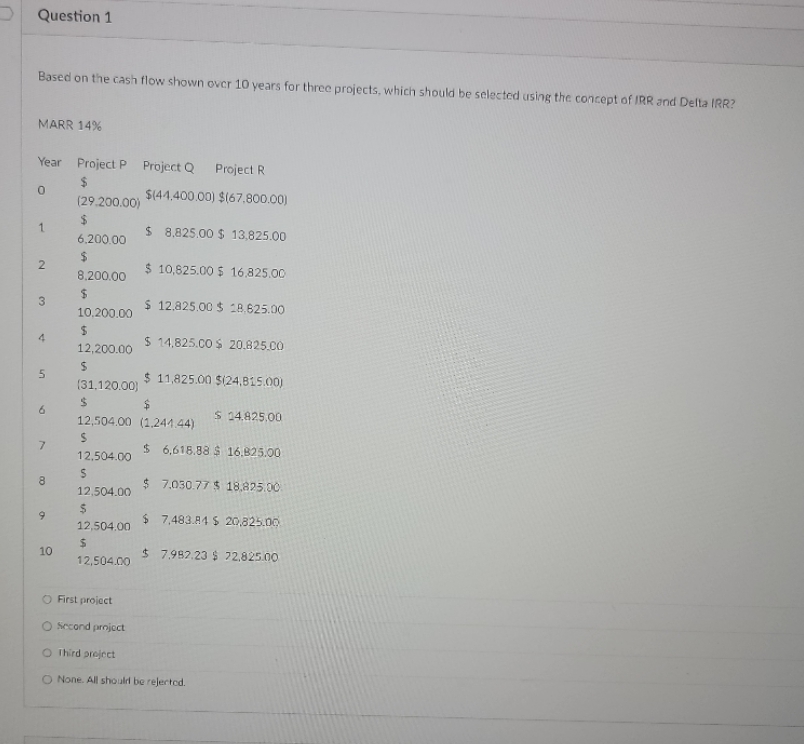

Question: Question 1 Based on the cash flow shown over 10 years for three projects, which should be selected using the concept of IRR and

Question 1 Based on the cash flow shown over 10 years for three projects, which should be selected using the concept of IRR and Delta IRR? MARR 14% Year Project P Project Q Project R 0 (29.200.00) $(44.400.00) $(67.800.00) 1 6,200.00 $ 8,825.00 $ 13,825.00 2 8,200.00 $ 10,825.00 $ 16.825.00 $ 3 $ 12,825.00 $ 18.625.00 10,200.00 $ 4 $14,825.00 $ 20.825.00 12,200.00 $ 5 (31,120.00) $ 11,825.00 $(24,815.00) $ 9 $ 14.825.00 12,504.00 (1.244.44) $ 7 $ 6,618.88 $ 16.825.00 12,504.00 $ 8 $ 7,030.77 $ 18.825.00 12,504.00 $ 9 $ 7,483.84 $ 20,825.00 12,504.00 $ 10 $ 7.982.23 $ 72,825.00 12,504.00 O First project O Second project O Third project O None. All should be rejected.

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

To determine which project should be selected using the concepts of Internal Rate of Return IRR and ... View full answer

Get step-by-step solutions from verified subject matter experts