Question: question 1 Lez Fox well has been operating a small transportation company for 25 years. The business has boomed in recent years, and Lez decided

question 1

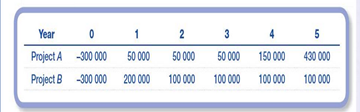

Lez Fox well has been operating a small transportation company for 25 years. The business has boomed in recent years, and Lez decided to invest another $ 300 000 to expand his business. There are two proposed mutually exclusive projects, and their cash flows are as follows.

Lez feels that project B is better since he can get his initial invested money back in two years time. For Lezs small business, the cost of capital is 10%.

please Draw NPV profiles for both projects. At what discount rate do the NPV profiles cross?

Year 0 1 Project A-300 000 50 000 Project B -300000 -300 000 200 000 2 3 4 50 000 50000 150000 100 000 100 000 100 000 5 5 430 000 100 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts