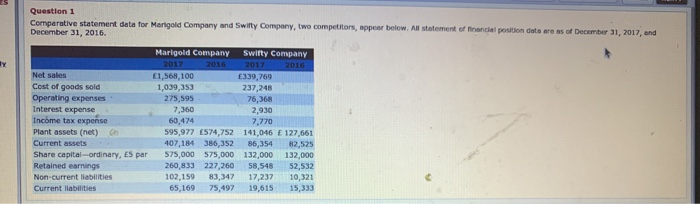

Question: Question 1 Comparative statement data for Marigold company and Swifty Company, we competitors, appear below. All statement of December 31, 2016. ancial position data areas

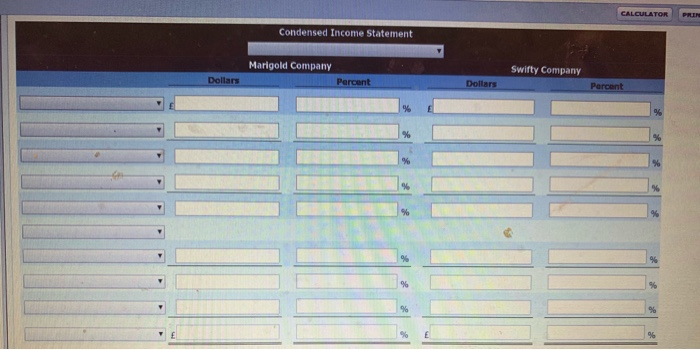

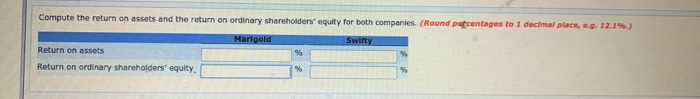

Question 1 Comparative statement data for Marigold company and Swifty Company, we competitors, appear below. All statement of December 31, 2016. ancial position data areas of December 31, 2017, and Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Plant assets (net) Current assets Share capital ordinary, ES par Retained earnings Non-current liabilities Current liabilities Marigold Company 2017 2016 (1,568,100 1,039353 275,595 7.360 60,474 595 977 574,752 407,154 355 352 575,000 $75,000 260,833 227,260 102,159 83,347 65,16975,497 Swilty Company 2017 2016 339,769 237,248 76,368 2,930 7,770 141.046 E 127.561 354 2.525 132,000 132,000 58,548 52,532 17,237 10,321 19,615 15,333 CALCULATOR PRIN Condensed Income Statement Swifty Company Marigold Company Percent Dollars Dollars Percent Compute the return on assets and the return on ordinary shareholders' equity for both companies. (Round percentages to I decimal place, ... 12.19.) Marigold Swifty Return on assets Return on ordinary shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts