Question: Question 1 Not yet saved Small firm effect can exist without violating efficient market hypothesis. Is the above statement true or false? Give explanations. Marked

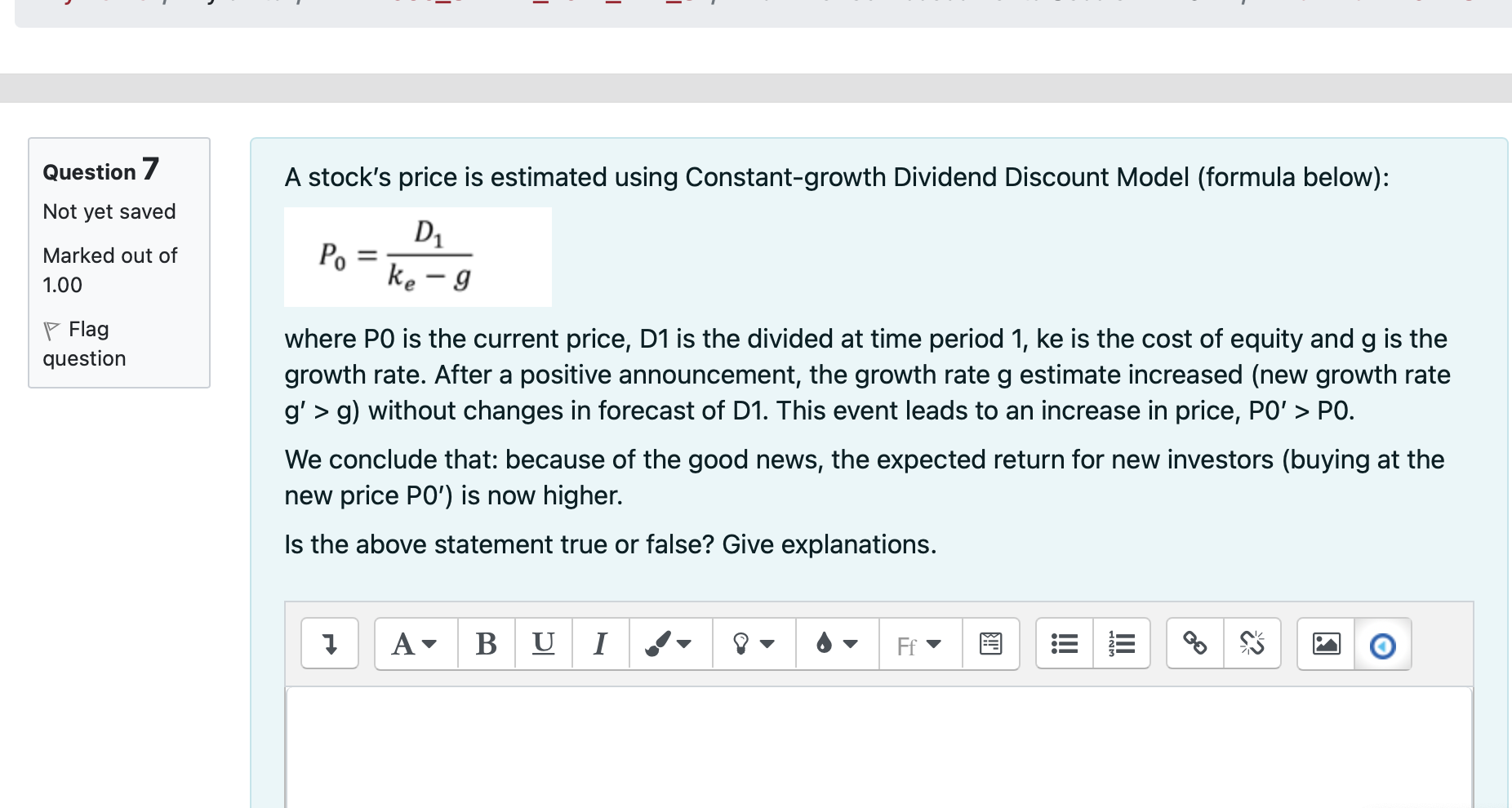

Question 1 Not yet saved Small firm effect can exist without violating efficient market hypothesis. Is the above statement true or false? Give explanations. Marked out of 1.00 1 A B U I Ff !!! III c? P Flag question Question 2 Not yet saved Marked out of 1.00 The Sharpe Ratio of portfolio A is 0.9 and the Sharpe Ratio of Portfolio B is 0.5. Standard deviation A is 20% and standard deviation of B is 10%. The risk-free asset in the market has a return of 2%. Portfolio B is a better choice for an investor whose investment target is to maximise return while keeping standard deviation below 12%. Is the above statement True or False? Give explanations. P Flag question I A B U I Ff LIE III ? O Question 3 Not yet saved Duration of a bond is defined as the weighted average of the times at which payments are made to the bondholder. Changes in the bond price do not have any impact on the duration of a bond when everything else is kept the same. Marked out of 1.00 P Flag question Is the above statement True or False? Give explanations. I A B U I Ff iii III ? Question 4 Not yet saved A long futures position is similar to a long call position. The main difference is that a long position in futures gives the right to buy the underlying asset whereas the long call position obligates the trader to buy Is the above statement true or false? Give explanations. Marked out of 1.00 P Flag question 1 A B U I Ff B!! iii III C ? O Question 5 Not yet saved Bond A matures in 6 years, has a modified duration equal to 4 years, and a yield equal to 10%. Bond A must be a zero coupon bond based on the information given. Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff Lii jii III ? Question 6 Not yet saved "A protective put is an investment strategy that involves purchasing an asset and a put on that asset simultaneously. It guarantees a maximum payoff equal to the put's exercise price." Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff jii III C? O Question 7 A stock's price is estimated using Constant-growth Dividend Discount Model (formula below): Not yet saved Marked out of 1.00 D Po = ke - g P Flag question where PO is the current price, D1 is the divided at time period 1, ke is the cost of equity and g is the growth rate. After a positive announcement, the growth rate g estimate increased (new growth rate g'>g) without changes in forecast D1. This event leads to an increase in price, PO' > PO. We conclude that: because of the good news, the expected return for new investors (buying at the new price PO') is now higher. Is the above statement true or false? Give explanations. 1 A B U I Ff !!! III 3? O Question 8 Not yet saved "A hedger who is long in a gold futures contract has to close out his position prior to futures maturity. The increase in basis benefits the profitability of her position." Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff Lii jii III C? Question 1 Not yet saved Small firm effect can exist without violating efficient market hypothesis. Is the above statement true or false? Give explanations. Marked out of 1.00 1 A B U I Ff !!! III c? P Flag question Question 2 Not yet saved Marked out of 1.00 The Sharpe Ratio of portfolio A is 0.9 and the Sharpe Ratio of Portfolio B is 0.5. Standard deviation A is 20% and standard deviation of B is 10%. The risk-free asset in the market has a return of 2%. Portfolio B is a better choice for an investor whose investment target is to maximise return while keeping standard deviation below 12%. Is the above statement True or False? Give explanations. P Flag question I A B U I Ff LIE III ? O Question 3 Not yet saved Duration of a bond is defined as the weighted average of the times at which payments are made to the bondholder. Changes in the bond price do not have any impact on the duration of a bond when everything else is kept the same. Marked out of 1.00 P Flag question Is the above statement True or False? Give explanations. I A B U I Ff iii III ? Question 4 Not yet saved A long futures position is similar to a long call position. The main difference is that a long position in futures gives the right to buy the underlying asset whereas the long call position obligates the trader to buy Is the above statement true or false? Give explanations. Marked out of 1.00 P Flag question 1 A B U I Ff B!! iii III C ? O Question 5 Not yet saved Bond A matures in 6 years, has a modified duration equal to 4 years, and a yield equal to 10%. Bond A must be a zero coupon bond based on the information given. Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff Lii jii III ? Question 6 Not yet saved "A protective put is an investment strategy that involves purchasing an asset and a put on that asset simultaneously. It guarantees a maximum payoff equal to the put's exercise price." Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff jii III C? O Question 7 A stock's price is estimated using Constant-growth Dividend Discount Model (formula below): Not yet saved Marked out of 1.00 D Po = ke - g P Flag question where PO is the current price, D1 is the divided at time period 1, ke is the cost of equity and g is the growth rate. After a positive announcement, the growth rate g estimate increased (new growth rate g'>g) without changes in forecast D1. This event leads to an increase in price, PO' > PO. We conclude that: because of the good news, the expected return for new investors (buying at the new price PO') is now higher. Is the above statement true or false? Give explanations. 1 A B U I Ff !!! III 3? O Question 8 Not yet saved "A hedger who is long in a gold futures contract has to close out his position prior to futures maturity. The increase in basis benefits the profitability of her position." Is the above statement True or False? Give explanations. Marked out of 1.00 P Flag question 1 A BU I Ff Lii jii III C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts