Question: 1. Cindy exchanges a 12-unit residential apartment building, which has an adjusted basis of $620,000, for undeveloped investment land which has a fair market value

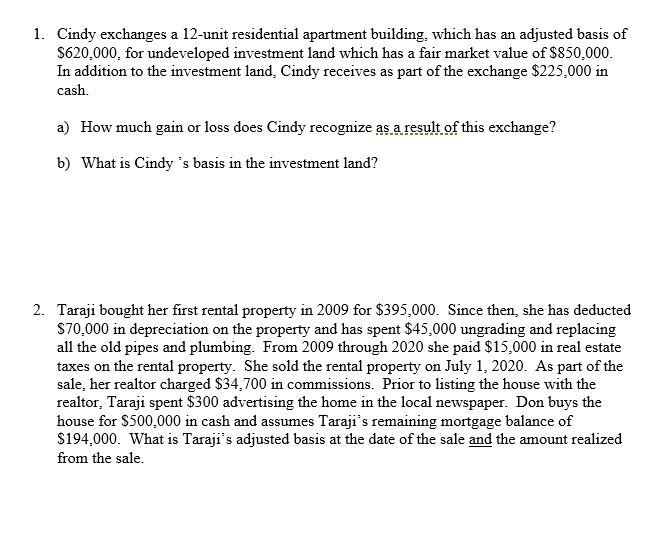

1. Cindy exchanges a 12-unit residential apartment building, which has an adjusted basis of $620,000, for undeveloped investment land which has a fair market value of $850,000. In addition to the investment land, Cindy receives as part of the exchange $225,000 in cash. a) How much gain or loss does Cindy recognize as a result of this exchange? b) What is Cindy's basis in the investment land? 2. Taraji bought her first rental property in 2009 for $395,000. Since then, she has deducted $70,000 in depreciation on the property and has spent $45,000 ungrading and replacing all the old pipes and plumbing. From 2009 through 2020 she paid $15,000 in real estate taxes on the rental property. She sold the rental property on July 1, 2020. As part of the sale, her realtor charged $34,700 in commissions. Prior to listing the house with the realtor, Taraji spent $300 advertising the home in the local newspaper. Don buys the house for $500,000 in cash and assumes Taraji's remaining mortgage balance of $194,000. What is Taraji's adjusted basis at the date of the sale and the amount realized from the sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts