Question: Question 1 Consider a Kyle model with many speculators i E {1,2, ...,N}. Every speculator uses a linear strategy Pi = B(v - u). Everything

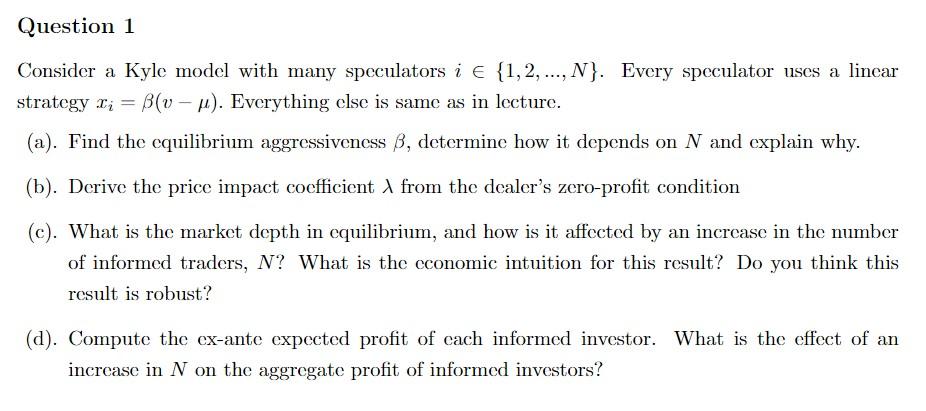

Question 1 Consider a Kyle model with many speculators i E {1,2, ...,N}. Every speculator uses a linear strategy Pi = B(v - u). Everything else is same as in lecture. (a). Find the equilibrium aggressiveness B, determine how it depends on N and explain why. (b). Derive the price impact coefficient from the dealer's zero-profit condition (c). What is the market depth in cquilibrium, and how is it affected by an increase in the number of informed traders, N? What is the economic intuition for this result? Do you think this result is robust? (d). Compute the ex-ante expected profit of cach informed investor. What is the effect of an increase in N on the aggregate profit of informed investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts