Question: QUESTION 1 Course Learning Outcome (CLO) 1: Critically evaluate contemporary issues, theories and empirical research evidence in financial and management accounting, including strengths and limitations.

QUESTION 1 Course Learning Outcome (CLO) 1: Critically evaluate contemporary issues, theories and empirical research evidence in financial and management accounting, including strengths and limitations. International Financial Reporting Standards (IFRS) and General Accepted Accounting Principles (GAAP) have disagreement in the treatments to some of accounts in financial statements. Based on the above statement, discuss the disagreement in the accounting treatment or standards utilized by Exxon Mobil and Royal Dutch Shell (Shell). [Total: 25 marks] QUESTION 2 Course Learning Outcome (CLO) 2: Explain the implications and relevance of the current knowledge boundaries in accounting theory. Discuss FOUR (4) areas where Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) standards differ with Malaysian Accounting Standard Boards (MASB) standards. [Total: 25 marks] . BAA3733 ACCOUNTING THEORY & PRACTICE Page 2 of 6 QUESTION 3 Course Learning Outcome (CLO) 3: Critically evaluate some alternative technical approaches and extensions to accounting theory and practice. Relevance and reliability are two cores principles that have to be met by accountants in order to assist and guide users to make decisions. However, some regards these two principles as two competing attributes in a piece of information, and others said these two are complementary. Based on the statement above, justify your understanding regarding this accounting matter by referring to relevant scholars' reasoning, sources or examples. [Total: 25 marks] QUESTION 4 Course Learning Outcome (CLO) 4: Recognize some of the implications of alternative national and cultural contexts in which accounting can be seen as operating and how accounting theory may be applied to complex multinational businesses. Social accounting involves the identifications and recording of the social responsibility activities conducted by an entity. This aspect is shown in the company's annual report. The following a

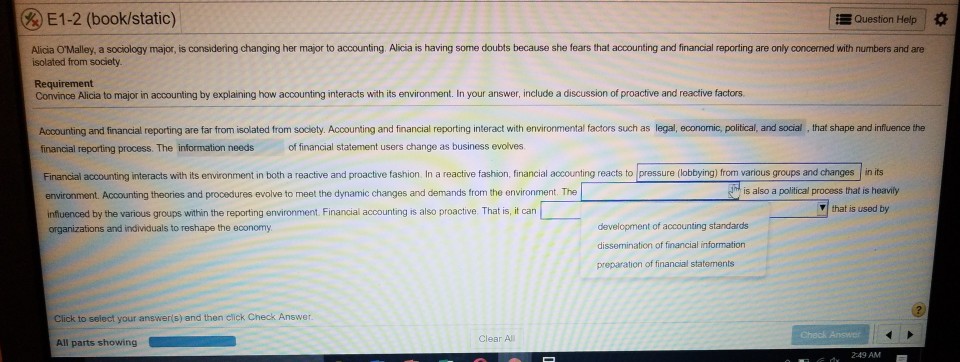

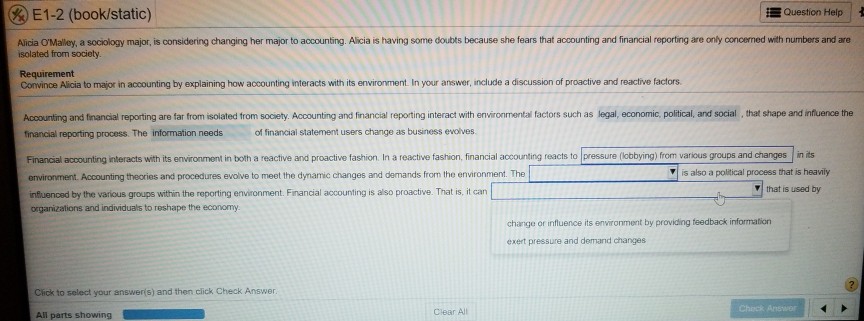

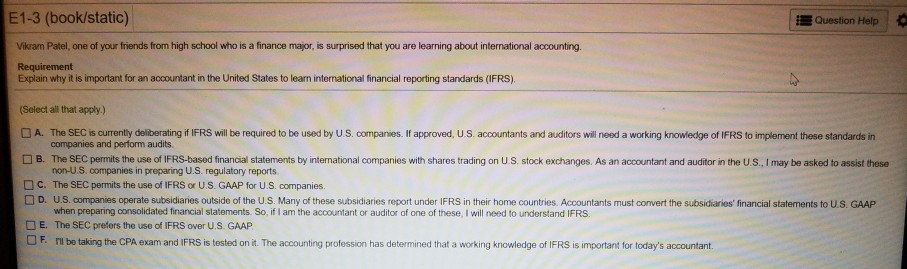

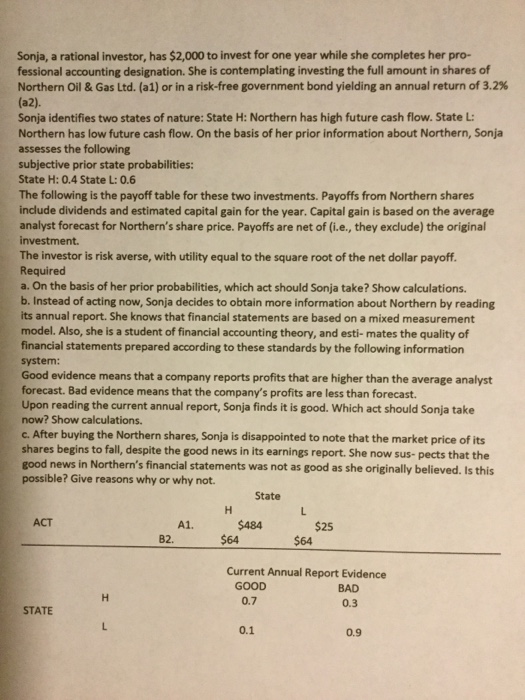

E1-2 (book/static) Question Help Alicia O'Malley, a sociology major, is considering changing her major to accounting. Alicia is having some doubts because she fears that accounting and financial reporting are only concerned with numbers and are isolated from society. Requirement Convince Alicia to major in accounting by explaining how accounting interacts with its environment. In your answer, include a discussion of proactive and reactive factors. Accounting and financial reporting are far from isolated from society. Accounting and financial reporting interact with environmental factors such as legal, economic, political, and social , that shape and influence the financial reporting process. The information needs of financial statement users change as business evolves, Financial accounting interacts with its environment in both a reactive and proactive fashion. In a reactive fashion, financial accounting reacts to pressure (lobbying) from various groups and changes in its environment. Accounting theories and procedures evolve to meet the dynamic changes and demands from the environment. The is also a political process that is heavily influenced by the various groups within the reporting environment. Financial accounting is also proactive, That is, it can that is used by organizations and individuals to reshape the economy. development of accounting standards dissemination of financial information preparation of financial statements Click to select your answer(s) and then click Check Answer. All parts showing Clear All Check Answer 2:49 AME1-2 (book/static) Question Help Alicia O'Malley, a sociology major, is considering changing her major to accounting. Alicia is having some doubts because she fears that accounting and financial reporting are only concerned with numbers and are isolated from society. Requirement Convince Alicia to major in accounting by explaining how accounting interacts with its environment. In your answer, include a discussion of proactive and reactive factors. Accounting and financial reporting are far from isolated from society. Accounting and financial reporting interact with environmental factors such as legal, economic, political, and social , that shape and influence the financial reporting process. The information needs of financial statement users change as business evolves. Financial accounting interacts with its environment in both a reactive and proactive fashion. In a reactive fashion, financial accounting reacts to pressure (lobbying) from various groups and changes in its environment. Accounting theories and procedures evolve to meet the dynamic changes and demands from the environment. The is also a political process that is heavily influenced by the various groups within the reporting environment. Financial accounting is also proactive. That is, it can that is used by organizations and individuals to reshape the economy change or influence its environment by providing feedback information exert pressure and demand changes Click to select your answers) and then click Check Answer. ? All parts showing Clear All Check AnswerE1-3 (book/static) Question Help Vikram Patel, one of your friends from high school who is a finance major, is surprised that you are learning about international accounting. Requirement Explain why it is important for an accountant in the United States to leam international financial reporting standards (IFRS), (Select all that apply.) )A. The SEC is currently deliberating if IFRS will be required to be used by U.S. companies. If approved, U.S. accountants and auditors will need a working knowledge of IFRS to implement these standards in companies and perform audits B. The SEC permits the use of IFRS-based financial statements by international companies with shares trading on U.S. stock exchanges. As an accountant and auditor in the U.S., I may be asked to assist these non-U.S. companies in preparing U.S. regulatory reports OC. The SEC permits the use of IFRS or U.S. GAAP for U.S. companies, D. U.S. companies operate subsidiaries outside of the U.S. Many of these subsidiaries report under IFRS in their home countries. Accountants must convert the subsidiaries' financial statements to U.S. GAAP when preparing consolidated financial statements. So, if I am the accountant or auditor of one of these, I will need to understand IFRS. DE. The SEC prefers the use of IFRS over U.S. GAAP. F. I'll be taking the CPA exam and IFRS is tested on it. The accounting profession has determined that a working knowledge of IFRS is important for today's accountant.Sonja, a rational investor, has $2,000 to invest for one year while she completes her pro- fessional accounting designation. She is contemplating investing the full amount in shares of Northern Oil & Gas Led. (al) or in a risk-free government bond yielding an annual return of 3.2% (a2). Sonja identifies two states of nature: State H: Northern has high future cash flow. State L: Northern has low future cash flow. On the basis of her prior information about Northern, Sonja assesses the following subjective prior state probabilities: State H: 0.4 State L: 0.6 The following is the payoff table for these two investments. Payoffs from Northern shares include dividends and estimated capital gain for the year. Capital gain is based on the average analyst forecast for Northern's share price. Payoffs are net of (i.e., they exclude) the original investment. The investor is risk averse, with utility equal to the square root of the net dollar payoff. Required a. On the basis of her prior probabilities, which act should Sonja take? Show calculations. b. Instead of acting now, Sonja decides to obtain more information about Northern by reading its annual report. She knows that financial statements are based on a mixed measurement model. Also, she is a student of financial accounting theory, and esti- mates the quality of financial statements prepared according to these standards by the following information system: Good evidence means that a company reports profits that are higher than the average analyst forecast. Bad evidence means that the company's profits are less than forecast. Upon reading the current annual report, Sonja finds it is good. Which act should Sonja take now? Show calculations. c. After buying the Northern shares, Sonja is disappointed to note that the market price of its shares begins to fall, despite the good news in its earnings report. She now sus- pects that the good news in Northern's financial statements was not as good as she originally believed. Is this possible? Give reasons why or why not. State H L ACT A1. $484 $25 B2 $64 $64 Current Annual Report Evidence GOOD BAD H 0.7 0.3 STATE F 0.1 0.9