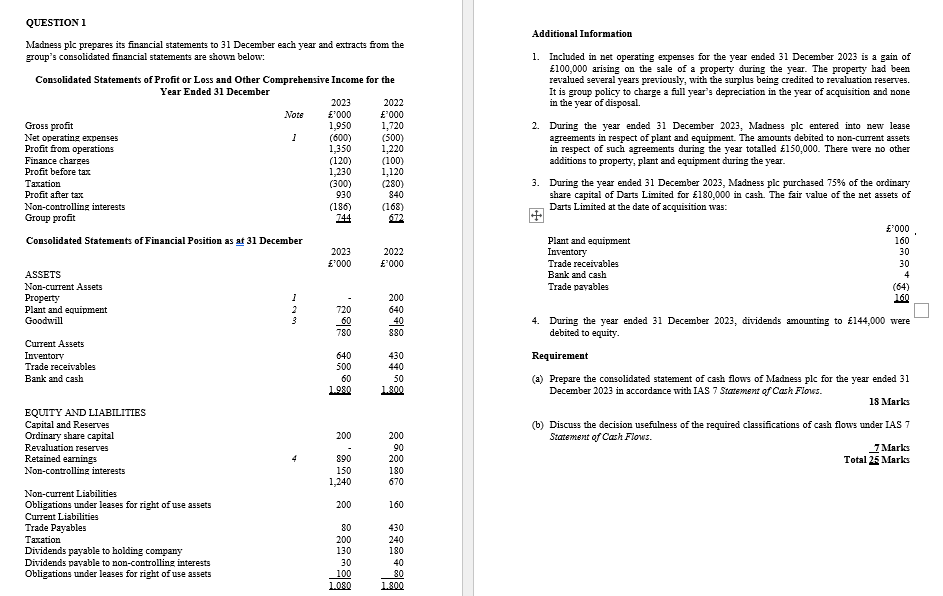

Question: QUESTION 1 Madness plc prepares its financial statements to 3 1 December each year and extracts from the group's consolidated financial statements are shown below:

QUESTION

Madness plc prepares its financial statements to December each year and extracts from the group's consolidated financial statements are shown below:

Consolidated Statements of Profit or Loss and Other Comprehensive Income for the Year Ended December

Additional Information

Included in net operating expenses for the year ended December is a gain of arising on the sale of a property during the year. The property had been revalued several years previously, with the surplus being credited to revaluation reserves. It is group policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal.

During the year ended December Madness ple entered into new lease agreements in respect of plant and equipment. The amounts debited to noncurrent assets in respect of such agreements during the year totalled There were no other additions to property, plant and equipment during the year.

During the year ended December Madness plc purchased of the ordinary share capital of Darts Limited for in cash. The fair value of the net assets of Darts Limited at the date of acquisition was:

During the year ended December dividends amounting to were debited to equity.

Requirement

a Prepare the consolidated statement of cash flows of Madness plc for the year ended December in accordance with IAS Statement of Cash Flows.

Marks

b Discuss the decision usefulness of the required classifications of cash flows under IAS Statement of Cash Flows.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock