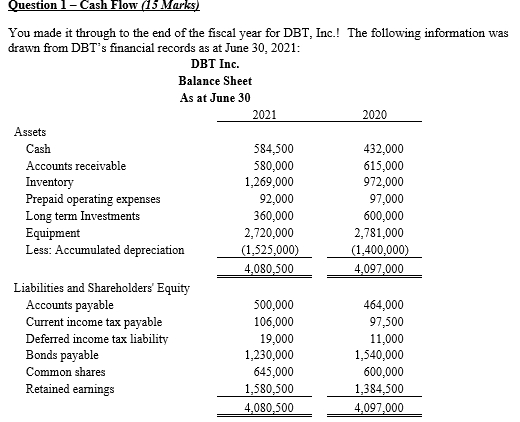

Question: Question 1 - Cash Flow (15 Marks) You made it through to the end of the fiscal year for DBT, Inc.! The following information was

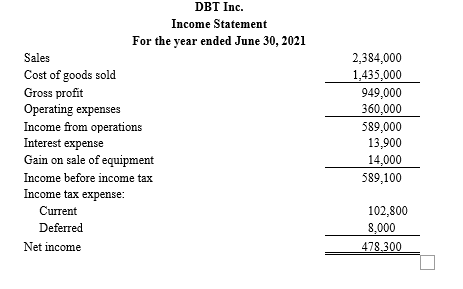

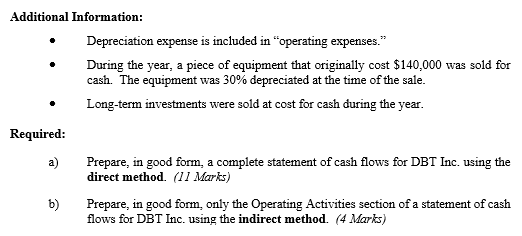

Question 1 - Cash Flow (15 Marks) You made it through to the end of the fiscal year for DBT, Inc.! The following information was drawn from DBT's financial records as at June 30, 2021: DBT Inc. Balance Sheet As at June 30 2021 2020 Assets Cash 584,500 432,000 Accounts receivable 580,000 615,000 Inventory 1,269,000 972,000 Prepaid operating expenses 92,000 97,000 Long term Investments 360,000 600,000 Equipment 2,720,000 2,781,000 Less: Accumulated depreciation (1,525,000) (1,400,000) 4,080,500 4,097,000 Liabilities and Shareholders' Equity Accounts payable 500,000 464,000 Current income tax payable 106,000 97,500 Deferred income tax liability 19,000 11,000 Bonds payable 1,230,000 1,540,000 Common shares 645,000 600,000 Retained eamings 1,580,500 1,384,500 4,080,500 4,097,000 DBT Inc. Income Statement For the year ended June 30, 2021 Sales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Gain on sale of equipment Income before income tax Income tax expense: Current Deferred Net income 2,384,000 1,435,000 949,000 360,000 589,000 13,900 14,000 589,100 102,800 8,000 478.300 Additional Information: Depreciation expense is included in "operating expenses." During the year, a piece of equipment that originally cost $140,000 was sold for cash. The equipment was 30% depreciated at the time of the sale. Long-term investments were sold at cost for cash during the year. Required: a) Prepare, in good form, a complete statement of cash flows for DBT Inc. using the direct method. (11 Marks) Prepare, in good form, only the Operating Activities section of a statement of cash flows for DBT Inc. using the indirect method. (4 Marks) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts