Question: question 1 multiple choice question 2 answer choices: The McGregor Whisky Company is proposing to market diet scotch. The product will first be test-marketed for

question 1

multiple choice question 2

answer choices:

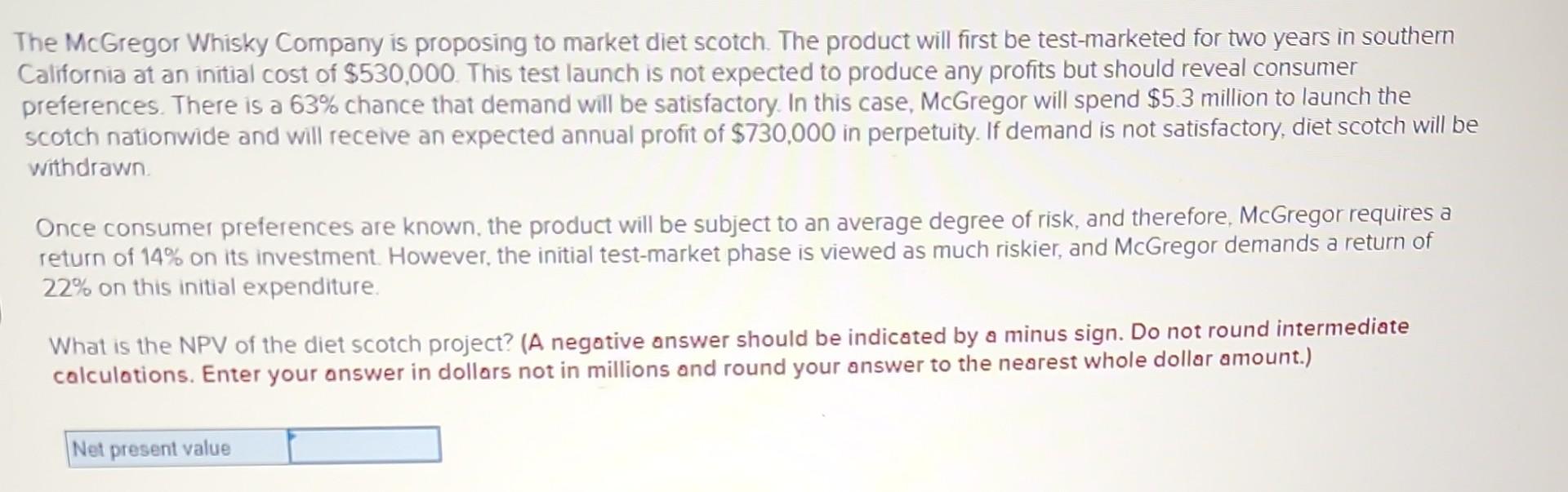

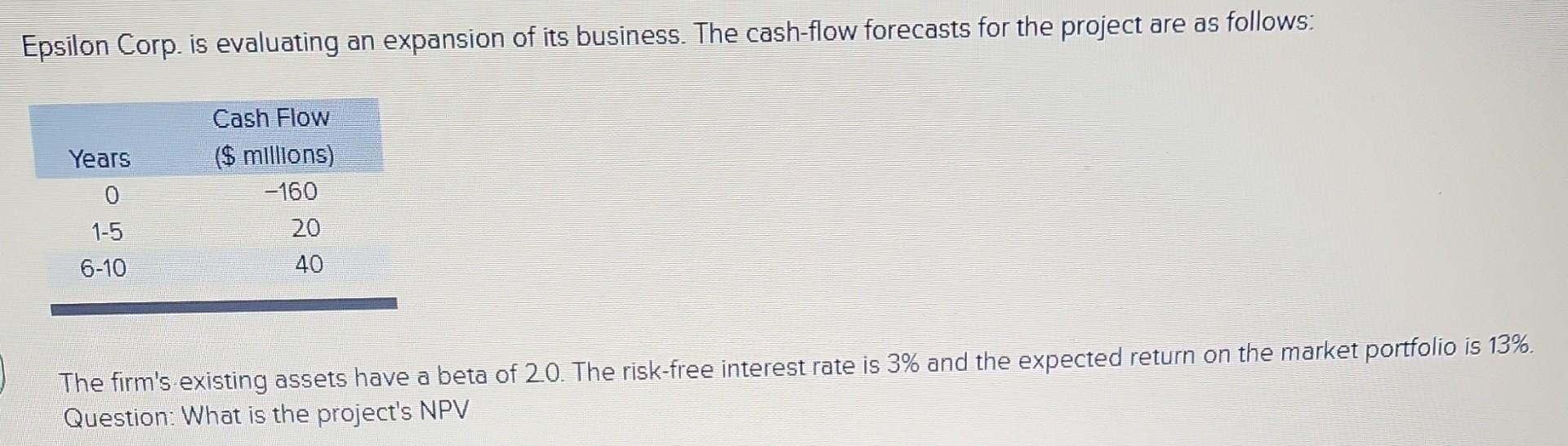

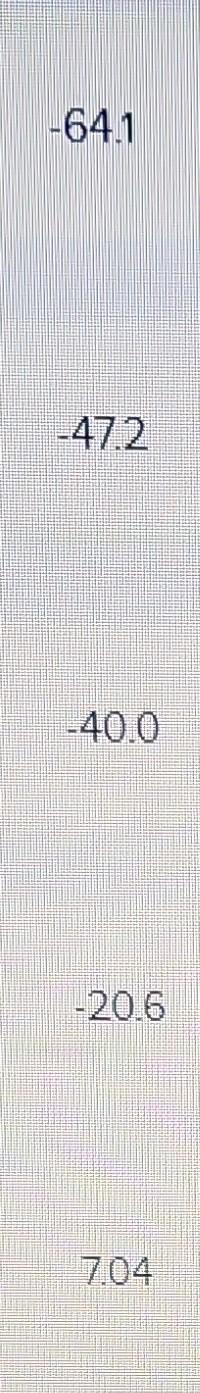

The McGregor Whisky Company is proposing to market diet scotch. The product will first be test-marketed for two years in southern California at an initial cost of $530,000. This test launch is not expected to produce any profits but should reveal consumer preferences. There is a 63% chance that demand will be satisfactory. In this case, McGregor will spend $5.3 million to launch the scotch nationwide and will receive an expected annual profit of $730,000 in perpetuity. If demand is not satisfactory, diet scotch will be withdrawn. Once consumer preferences are known, the product will be subject to an average degree of risk, and therefore, McGregor requires a return of 14% on its investment. However, the initial test-market phase is viewed as much riskier, and McGregor demands a return of 22% on this initial expenditure. What is the NPV of the diet scotch project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in dollars not in millions and round your answer to the nearest whole dollar amount.) Epsilon Corp. is evaluating an expansion of its business. The cash-flow forecasts for the project are as follows: The firm's existing assets have a beta of 20 . The risk-free interest rate is 3% and the expected return on the market portfolio is 13%. Question: What is the project's NPV 64.1 47.2 40.0 20.6 7.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts