Question: Question 1: Indicate for each item below if the situation is a permanent difference or atemporary difference (use drop down menu). Question 2: Indicate for

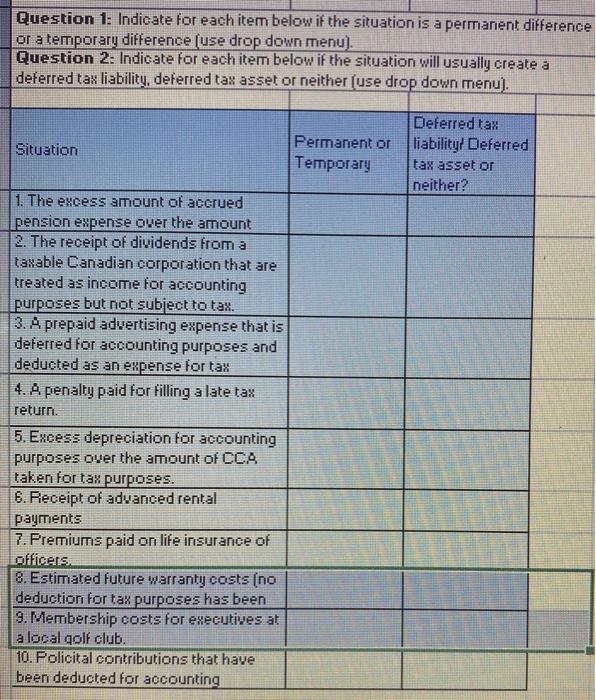

Question 1: Indicate for each item below if the situation is a permanent difference or atemporary difference (use drop down menu). Question 2: Indicate for each item below if the situation will usually create a deferred tax liability, deferred tax asset or neither (use drop down menu). Situation Permanent or Temporary Deferred tax liability/ Deferred tax asset or neither? 1. The excess amount of accrued pension expense over the amount 2. The receipt of dividends from a taxable Canadian corporation that are treated as income for accounting purposes but not subject to tax. 3. A prepaid advertising expense that is deferred for accounting purposes and deducted as an expense for tax 4. A penalty paid for Filling a late tax return 5. Excess depreciation for accounting purposes over the amount of CCA taken for tax purposes. 6. Peceipt of advanced rental payments 7. Premiums paid on life insurance of Officers 8. Estimated future warranty costs (no deduction for tax purposes has been 9. Membership costs for executives at a local golf club. 10. Policital contributions that have been deducted for accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts