Question: Question 1. Expected yearly yield a) Present in which intervals the expected yearly yield should be at in 67%, 95% and 99% of the cases.

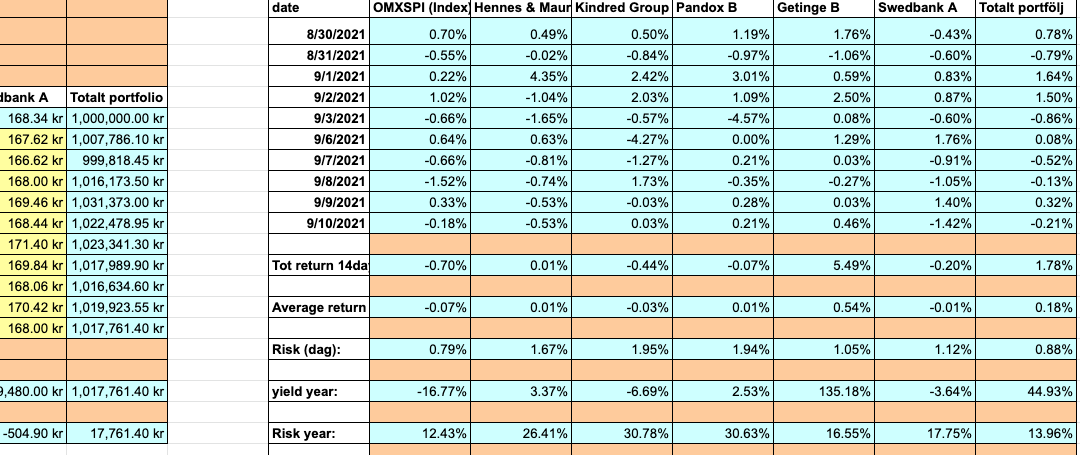

Question 1. Expected yearly yield a) Present in which intervals the expected yearly yield should be at in 67%, 95% and 99% of the cases. b) How has the diversification impacted these intervals compared to if you would have only bought stocK in a normal corporation. Question 2. Average yield and total return a) Analyse the average yield and the total return for each stock. b) Is the development during this short period a good prognosis for the future? Datasheet attached below;

date bank A Totalt portfolio 168.34 kr 1,000,000.00 kr 167.62 kr 1,007,786.10 kr 166.62 kr 999,818.45 kr 168.00 kr 1,016,173.50 kr 169.46 kr 1,031,373.00 kr 168.44 kr 1,022,478.95 kr 171.40 kr 1,023,341.30 kr 169.84 kr 1,017,989.90 kr 168.06 kr 1,016,634.60 kr 170.42 kr 1,019,923.55 kr 168.00 kr 1,017,761.40 kr 8/30/2021 8/31/2021 9/1/2021 9/2/2021 9/3/2021 9/6/2021 9/7/2021 9/8/2021 9/9/2021 9/10/2021 OMXSPI (Index Hennes & Maur Kindred Group Pandox B Getinge B Swedbank A Totalt portflj 0.70% 0.49% 0.50% 1.19% 1.76% -0.43% 0.78% -0.55% -0.02% -0.84% -0.97% -1.06% -0.60% -0.79% 0.22% 4.35% 2.42% 3.01% 0.59% 0.83% 1.64% 1.02% -1.04% 2.03% 1.09% 2.50% 0.87% 1.50% -0.66% -1.65% -0.57% -4.57% 0.08% -0.60% -0.86% 0.64% 0.63% -4.27% 0.00% 1.29% 1.76% 0.08% -0.66% -0.81% -1.27% 0.21% 0.03% -0.91% -0.52% -1.52% -0.74% 1.73% -0.35% -0.27% -1.05% -0.13% 0.33% -0.53% -0.03% 0.28% 0.03% 1.40% 0.32% -0.18% -0.53% 0.03% 0.21% 0.46% -1.42% -0.21% Tot return 14da -0.70% 0.01% -0.44% -0.07% 5.49% -0.20% 1.78% Average return -0.07% 0.01% -0.03% 0.01% 0.54% -0.01% 0.18% Risk (dag): 0.79% 1.67% 1.95% 1.94% 1.05% 1.12% 0.88% 9,480.00 kr 1,017,761.40 kr yield year: -16.77% 3.37% -6.69% 2.53% 135.18% -3.64% 44.93% -504.90 kr 17,761.40 kr Risk year: 12.43% 26.41% 30.78% 30.63% 16.55% 17.75% 13.96% date bank A Totalt portfolio 168.34 kr 1,000,000.00 kr 167.62 kr 1,007,786.10 kr 166.62 kr 999,818.45 kr 168.00 kr 1,016,173.50 kr 169.46 kr 1,031,373.00 kr 168.44 kr 1,022,478.95 kr 171.40 kr 1,023,341.30 kr 169.84 kr 1,017,989.90 kr 168.06 kr 1,016,634.60 kr 170.42 kr 1,019,923.55 kr 168.00 kr 1,017,761.40 kr 8/30/2021 8/31/2021 9/1/2021 9/2/2021 9/3/2021 9/6/2021 9/7/2021 9/8/2021 9/9/2021 9/10/2021 OMXSPI (Index Hennes & Maur Kindred Group Pandox B Getinge B Swedbank A Totalt portflj 0.70% 0.49% 0.50% 1.19% 1.76% -0.43% 0.78% -0.55% -0.02% -0.84% -0.97% -1.06% -0.60% -0.79% 0.22% 4.35% 2.42% 3.01% 0.59% 0.83% 1.64% 1.02% -1.04% 2.03% 1.09% 2.50% 0.87% 1.50% -0.66% -1.65% -0.57% -4.57% 0.08% -0.60% -0.86% 0.64% 0.63% -4.27% 0.00% 1.29% 1.76% 0.08% -0.66% -0.81% -1.27% 0.21% 0.03% -0.91% -0.52% -1.52% -0.74% 1.73% -0.35% -0.27% -1.05% -0.13% 0.33% -0.53% -0.03% 0.28% 0.03% 1.40% 0.32% -0.18% -0.53% 0.03% 0.21% 0.46% -1.42% -0.21% Tot return 14da -0.70% 0.01% -0.44% -0.07% 5.49% -0.20% 1.78% Average return -0.07% 0.01% -0.03% 0.01% 0.54% -0.01% 0.18% Risk (dag): 0.79% 1.67% 1.95% 1.94% 1.05% 1.12% 0.88% 9,480.00 kr 1,017,761.40 kr yield year: -16.77% 3.37% -6.69% 2.53% 135.18% -3.64% 44.93% -504.90 kr 17,761.40 kr Risk year: 12.43% 26.41% 30.78% 30.63% 16.55% 17.75% 13.96%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts