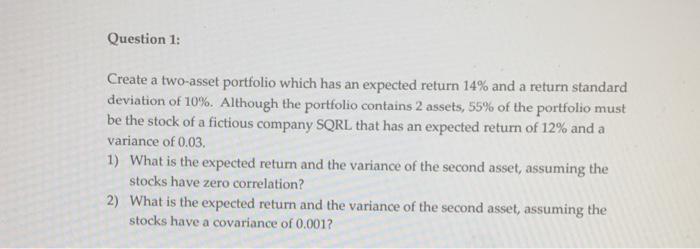

Question: Question 1: Create a two-asset portfolio which has an expected return 14% and a return standard deviation of 10%. Although the portfolio contains 2 assets,

Question 1: Create a two-asset portfolio which has an expected return 14% and a return standard deviation of 10%. Although the portfolio contains 2 assets, 55% of the portfolio must be the stock of a fictious company SQRL that has an expected return of 12% and a variance of 0.03. 1) What is the expected return and the variance of the second asset, assuming the stocks have zero correlation? 2) What is the expected return and the variance of the second asset, assuming the stocks have a covariance of 0.001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts