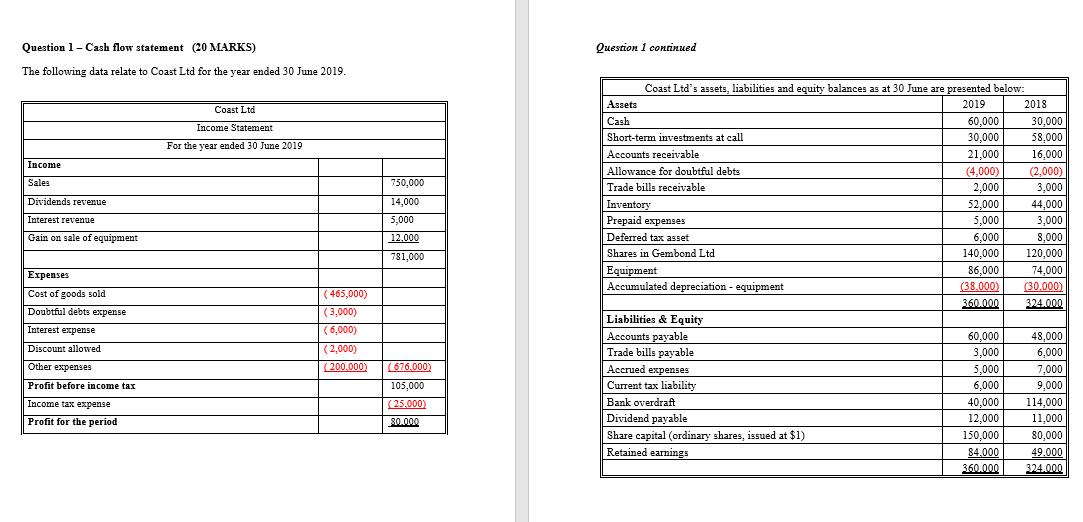

Question: Question 1- Cash flow statement (20 MARKS) The following data relate to Coast Ltd for the year ended 30 June 2019. Coast Ltd Income

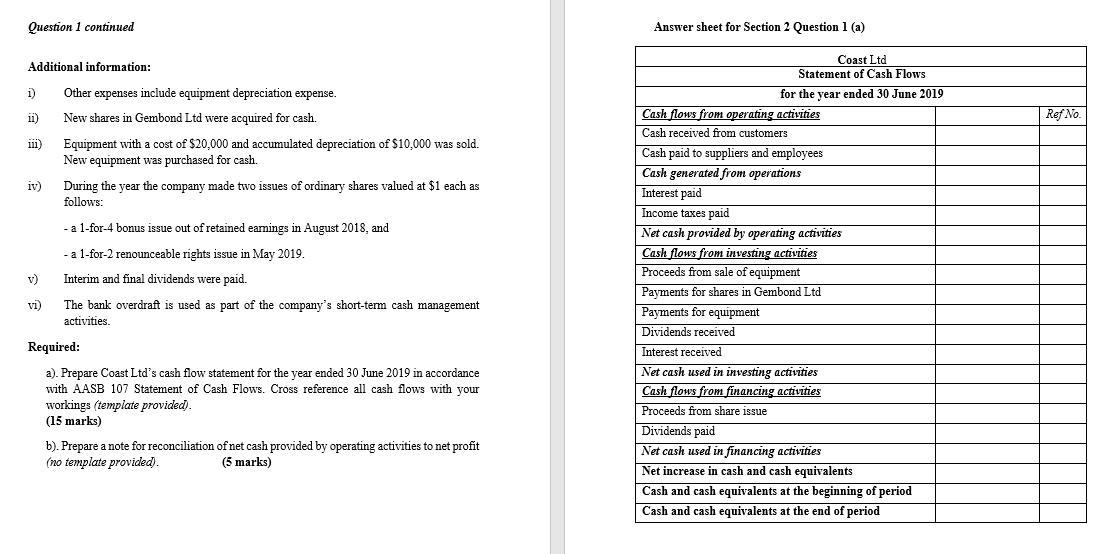

Question 1- Cash flow statement (20 MARKS) The following data relate to Coast Ltd for the year ended 30 June 2019. Coast Ltd Income Statement For the year ended 30 June 2019 Income Sales Dividends revenue Interest revenue Gain on sale of equipment Expenses Cost of goods sold Doubtful debts expense Interest expense Discount allowed Other expenses Profit before income tax Income tax expense Profit for the period. (465,000) (3,000) (6,000) (2,000) (200,000) 750,000 14,000 5,000 12,000 781,000 (676,000) 105,000 (25,000) 80.000 Question 1 continued Coast Ltd's assets, liabilities and equity balances as at 30 June are presented below: 2019 2018 Assets Cash 60,000 30,000 Short-term investments at call 30,000 58,000 Accounts receivable 21,000 16,000 Allowance for doubtful debts (2,000) (4,000) 2,000 Trade bills receivable 3,000 Inventory arv cance 52,000 44,000 Prepaid expenses 5,000 3,000 Deferred tax asset 6,000 8,000 Shares in Gembond Ltd 140,000 120,000 Equipment 86,000 74.000 Accumulated depreciation - equipment (38,000) (30,000) 360.000 324.000 Liabilities & Equity Accounts payable 60,000 48,000 3,000 6,000 Trade bills payable Accrued expenses 5,000 7,000 Current tax liability 6,000 9,000 Bank overdraft 40,000 114,000 Dividend payable 12,000 11,000 150,000 80,000 Share capital (ordinary shares, issued at $1) Retained earnings 84,000 49,000 360.000 324.000 Question 1 continued Additional information: 1) Other expenses include equipment depreciation expense. 11) New shares in Gembond Ltd were acquired for cash. iii) Equipment with a cost of $20,000 and accumulated depreciation of $10,000 was sold. New equipment was purchased for cash. iv) During the year the company made two issues of ordinary shares valued at $1 each as follows: - a 1-for-4 bonus issue out of retained earnings in August 2018, and - a 1-for-2 renounceable rights issue in May 2019. v) Interim and final dividends were paid. vi) The bank overdraft is used as part of the company's short-term cash management activities. Required: a). Prepare Coast Ltd's cash flow statement for the year ended 30 June 2019 in accordance with AASB 107 Statement of Cash Flows. Cross reference all cash flows with your workings (template provided). (15 marks) b). Prepare a note for reconciliation of net cash provided by operating activities to net profit (no template provided). (5 marks) Answer sheet for Section 2 Question 1 (a) Cash flows from operating activities Cash received from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid Net cash provided by operating activities Cash flows from investing activities Proceeds from sale of equipment Payments for shares in Gembond Ltd Payments for equipment Dividends received Interest received Net cash used in investing activities Cash flows from financing activities Proceeds from share issue Dividends paid Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at the beginning of period Cash and cash equivalents at the end of period Coast Ltd Statement of Cash Flows for the year ended 30 June 2019 Ref No.

Step by Step Solution

3.30 Rating (144 Votes )

There are 3 Steps involved in it

a As per Direct method Cash flows from Operating Activities Cash received from customers Cash paid t... View full answer

Get step-by-step solutions from verified subject matter experts