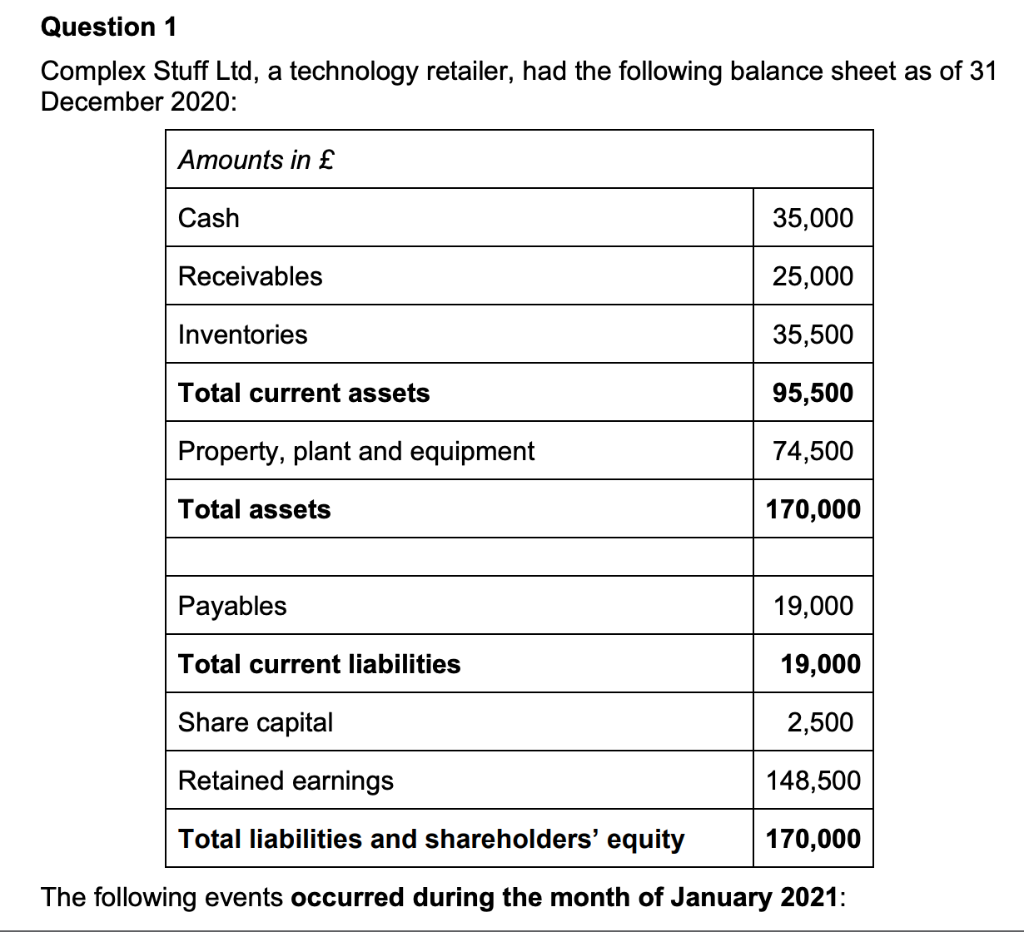

Question: Question 1 Complex Stuff Ltd, a technology retailer, had the following balance sheet as of 31 December 2020: Amounts in Cash 35,000 Receivables 25,000 Inventories

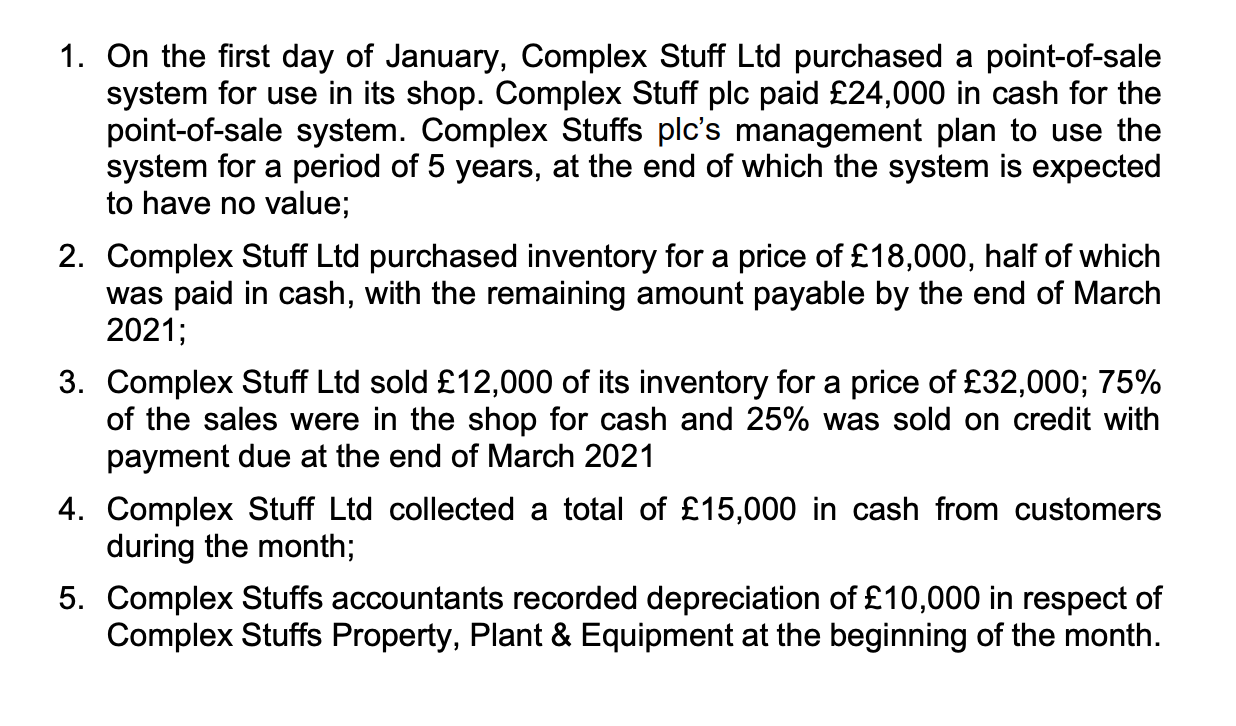

Question 1 Complex Stuff Ltd, a technology retailer, had the following balance sheet as of 31 December 2020: Amounts in Cash 35,000 Receivables 25,000 Inventories 35,500 Total current assets 95,500 Property, plant and equipment 74,500 Total assets 170,000 Payables 19,000 Total current liabilities 19,000 Share capital 2,500 Retained earnings 148,500 Total liabilities and shareholders' equity 170,000 The following events occurred during the month of January 2021: a 1. On the first day of January, Complex Stuff Ltd purchased a point-of-sale system for use in its shop. Complex Stuff plc paid 24,000 in cash for the point-of-sale system. Complex Stuffs plc's management plan to use the system for a period of 5 years, at the end of which the system is expected to have no value; 2. Complex Stuff Ltd purchased inventory for a price of 18,000, half of which was paid in cash, with the remaining amount payable by the end of March 2021; 3. Complex Stuff Ltd sold 12,000 of its inventory for a price of 32,000; 75% of the sales were in the shop for cash and 25% was sold on credit with payment due at the end of March 2021 4. Complex Stuff Ltd collected a total of 15,000 in cash from customers during the month; 5. Complex Stuffs accountants recorded depreciation of 10,000 in respect of Complex Stuffs Property, Plant & Equipment at the beginning of the month. a) Prepare Complex Stuffs's balance sheet at the end of January 2021, providing a brief explanation of the accounting choices you make in the process. (18 marks) b) What is Complex Stuffs working capital at the end of January 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts