Question: Question 1: Highland Hill Wind Project The wind project at Highland Hill was the result of nearly four years of research and planning. The project

Question 1: Highland Hill Wind Project The wind project at Highland Hill was the result of nearly four years of research and planning. The project would mitigate high energy prices for the residents in the area. Over a course of three years, a study was conducted to gather comprehensive data on the average wind speed, direction, and frequency for a 40-meter high tower located at the site on Northeastern Massachusetts. The study provided an average yearly utilization of 29% of the installed capacity.

Highland Hill would be building three 1.5MW turbines for a total generation capacity of 4.5MW. Total investment costs included $7,600,000 for the turbines, $4,000,000 for construction, and $1,300,000 for Property & escrow. The project also required a fee of $1,600,000 for the developer. Turbines have a 20-year life expectancy, even though it can be extended.

Highland Hill secured a 20-year PPA with the local utility company at a price of $0.051, which will be adjusted for inflation annually at 2.5%. The developer also intended to sell the RECs generated by the project to increase the economic viability of the project and negotiated the sale of RECs at a five-year fixed rate of $30 per MWh with an electric utility company serving southern Massachusetts. The prices of RECs exhibit high volatility, but it was expected that the project could sell RECs after this period at a similar price.

The developer was successful in securing government-sponsored financing through a loan from the Rural Utilities Service (RUS), an agency of the United States Department of Agriculture (USDA). This 20-year loan was for an amount of $9 million and at a rate of 4.25% per year.

The project could benefit from a PTC incentive for 10 years at a rate of 2.1 cents per kWh, updated at 2.5% per year. Alternatively, the project could benefit from a 30% ITC. However, developers of wind projects may opt for either an ITC or a PTC, but not both. The project also benefited from accelerated depreciation. It was estimated that about 90% of the costs of the project qualified for this incentive. Assume a straight-line depreciation schedule for the remaining value. Assume a tax rate of 40% and a 15% required return by equity investors.

1.1.How much do you estimate equity investors are willing to invest in this project?

1.2.What is the value of the PTC for equity investors?

1.3.What is the value of the ITC for equity investors?

1.4.What is the value of the accelerated depreciation regime for equity investors? 2

1.5.What is the NPV of the project without the PTC, ITC, and accelerated depreciation incentives? Would it be economically viable? Assume the same amount for the equity investment that you estimated in 1.1. and use the WACC to discount the CFs of the project.

plz use excel to solve these questions

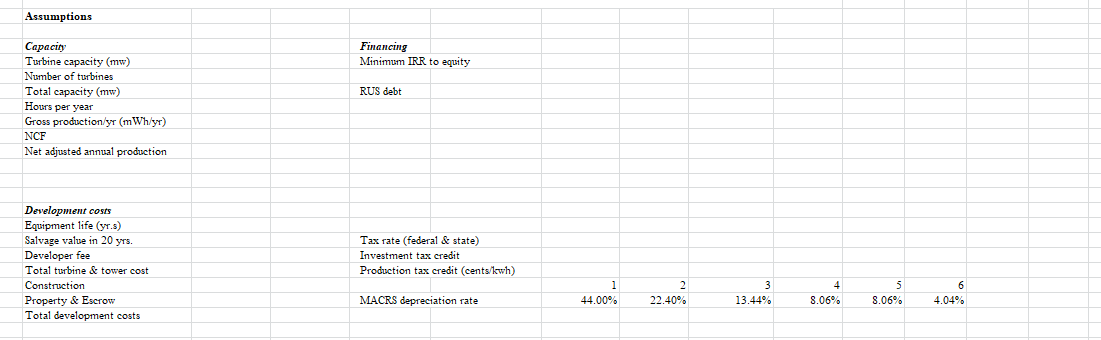

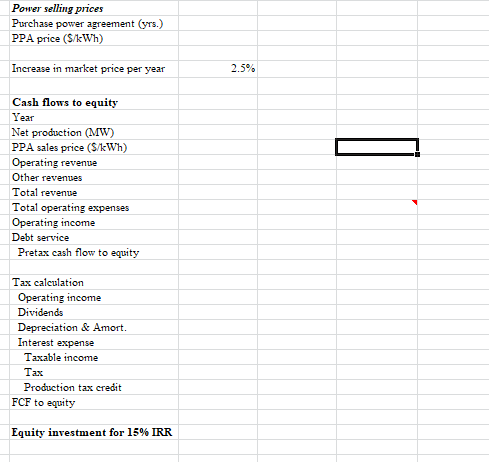

Assumptions Capacity Financing Turbine capacity (mw) Minimum IRR to equity Number of turbines Total capacity (mw) RUS debt Hours per year Gross production/yr (mWh/yr) NCF Net adjusted annual production Development costs Equipment life (yr.s) Salvage value in 20 yrs. Tax rate (federal \& state) Developer fee Investment tax credit Total turbine & tower cost Production tax credit (cents/kwh) Construction Property \& Escrow MACRS depreciation rate \begin{tabular}{|r|r|r|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & 6 \\ \hline 44.00% & 22.40% & 13.44% & 8.06% & 8.06% & 4.04% \\ \hline \end{tabular} Power selling prices Purchase power agreement (yrs.) PPA price (\$/kWh) Increase in market price per year 2.5% Cash flows to equity Year Net production (MW) PPA sales price ( S/kWh) Operating revenve Other revenves Total revenue Total operating expenses Operating income Debt service Pretax cash flow to equity Tax calculation Operating income Dividends Depreciation \& Amort. Interest expense Taxable income Tax Production tax credit FCF to equity Equity investment for 15% IRR Assumptions Capacity Financing Turbine capacity (mw) Minimum IRR to equity Number of turbines Total capacity (mw) RUS debt Hours per year Gross production/yr (mWh/yr) NCF Net adjusted annual production Development costs Equipment life (yr.s) Salvage value in 20 yrs. Tax rate (federal \& state) Developer fee Investment tax credit Total turbine & tower cost Production tax credit (cents/kwh) Construction Property \& Escrow MACRS depreciation rate \begin{tabular}{|r|r|r|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & 6 \\ \hline 44.00% & 22.40% & 13.44% & 8.06% & 8.06% & 4.04% \\ \hline \end{tabular} Power selling prices Purchase power agreement (yrs.) PPA price (\$/kWh) Increase in market price per year 2.5% Cash flows to equity Year Net production (MW) PPA sales price ( S/kWh) Operating revenve Other revenves Total revenue Total operating expenses Operating income Debt service Pretax cash flow to equity Tax calculation Operating income Dividends Depreciation \& Amort. Interest expense Taxable income Tax Production tax credit FCF to equity Equity investment for 15% IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts