Question: Question 1 i. Explain what is meant by an efficiency frontier in portfolio theory and draw an efficiency frontier for two risky assets assuming that

Question 1

i. Explain what is meant by an efficiency frontier in portfolio theory and draw an efficiency frontier for two risky assets assuming that the correlation coefficient between the two asset is zero. Clearly indicate the region of dominant portfolios and the minimum variance portfolio.

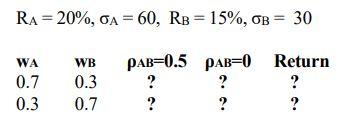

ii. You are given the following data about the returns on security A, RA and security B, RB. Along with the standard deviations of returns on asset A, A and the standard deviations of returns on asset B, B. Complete the following table for standard deviations of the portfolio for the two values of the correlation coefficient of returns on securities A and B (AB) and the differing weights attached to the two securities wA and wB. Show your workings.

RA= 20%, OA = 60, RB = 15%, OB = 30 WA 0.7 0.3 WB 0.3 0.7 paB=0.5 PAB=0 Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts