Question: QUESTION 1 Net Present Value Method The management of Origami Company, a wholesale distributor of cracker products, is considering the purchase of a $30,000 machine

QUESTION 1

Net Present Value Method

The management of Origami Company, a wholesale distributor of cracker products, is considering the purchase of a $30,000 machine that would reduce operating costs in its warehouse by $5,000 per year. At the end of the machine's eight-year useful life, it will have no scrap value. The company's required rate of return is 11%.

Required:

(Ignore income taxes.)

- Determine the net present value of the investment in the machine.

- What is the difference between the total undiscounted cash inflows and cash outflows over the entire life of the machine?

QUESTION 2

Internal Rate of Return

Billy Brown, owner of Billy's Ice Cream On-the Go is investigating the purchase of a new $45,000 delivery truck that would contain specially designed warming racks. The new truck would have a six-year useful life. It would save $5,400 per year over the present method of delivering pizzas. In addition, it would result in the sale of 1,800 more litres of ice cream each year. The company realizes a contribution margin of $2 per litre.

Required:

(Ignore income taxes.)

- What would be the total annual cash inflows associated with the new truck for capital budgeting purposes?

- Find the internal rate of return promised by the new truck to the nearest whole percent point.

- In addition to the data above, assume that due to the unique warming racks, the truck will have a $13,000 salvage value at the end of six years. Under these conditions, compute the internal rate of return to the nearest whole percentage point. (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.

QUESTION 3

Uncertain Future Cash Flows

Jannsen Limited is investigating the purchase of solar panels that would save $100,000 each year in electricity costs. This solar panels cost $750,000 and is expected to have a 10-year useful life with no salvage value. The company requires a minimum 15% rate of return on all equipment purchases. This equipment would provide intangible benefits (such as greater flexibility and higher-quality output) that are difficult to estimate and yet are quite significant.

Required:

(Ignore income taxes.)

What dollar value per year would the intangible benefits have to be worth in order to make the solar panels an acceptable investment?

QUESTION 4

Preference Ranking

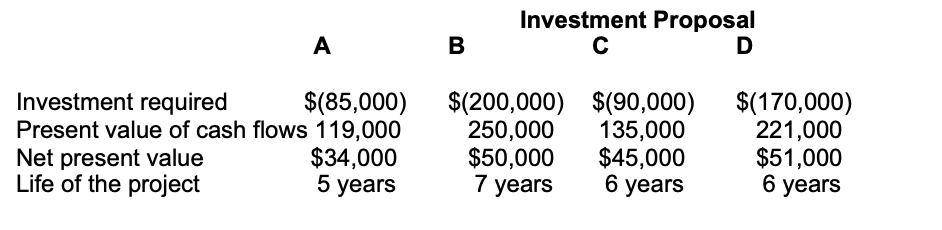

Information on four investment proposals is given below:

Investment Proposal A B C D Investment required $(85,000) $(200,000) $(90,000) $(170,000) Present value of cash flows 119,000 250,000 135,000 221,000 Net present value $34,000 $50,000 $45,000 $51,000 Life of the project 5 years 7 years 6 years 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts