Question: Question 1: Consider the questions below What are your thoughts on the below scenarios? Which of the following phrases is false: A confidence interval is

Question 1: Consider the questions below

What are your thoughts on the below scenarios?

Which of the following phrases is false:

A confidence interval is a useful technique to illustrate the implications of exchange rate volatility for business transactions.

Exchange rates are more volatile than stock returns and commodity prices.

The yearly volatility of spot exchange rates is on average 10 percent for most currencies.

The normal distribution is a reasonable description of changes in exchange rates.

A simple way to hedge a foreign currency liability is:

To buy dollars forward.

To buy foreign currency forward..

To sell foreign currency forward.

To buy dollars spot.

The best way to forecast the exchange rate for horizons up to two years is

Use the current spot exchange rate as a forecast of the future spot exchange rate.

Use economic models of the nominal exchange rate.

Use statistical models that regress the exchange rate on past the exchange rate as well as other relevant variables such as the trade balance and the growth rate of the economy.

Use the forecasts of professional forecasters.

Which of the following statements is true.

Relative PPP holds in the short run.

Relative PPP holds in the long run.

Absolute PPP holds in the long run.

Relative PPP holds in the short and in the long run.

Which of the following statements is true

The RER is a good predictor of the nominal exchange rate for countries with high, volatile inflation.

The RER predicts the nominal exchange rate at horizons shorter than 2 years.

The RER predicts the nominal exchange rate at horizons longer than 2 years in countries that grow at the same rate and have inflation under control.

The RER helps predict the nominal exchange rate in countries with capital controls.

Which of the following phrases is false:

It is easier to forecast in the sample than out of sample.

Bank forecasts are generally more accurate than the random walk.

It is very difficult to beat the random walk method in forecasting exchange rates at horizons up to two years.

The random walk forecasting method makes large forecasting errors.

The most important form of exchange rate exposure is:

Translation exposure.

Transaction and translation exposures.

Transaction exposure.

Economic exposure.

Question 2: Answer all questions below

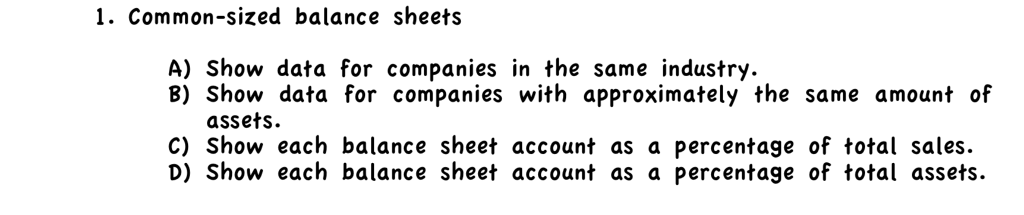

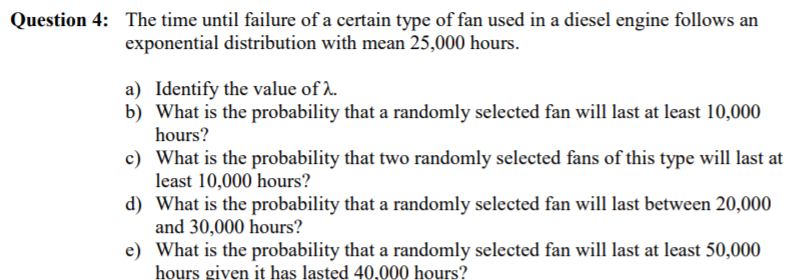

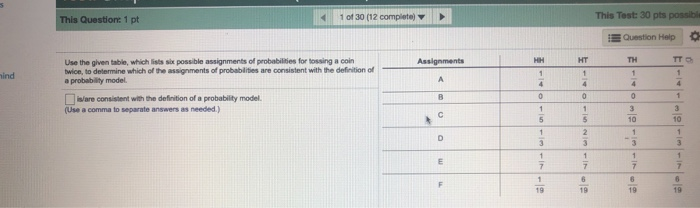

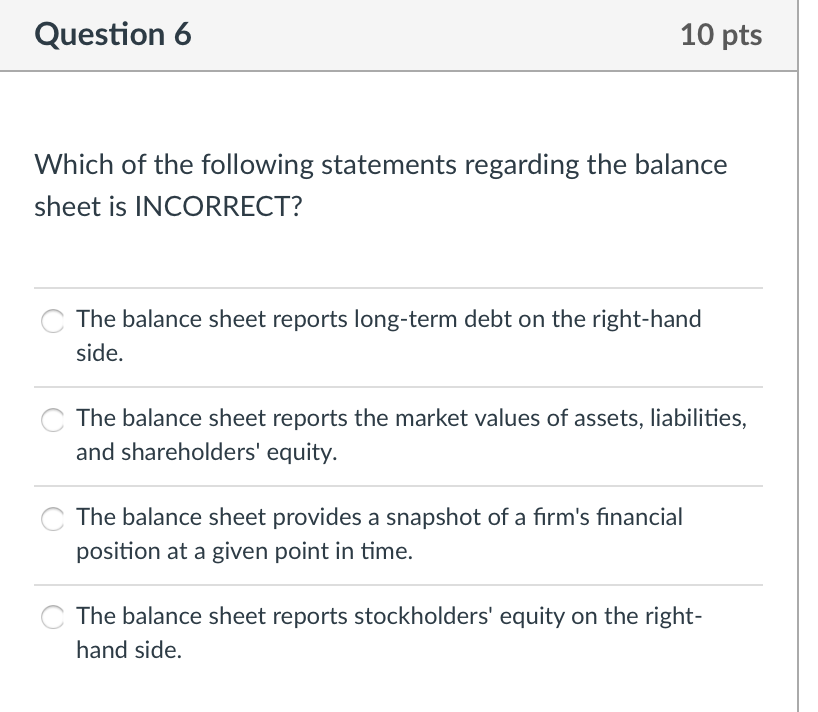

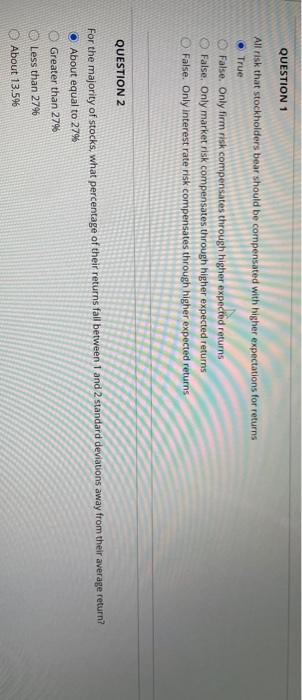

1. Common-sized balance sheets A) Show data For companies in the same industry. 8) Show data for companies with approximately the same amount of assets. C) Show each balance sheet account as a percentage of total sales. D) Show each balance sheet account as a percentage of total assets. Question 4: The time until failure of a certain type of fan used in a diesel engine follows an exponential distribution with mean 25,000 hours. a) Identify the value of 2. b) What is the probability that a randomly selected fan will last at least 10,000 hours? c) What is the probability that two randomly selected fans of this type will last at least 10,000 hours? d) What is the probability that a randomly selected fan will last between 20,000 and 30,000 hours? e) What is the probability that a randomly selected fan will last at least 50,000 hours given it has lasted 40.000 hours?This Question: 1 pt 1 of 30 (12 complete) + This Test: 30 pts possibl Question Help Use the given table, which lists six possible assignments of probabilities for tossing a coin Assignments HH HT TH TT twice, to determine which of the assignments of probabilities are consistent with the definition of probability model. A Ware consistent with the definition of a probability model. 1 (Uve a comma to separate answers as needed.) 10 10 D - 4- F 19Question 6 10 pts Which of the following statements regarding the balance sheet is INCORRECT? if\" The balance sheet reports long-term debt on the right-hand side. If\" The balance sheet reports the market values of assets, liabilities, and shareholders' equity. f\" The balance sheet provides a snapshot of a rm's nancial position at a given point in time. 5\"\" The balance sheet reports stockholders' equity on the right- hand side. QUESTION 1 All risk that stockholders bear should be compensated with higher expectations for returns True False. Only firm risk compensates through higher expected returns )False, Only market risk compensates through higher expected returns False. Only interest rate risk compensates through higher expected returns QUESTION 2 For the majority of stocks, what percentage of their returns fall between 1 and 2 standard deviations away from their average return? About equal to 27% Greater than 279% Less than 2796 About 13.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts