Question: Question 1 Fraser Ltd. uses the allowance method to account for uncollectible accounts. The company estimates bad debts as 4% of accounts receivable. On November

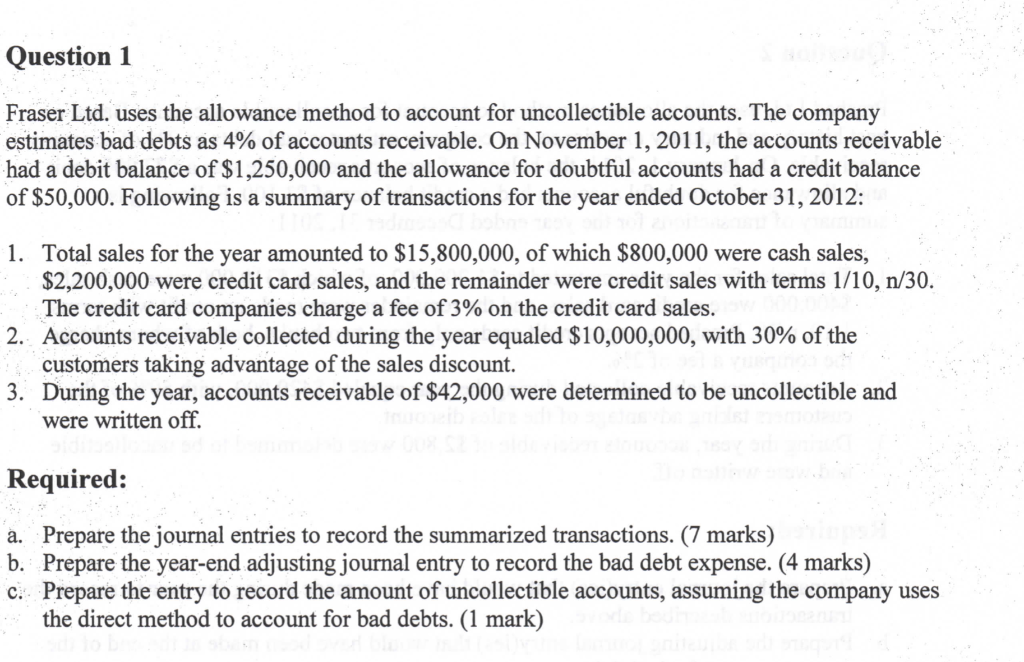

Question 1 Fraser Ltd. uses the allowance method to account for uncollectible accounts. The company estimates bad debts as 4% of accounts receivable. On November 1, 2011, the accounts receivable had a debit balance of $1,250,000 and the allowance for doubtful accounts had a credit balance of $50,000. Following is a summary of transactions for the year ended October 31, 2012: 1. Total sales for the year amounted to $15,800,000, of which $800,000 were cash sales, $2,200,000 were credit card sales, and the remainder were credit sales with terms 1/10, n/30. The credit card companies charge a fee of 3% on the credit card sales. 2. Accounts receivable collected during the year equaled $10,000,000, with 30% of the customers taking advantage of the sales discount. 3. During the year, accounts receivable of $42,000 were determined to be uncollectible and were written off. Required: a. Prepare the journal entries to record the summarized transactions. (7 marks) b. Prepare the year-end adjusting journal entry to record the bad debt expense. (4 marks) c. Prepare the entry to record the amount of uncollectible accounts, assuming the company uses the direct method to account for bad debts. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts