Question: Question 1 Part A Based on the information given below calculate 4 Four types of revenue for X Federal Government for the year 2020: Below

Question 1

Part A

Based on the information given below calculate 4 Four types of revenue for X Federal Government for the year 2020:

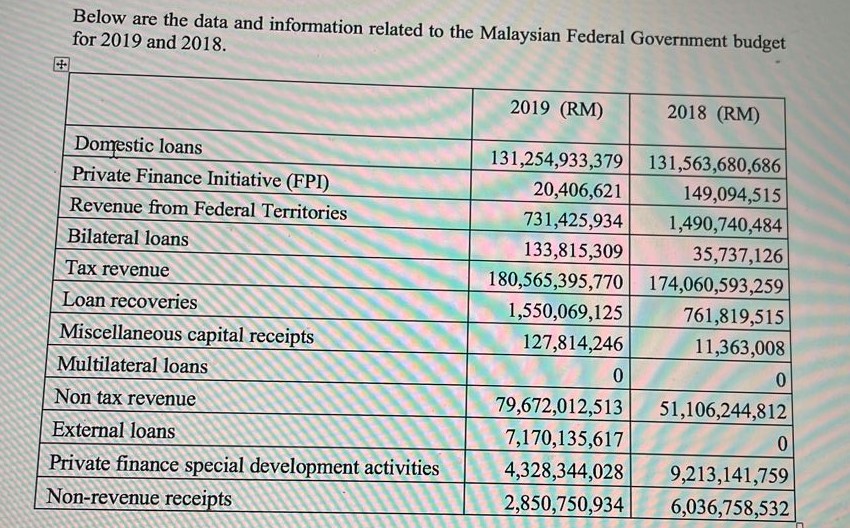

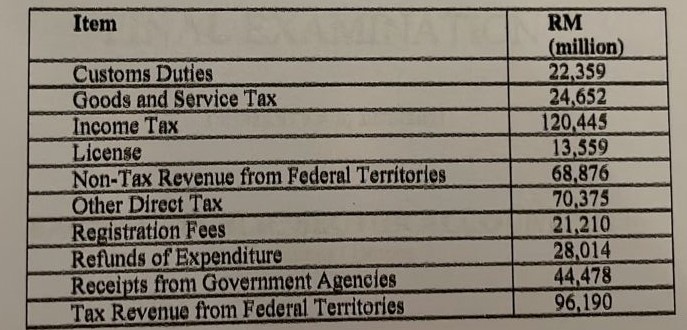

Below are the data and information related to the Malaysian Federal Government budget for 2019 and 2018. 2019 (RM) 2018 (RM) Domestic loans 131,254,933,379 131,563,680,686 Private Finance Initiative (FPI) 20,406,621 149,094,515 Revenue from Federal Territories 731,425,934 1,490,740,484 Bilateral loans 133,815,309 35,737,126 Tax revenue 180,565,395,770 174,060,593,259 Loan recoveries 1,550,069,125 761,819,515 Miscellaneous capital receipts 127,814,246 11,363,008 Multilateral loans 0 Non tax revenue 79,672,012,513 51,106,244,812 External loans 7,170,135,617 O Private finance special development activities 4,328,344,028 9,213,141,759 Non-revenue receipts 2,850,750,934 6,036,758,532Item RM (million) Customs Duties 22,359 Goods and Service Tax 24,652 Income Tax 120.445 License 13,559 Non-Tax Revenue from Federal Territories 68,876 Other Direct Tax 70.375 Registration Fees 21,210 Refunds of Expenditure 28,014 Receipts from Government Agencies 44.478 Tax Revenue from Federal Territories 96,190

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts