Question: Question 1 part 1 Question 1 part 2 Rob has $1,000 to invest for 120 days and is considering two options. Option 1: He can

Question 1 part 1

Question 1 part 2

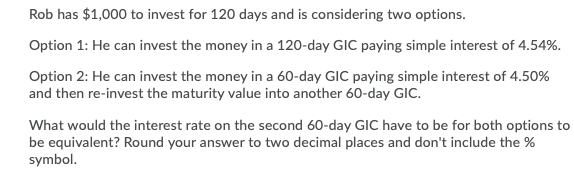

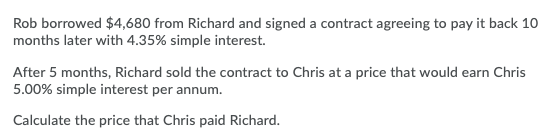

Rob has $1,000 to invest for 120 days and is considering two options. Option 1: He can invest the money in a 120-day GIC paying simple interest of 4.54%. Option 2: He can invest the money in a 60-day GIC paying simple interest of 4.50% and then re-invest the maturity value into another 60-day GIC. What would the interest rate on the second 60-day GIC have to be for both options to be equivalent? Round your answer to two decimal places and don't include the % symbol. Rob borrowed $4,680 from Richard and signed a contract agreeing to pay it back 10 months later with 4.35% simple interest. After 5 months, Richard sold the contract to Chris at a price that would earn Chris 5.00% simple interest per annum. Calculate the price that Chris paid Richard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts