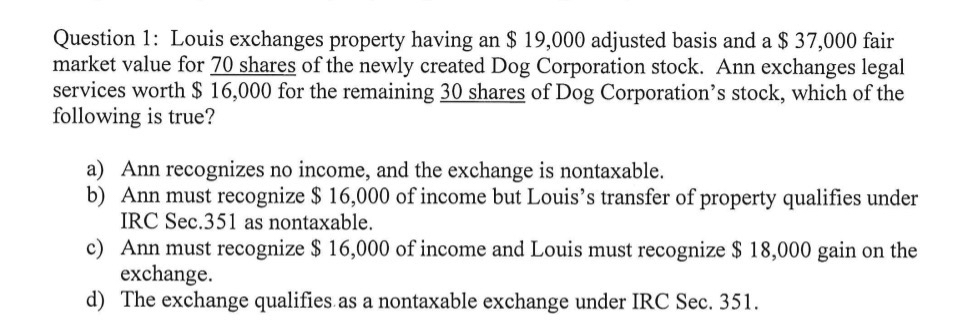

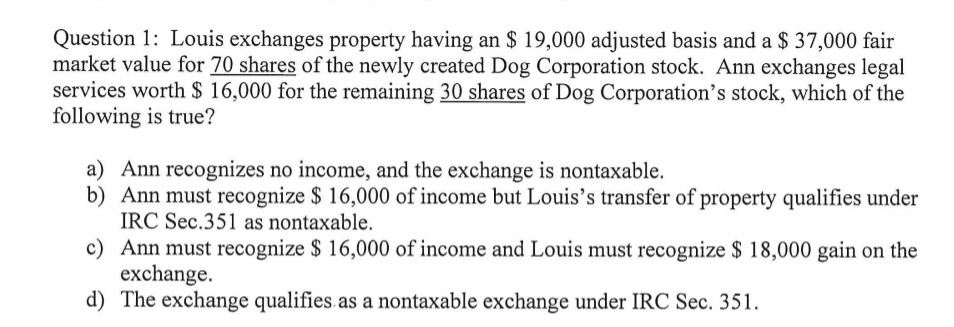

Question: Question 1 : Louis exchanges property having an $ 1 9 , 0 0 0 adjusted basis and a $ 3 7 , 0 0

Question : Louis exchanges property having an $ adjusted basis and a $ fair market value for shares of the newly created Dog Corporation stock. Ann exchanges legal services worth $ for the remaining shares of Dog Corporation's stock, which of the following is true?

a Ann recognizes no income, and the exchange is nontaxable.

b Ann must recognize $ of income but Louis's transfer of property qualifies under IRC Sec. as nontaxable.

c Ann must recognize $ of income and Louis must recognize $ gain on the exchange.

d The exchange qualifies as a nontaxable exchange under IRC Sec.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock