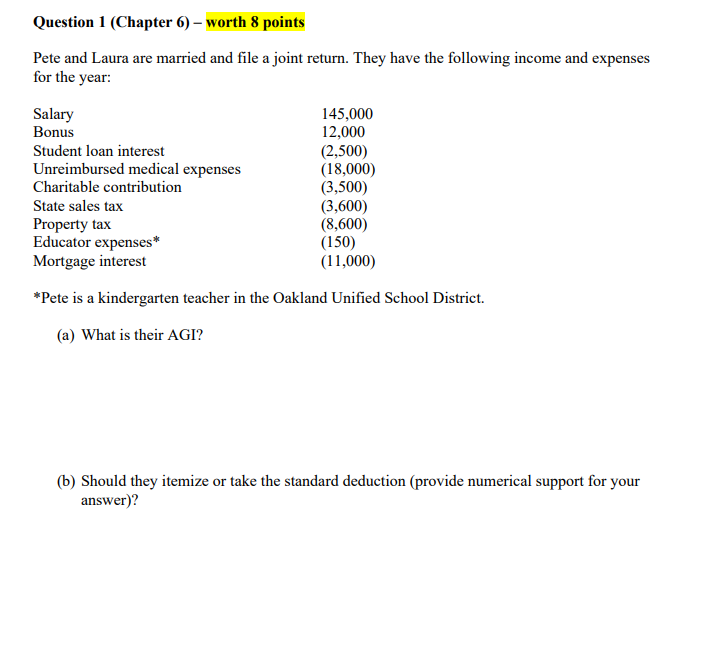

Question: Question 1 (Chapter 6) worth 8 points Pete and Laura are married and file a joint return. They have the following income and expenses for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts