Question: Question 2 Prashad Ltd. uses the allowance method to account for uncollectible accounts. Based on past history and industry experience, the company estimates bad debts

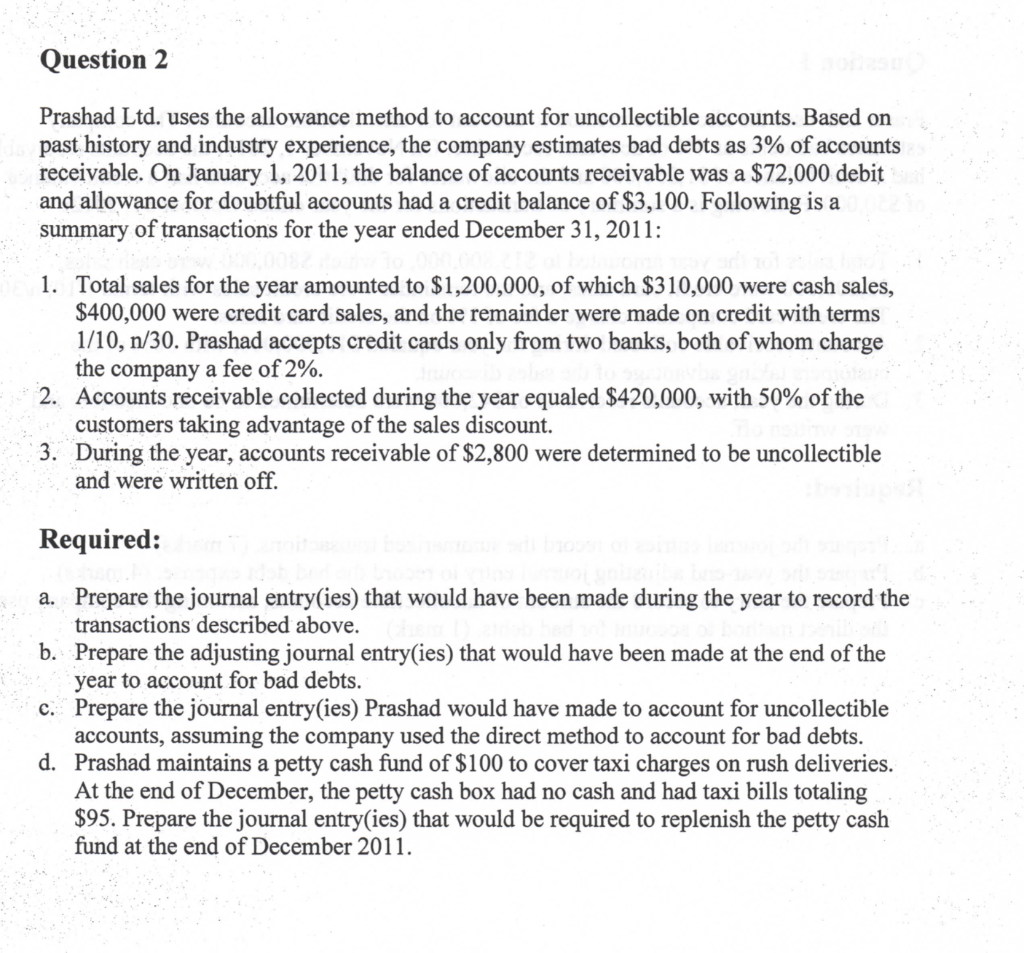

Question 2 Prashad Ltd. uses the allowance method to account for uncollectible accounts. Based on past history and industry experience, the company estimates bad debts as 3% of accounts receivable. On January 1, 2011, the balance of accounts receivable was a $72,000 debit and allowance for doubtful accounts had a credit balance of $3,100. Following is a summary of transactions for the year ended December 31, 2011: 1. Total sales for the year amounted to $1,200,000, of which $310,000 were cash sales, $400,000 were credit card sales, and the remainder were made on credit with terms 1/10, n/30. Prashad accepts credit cards only from two banks, both of whom charge the company a fee of 2%. 2. Accounts receivable collected during the year equaled $420,000, with 50% of the customers taking advantage of the sales discount. 3. During the year, accounts receivable of $2,800 were determined to be uncollectible and were written off. Required: a. Prepare the journal entry(ies) that would have been made during the year to record the transactions described above. b. Prepare the adjusting journal entry(ies) that would have been made at the end of the year to account for bad debts. c. Prepare the journal entry(ies) Prashad would have made to account for uncollectible accounts, assuming the company used the direct method to account for bad debts. d. Prashad maintains a petty cash fund of $100 to cover taxi charges on rush deliveries. At the end of December, the petty cash box had no cash and had taxi bills totaling $95. Prepare the journal entry(ies) that would be required to replenish the petty cash fund at the end of December 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts