Question: question 1- compute the maximum 2021 depreciation deductions, including the section 179 expense (ignoring business depreciation). question 2- compute the maximum 2022 depreciation deductions, including

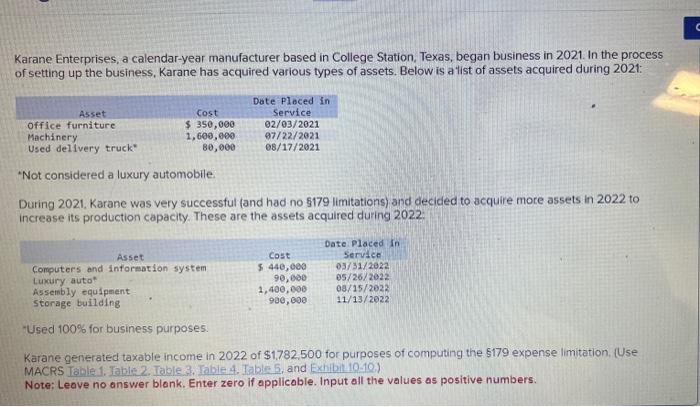

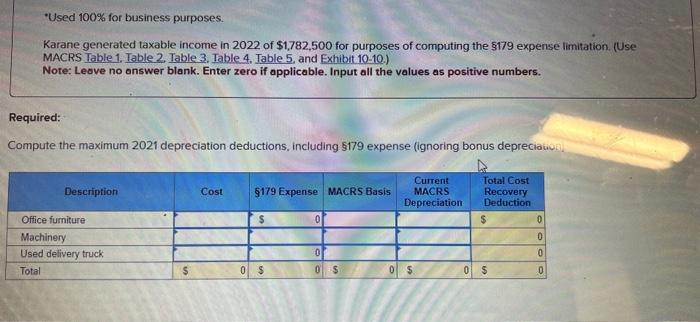

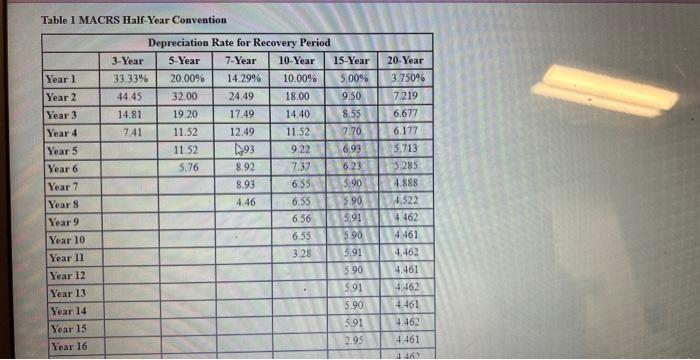

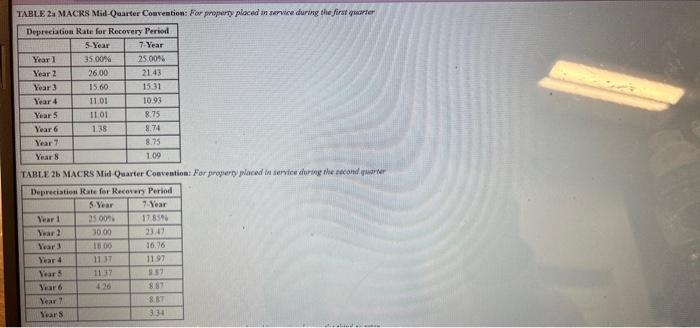

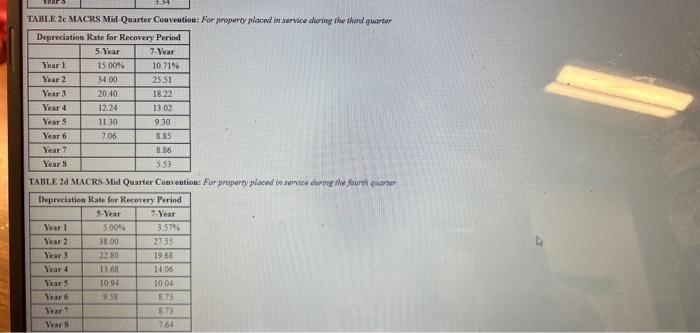

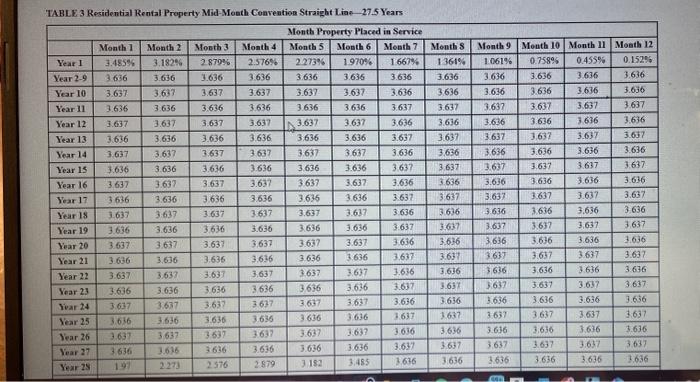

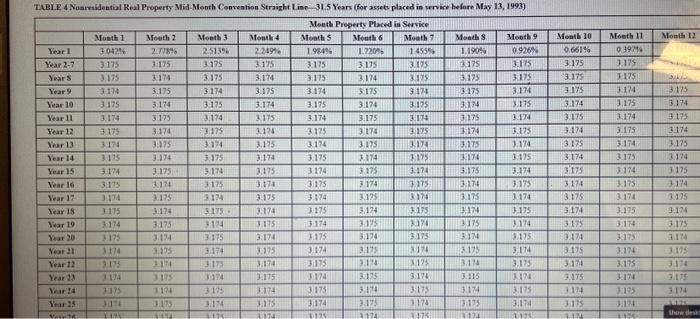

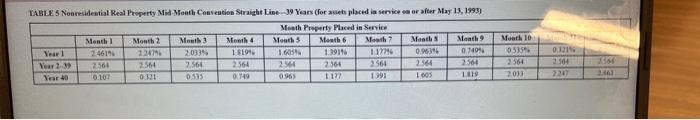

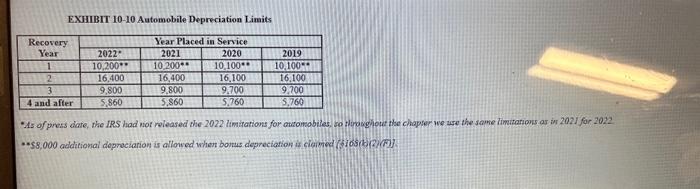

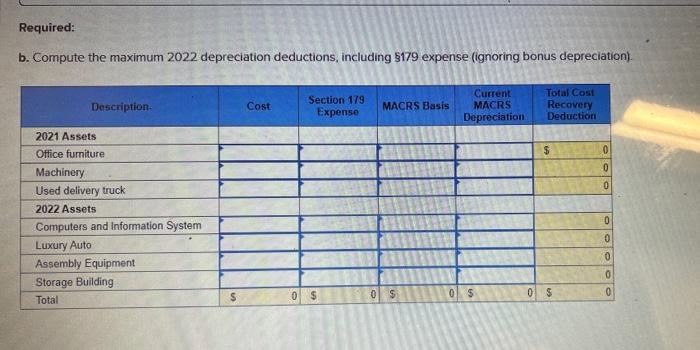

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : Not considered a luxury automobile During 2021, Karane was very successful (and had no $179 limitations) and deciced to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 Used 100% for business purposes. Karane generated taxable income in 2022 of $1,782.500 for purposes of computing the \$179 expense limitation. (Use MACRS Table 1. Table 2. Table 3, Tabie 4. Table 5, and Exhibi 10-10) Note: Leove no answer blonk. Enter zero if applicable. Input all the values as positive numbers. "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,782,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2, Table 3, Table 4. Table 5, and Exhibit 10-10.) Note: Leove no onswer blank. Enter zero if applicable. Input all the values as positive numbers. Required: Compute the maximum 2021 depreciation deductions, including $179 expense (ignoring bonus depreciatio:. Table I MACRS Half-Year Convention TABLE 2a MACRS Mid-Qaarter Convention: For property plocid in senvice during the first qwarter TMBLE: 2c MACRS Mid Quarter Convention: For mroperty placed in service during the thand guarter 'TABLE 3 Residential Rental Property Mid-Moeth Convention Straight L.iae 27.5 Years TUBI.E 4 Noaneideatial Real Property Mid- Month Convention Straight Line_.31.5 Years (for assets phaced in wervice before May 13, 1993) EXIIBIT 10 -10 Automobile Depreciation Timits b. Compute the maximum 2022 depreciation deductions, including $179 expense (ignoring bonus depreciation). Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : Not considered a luxury automobile During 2021, Karane was very successful (and had no $179 limitations) and deciced to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 Used 100% for business purposes. Karane generated taxable income in 2022 of $1,782.500 for purposes of computing the \$179 expense limitation. (Use MACRS Table 1. Table 2. Table 3, Tabie 4. Table 5, and Exhibi 10-10) Note: Leove no answer blonk. Enter zero if applicable. Input all the values as positive numbers. "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,782,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2, Table 3, Table 4. Table 5, and Exhibit 10-10.) Note: Leove no onswer blank. Enter zero if applicable. Input all the values as positive numbers. Required: Compute the maximum 2021 depreciation deductions, including $179 expense (ignoring bonus depreciatio:. Table I MACRS Half-Year Convention TABLE 2a MACRS Mid-Qaarter Convention: For property plocid in senvice during the first qwarter TMBLE: 2c MACRS Mid Quarter Convention: For mroperty placed in service during the thand guarter 'TABLE 3 Residential Rental Property Mid-Moeth Convention Straight L.iae 27.5 Years TUBI.E 4 Noaneideatial Real Property Mid- Month Convention Straight Line_.31.5 Years (for assets phaced in wervice before May 13, 1993) EXIIBIT 10 -10 Automobile Depreciation Timits b. Compute the maximum 2022 depreciation deductions, including $179 expense (ignoring bonus depreciation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts