Question: Question 1: Answer the question in the attached image l. a. True / False (explaing The difference between a FRM (F ixed-Rate Mortgage) and a

Question 1: Answer the question in the attached image

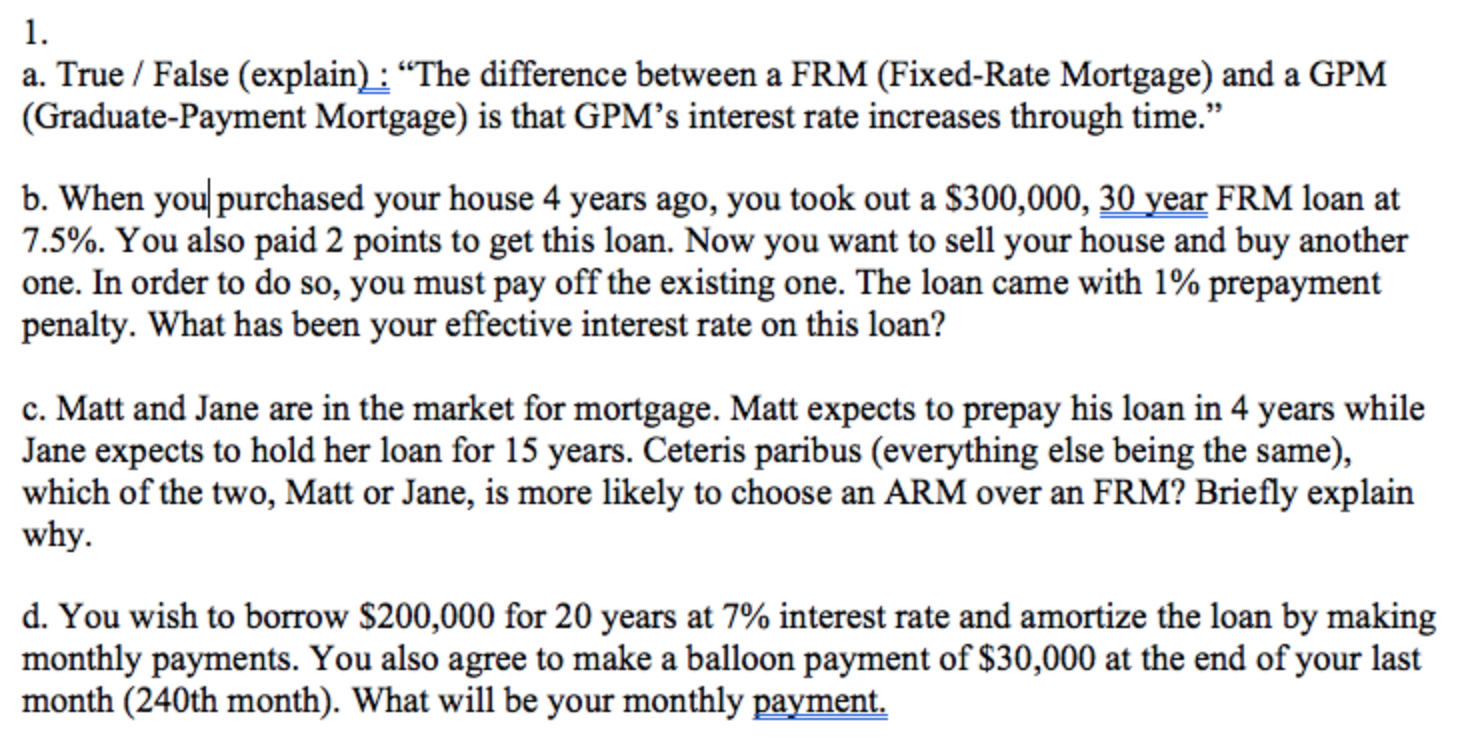

l. a. True / False (explaing "The difference between a FRM (F ixed-Rate Mortgage) and a GPM (Graduate-Payment Mortgage) is that GPM's interest rate increases through time." b. When youl purchased your house 4 years ago, you took out a $300,000, M FRM loan at 7.5%. You also paid 2 points to get this loan. Now you want to sell your house and buy another one. In order to do so, you must pay off the existing one. The loan came with 1% prepayment penalty. What has been your effective interest rate on this loan? c. Matt and Jane are in the market for mortgage. Matt expects to prepay his loan in 4 years while Jane expects to hold her loan for 15 years. Ceteris paribus (everything else being the same), which of the two, Matt or Jane, is more likely to choose an ARM over an FRM? Briey explain why. (1. You wish to borrow $200,000 for 20 years at 7% interest rate and amortize the loan by making monme payments. You also agree to make a balloon payment of $30,000 at the end of your last month (240th month). What will be your monthly M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts