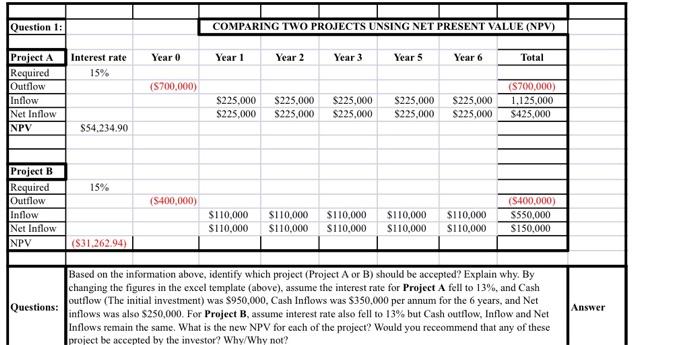

Question: Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Year 0 Year 1 Year 2 Year 3 Years Year 6 Interest rate 15% Total

Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Year 0 Year 1 Year 2 Year 3 Years Year 6 Interest rate 15% Total Project A Required Outflow Inflow Net Inflow NPV (S700.000) $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 $225,000 (S700,000) 1,125,000 $425,000 $54,234.90 15% (S400,000) Project B Required Outflow inflow Net Inflow NPV $110,000 S110,000 $110.000 S110,000 S110,000 $110,000 $110,000 $110,000 S110,000 $110,000 (S400.000) S550,000 S150.000 (S31.262.94) Questions: Based on the information above, identify which project (Project A or B) should be accepted? Explain why. By changing the figures in the excel template (above), assume the interest rate for Project A fell to 13%, and Cash outflow (The initial investment) was $950,000, Cash Inflows was $350,000 per annum for the 6 years, and Net inflows was also $250,000. For Project B, assume interest rate also fell to 13% but Cash outflow, Inflow and Net Inflows remain the same. What is the new NPV for each of the project? Would you receommend that any of these project be accepted by the investor? Why/Why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts