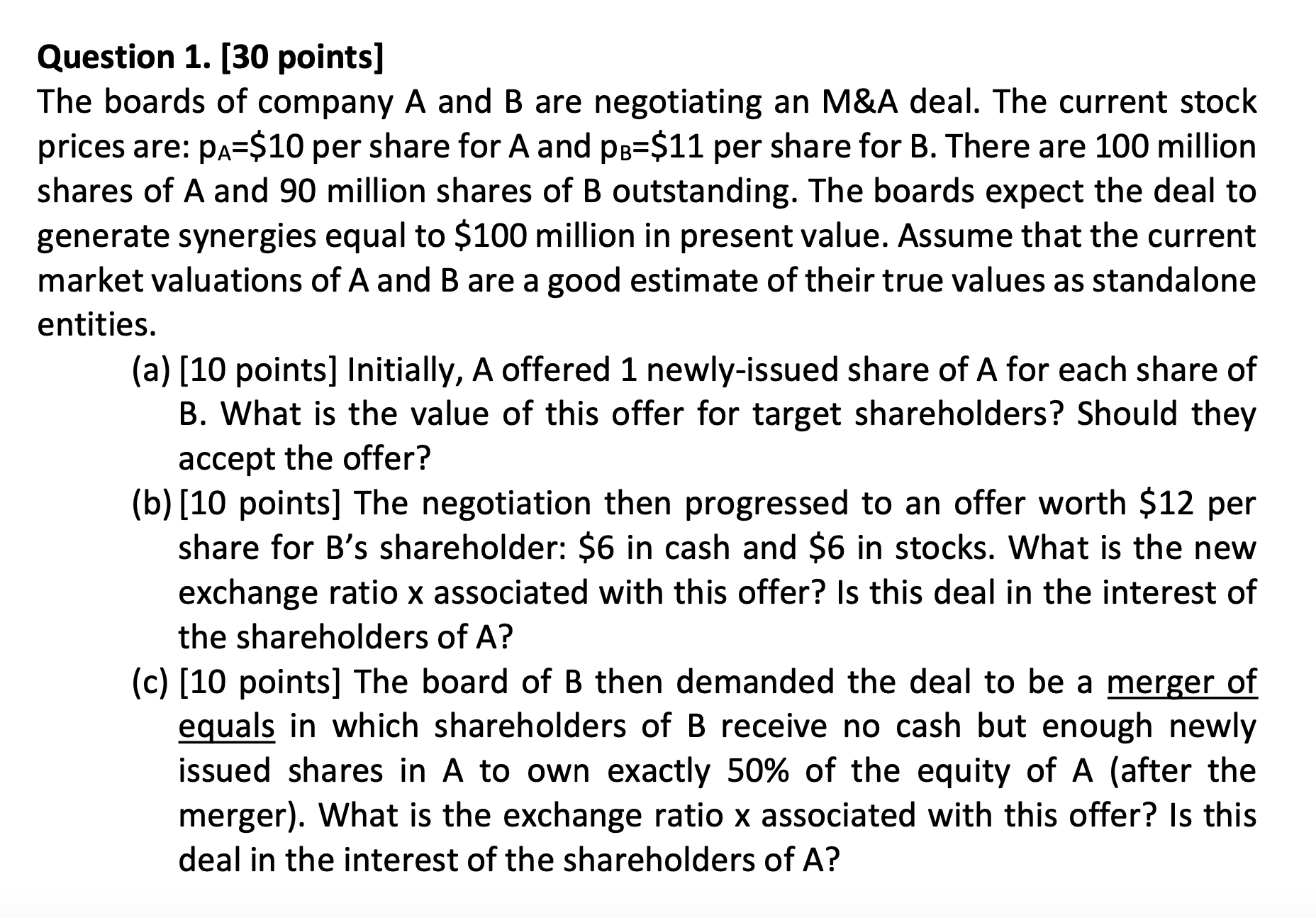

The boards of company A and are negotiating an M&A deal. The current stock

prices are: $ per share for A and $ per share for There are million shares of A and million shares of outstanding. The boards expect the deal to generate synergies equal to $ million in present value. Assume that the current market valuations of A and are a good estimate of their true values as standalone entities.

a points Initially, A offered newlyissued share of A for each share of

B What is the value of this offer for target shareholders? Should they

accept the offer?

b points The negotiation then progressed to an offer worth $ per

share for Bs shareholder: $ in cash and $ in stocks. What is the new

exchange ratio associated with this offer? Is this deal in the interest of

the shareholders of

c points The board of then demanded the deal to be a merger of

equals in which shareholders of receive no cash but enough newly

issued shares in A to own exactly of the equity of A after the

merger What is the exchange ratio associated with this offer? Is this

deal in the interest of the shareholders of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock