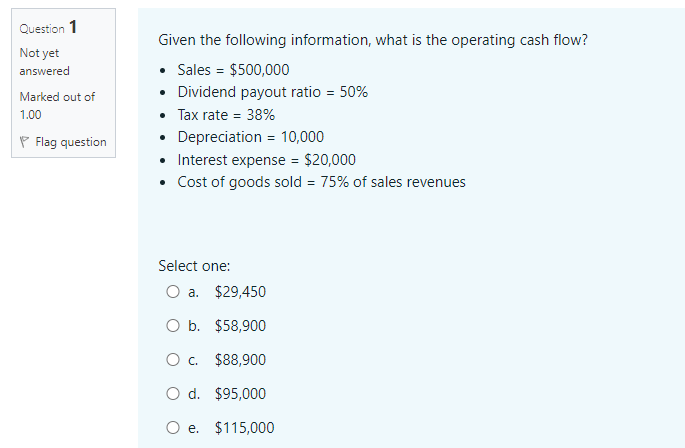

Question: Question 1 Given the following information, what is the operating cash flow? Not yet answered . Sales = $500,000 Marked out of . Dividend payout

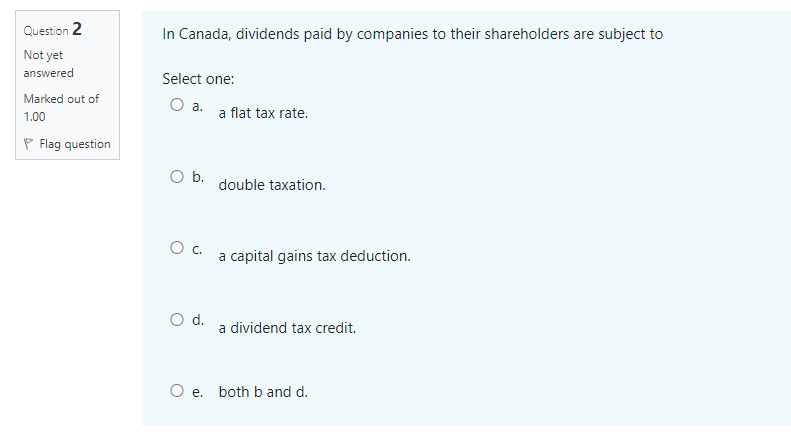

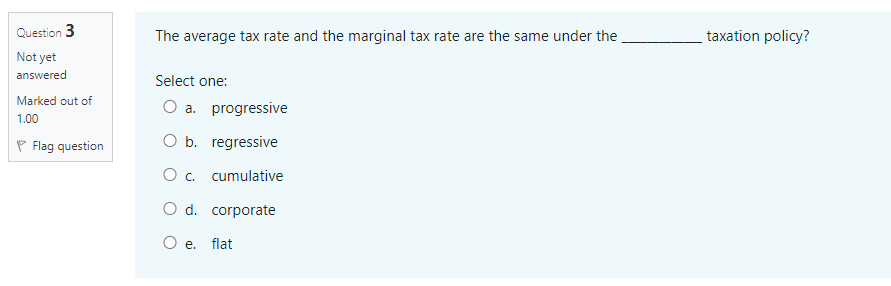

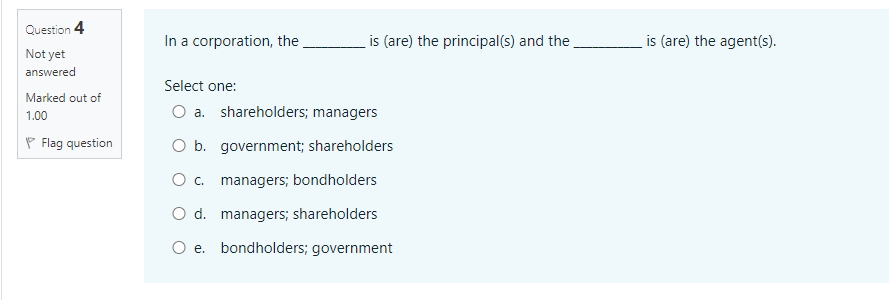

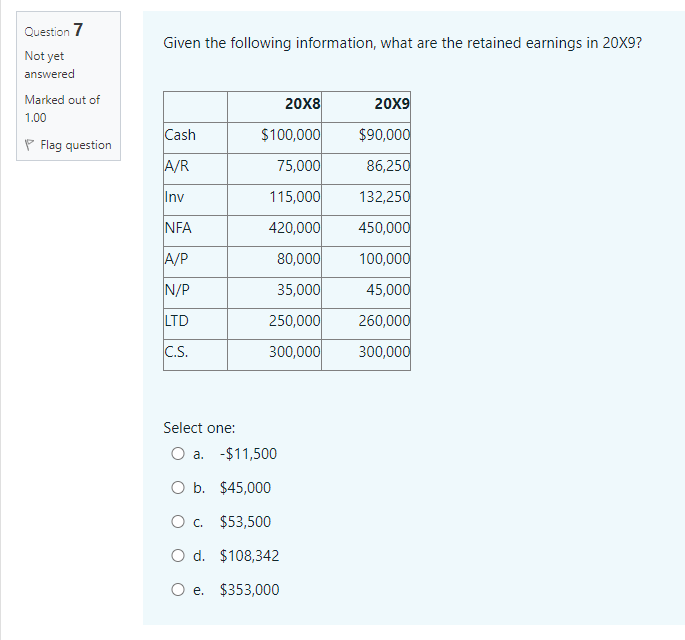

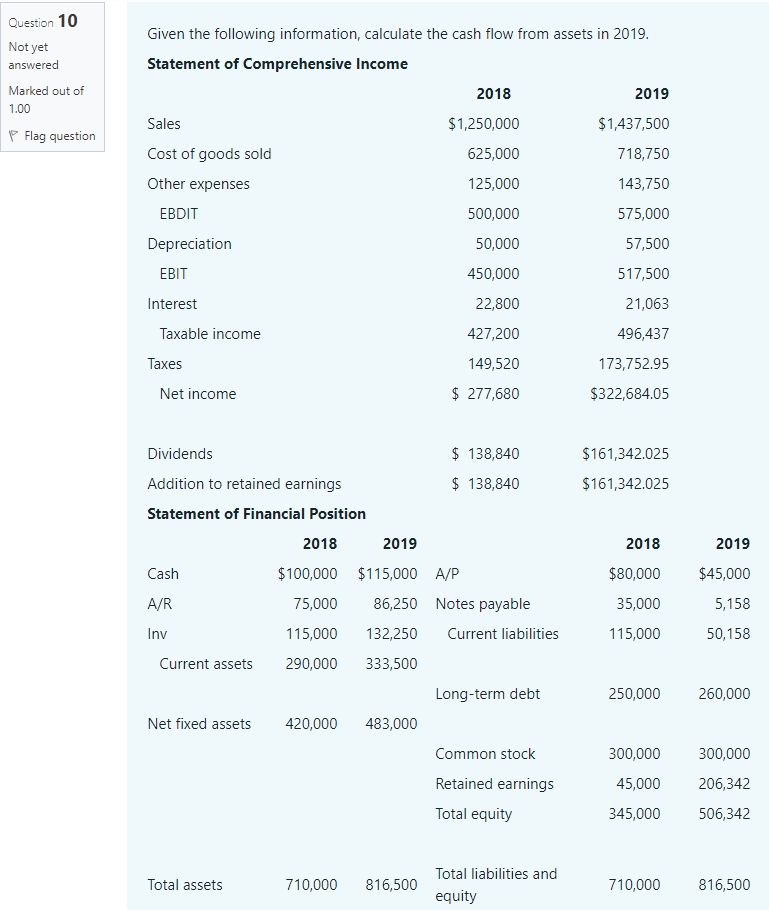

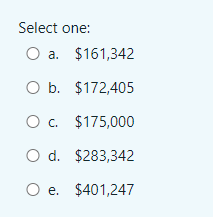

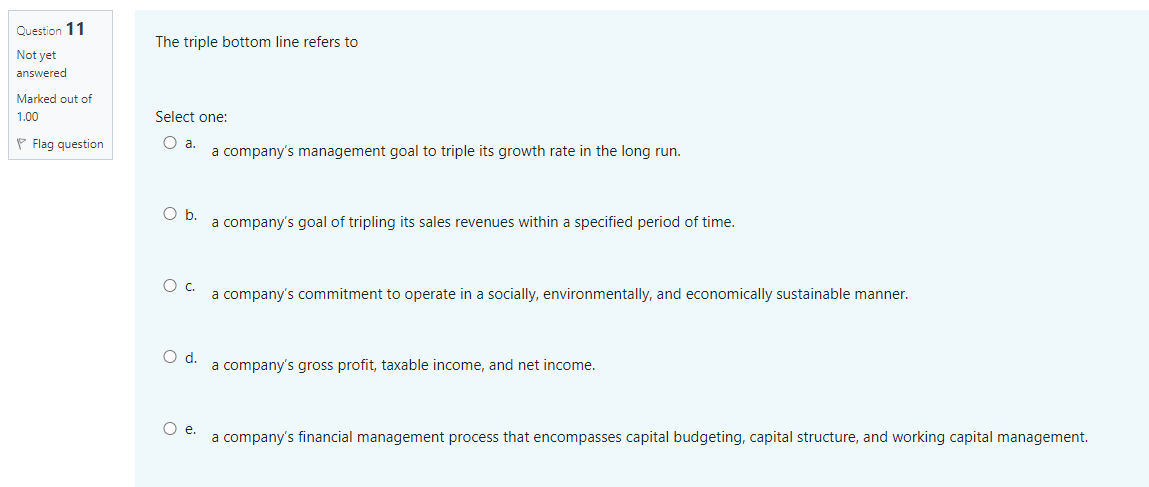

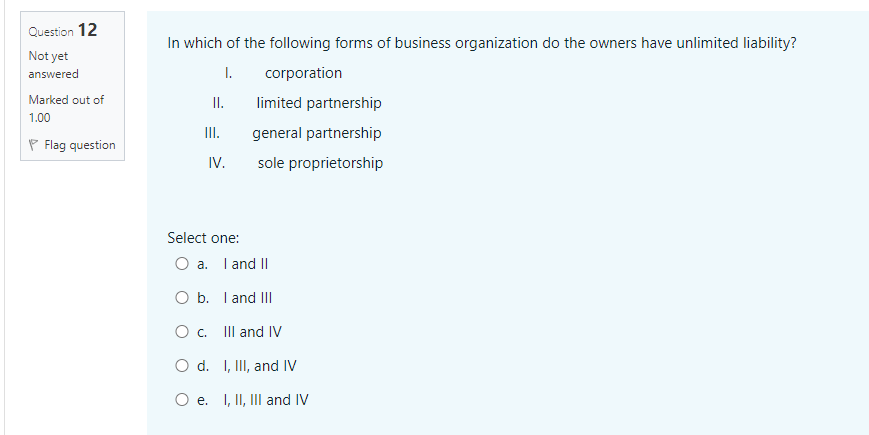

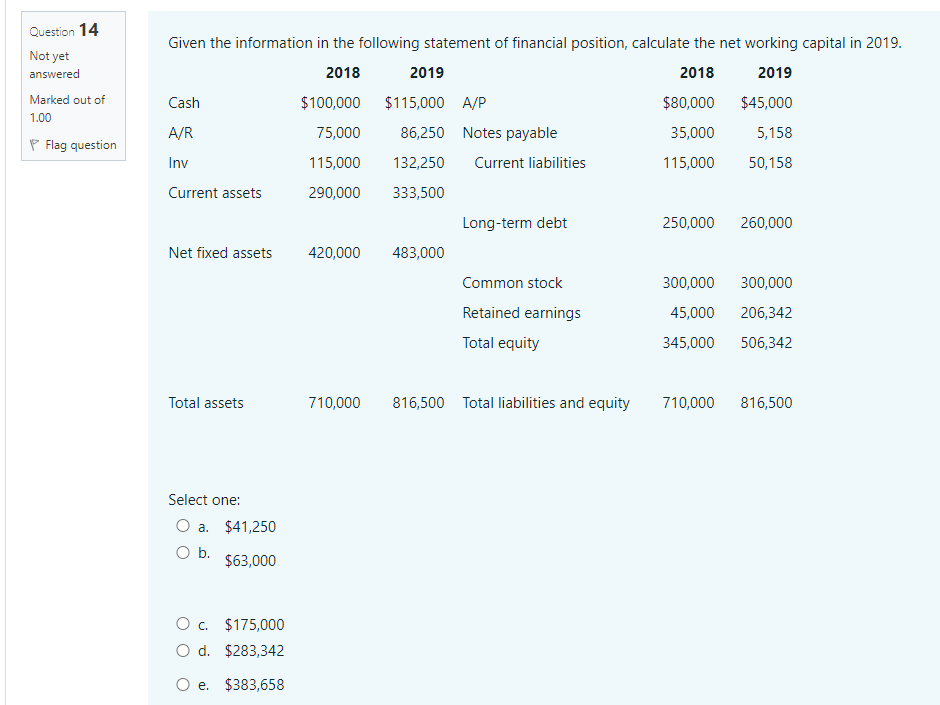

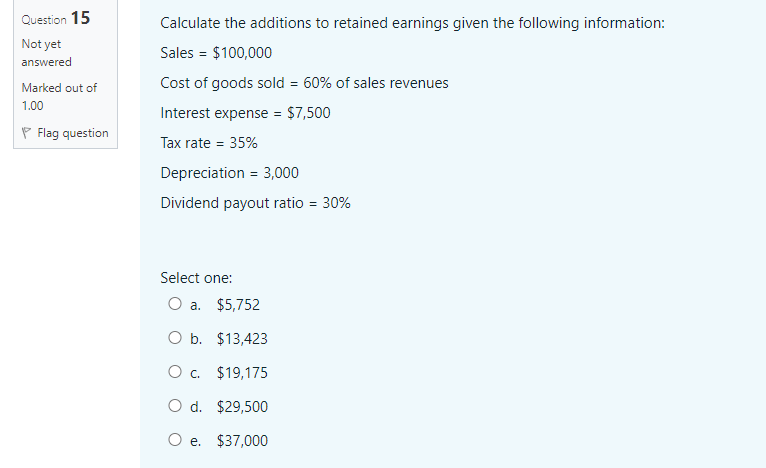

Question 1 Given the following information, what is the operating cash flow? Not yet answered . Sales = $500,000 Marked out of . Dividend payout ratio = 50% 1.00 . Tax rate = 38% Flag question . Depreciation = 10,000 . Interest expense = $20,000 . Cost of goods sold = 75% of sales revenues Select one: O a. $29,450 O b. $58,900 O c. $88,900 O d. $95,000 O e. $115,000Question 2 In Canada, dividends paid by companies to their shareholders are subject to Not yet answered Select one: Marked out of 1.00 O a. a flat tax rate. Flag question O b. double taxation. O C. a capital gains tax deduction. O d. a dividend tax credit. O e. both band d.Question 3 Not yet answered Marked put of 1.00 'F Flag question The average tax rate and the marginal tax rate are the same under the Select one: O a. progressive O b. regressive O c. cumulative O cl. corporate O e. at taxation policy? Question 4 In a corporation, the is (are) the principal(s) and the is (are) the agent(s). Not yet answered Select one: Marked out of 1.00 O a. shareholders; managers Flag question O b. government; shareholders O c. managers; bondholders O d. managers; shareholders O e. bondholders; governmentQuestion 7 Given the following information, what are the retained earnings in 20X9? Not yet answered Marked out of 20X8 20X9 1.00 Cash $100,000 $90,000 Flag question A/R 75,000 86,250 Inv 115,000 132,250 NFA 420,000 450,000 A/P 80,000 100,000 N/P 35,000 45,000 LTD 250,000 260,000 C.S. 300,000 300,000 Select one: O a. -$11,500 O b. $45,000 O c. $53,500 O d. $108,342 O e. $353,000Question 8 Holding more cash reserves will increase as well as Not yet answered Select one: Marked out of O a. liquidity; current liabilities 1.00 Flag question O b. liquidity; equity O c. equity; liabilities O d. liquidity; foregone profits O e. current liabilities; foregone profitsQuestion 9 In financial decision making, which of the following tax rates is relevant? Not yet answered Select one: Marked out of O a. marginal 1.00 Flag question O b. average O c. personal O d. corporate O e. flatQuestion 10 Given the following information, calculate the cash flow from assets in 2019. Not yet answered Statement of Comprehensive Income Marked out of 2018 2019 1.00 Sales $1,250,000 $ 1,437,500 Flag question Cost of goods sold 625,000 718,750 Other expenses 125,000 143,750 EBDIT 500,000 575,000 Depreciation 50,000 57,500 EBIT 450,000 517,500 Interest 22,800 21,063 Taxable income 427,200 496,437 Taxes 149,520 173,752.95 Net income $ 277,680 $322,684.05 Dividends $ 138,840 $161,342.025 Addition to retained earnings $ 138,840 $161,342.025 Statement of Financial Position 2018 2019 2018 2019 Cash $100,000 $115,000 A/P $80,000 $45,000 A/R 75,000 86,250 Notes payable 35,000 5,158 Inv 115,000 132,250 Current liabilities 115,000 50, 158 Current assets 290,000 333,500 Long-term debt 250,000 260,000 Net fixed assets 420,000 483,000 Common stock 300,000 300,000 Retained earnings 45,000 206,342 Total equity 345,000 506,342 Total liabilities and Total assets 710,000 816,500 710,000 816,500 equity\fQuestion 1 1 Not yet answered Marked out of 1.00 Y Flag question The triple bottom line refers to Select one: Oa a company's management goal to triple its growth rate in the long run. a company's goal of tripling its sales revenues within a specified period of time. a company's commitment to operate in a socially, environmentally. and economically sustainable manner. a company's gross prot, taxable income, and net income. a company's nancial management process that encompasses capital budgetingr capital structure, and working capital management. Question 12 In which of the following forms of business organization do the owners have unlimited liability? Not yet answered 1. corporation Marked out of limited partnership 1.00 Flag question general partnership IV. sole proprietorship Select one: O a. land Il O b. l and Ill O c. Ill and IV O d. I, Ill, and IV O e. I, II, Ill and IVQuestion 13 A security transaction such as an initial public offering (IPO) occurs in the Not yet answered Select one: Marked out of O a. primary financial market. 1.00 Flag question O b. secondary financial market. O c. over-the-counter (OTC) market. O d. dealer market. O e. money market.Question 14 Given the information in the following statement of financial position, calculate the net working capital in 2019. Not yet answered 2018 2019 2018 2019 Marked out of Cash $100,000 $115,000 A/P $80,000 $45,000 1.00 A/R 75,000 86,250 Notes payable 35,000 5,158 Flag question Inv 115,000 132,250 Current liabilities 115,000 50, 158 Current assets 290,000 333,500 Long-term debt 250,000 260,000 Net fixed assets 420,000 483,000 Common stock 300,000 300,000 Retained earnings 45,000 206,342 Total equity 345,000 506,342 Total assets 710,000 816,500 Total liabilities and equity 710,000 816,500 Select one: O a. $41,250 O b. $63,000 O c. $175,000 O d. $283,342 O e. $383,658Question I 5 Not yet answered Marked out of 1 .01] "F Flag question Calculate the additions to retained earnings given the following information: Sales = $1,{}{} Cost of goods sold = 'i of sales revenues Interest expense = $15M Tax rate = 35% Depreciation = EDGE Dividend payout ratio = 30% Select one: Q a. $5,152 C1 b. $135123 C1 :3. NEWS 0 d. $29500 G e. HEDGE}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts