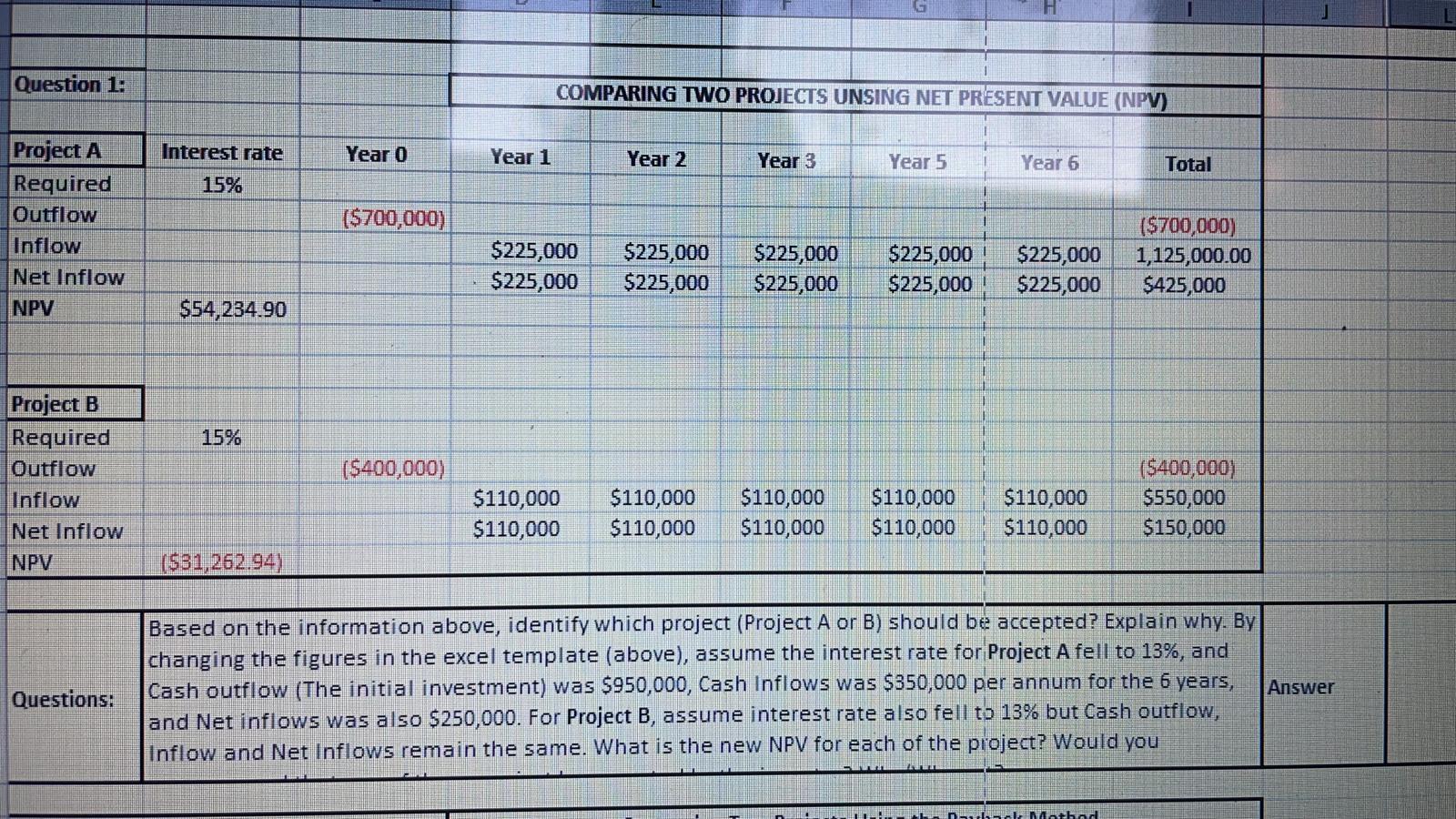

Question: Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Year 0 Year 1 Year 2 Interest rate 15% Year 3 Year 5 Year 6

Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Year 0 Year 1 Year 2 Interest rate 15% Year 3 Year 5 Year 6 Total Project A Required Outflow Inflow Net Inflow NPV ($700,000) $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 ($700,000) 1,125,000.00 $425,000 $54,234.90 15% Project B Required Outflow Inflow Net Inflow NPV ($400,000) $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 ($400,000) $550,000 $150,000 ($31,262.94) Questions: Based on the information above, identify which project (Project A or B) should be accepted? Explain why. By changing the figures in the excel template (above), assume the interest rate for Project A fell to 13%, and Cash outflow (The initial investment) was $950,000, Cash Inflows was $350,000 per annum for the 6 years, Answer and Net inflows was also $250,000. For Project B, assume interest rate also fell to 13% but Cash outflow, Inflow and Net Inflows remain the same. What is the new NPV for each of the project? Would you NB had Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Year 0 Year 1 Year 2 Interest rate 15% Year 3 Year 5 Year 6 Total Project A Required Outflow Inflow Net Inflow NPV ($700,000) $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 ($700,000) 1,125,000.00 $425,000 $54,234.90 15% Project B Required Outflow Inflow Net Inflow NPV ($400,000) $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 $110,000 ($400,000) $550,000 $150,000 ($31,262.94) Questions: Based on the information above, identify which project (Project A or B) should be accepted? Explain why. By changing the figures in the excel template (above), assume the interest rate for Project A fell to 13%, and Cash outflow (The initial investment) was $950,000, Cash Inflows was $350,000 per annum for the 6 years, Answer and Net inflows was also $250,000. For Project B, assume interest rate also fell to 13% but Cash outflow, Inflow and Net Inflows remain the same. What is the new NPV for each of the project? Would you NB had