Question: Question 1: Please provide clear explanation when needed and show necessary calculations. M Corporation is commercially domiciled in State A and is subject to tax

Question 1: Please provide clear explanation when needed and show necessary calculations.

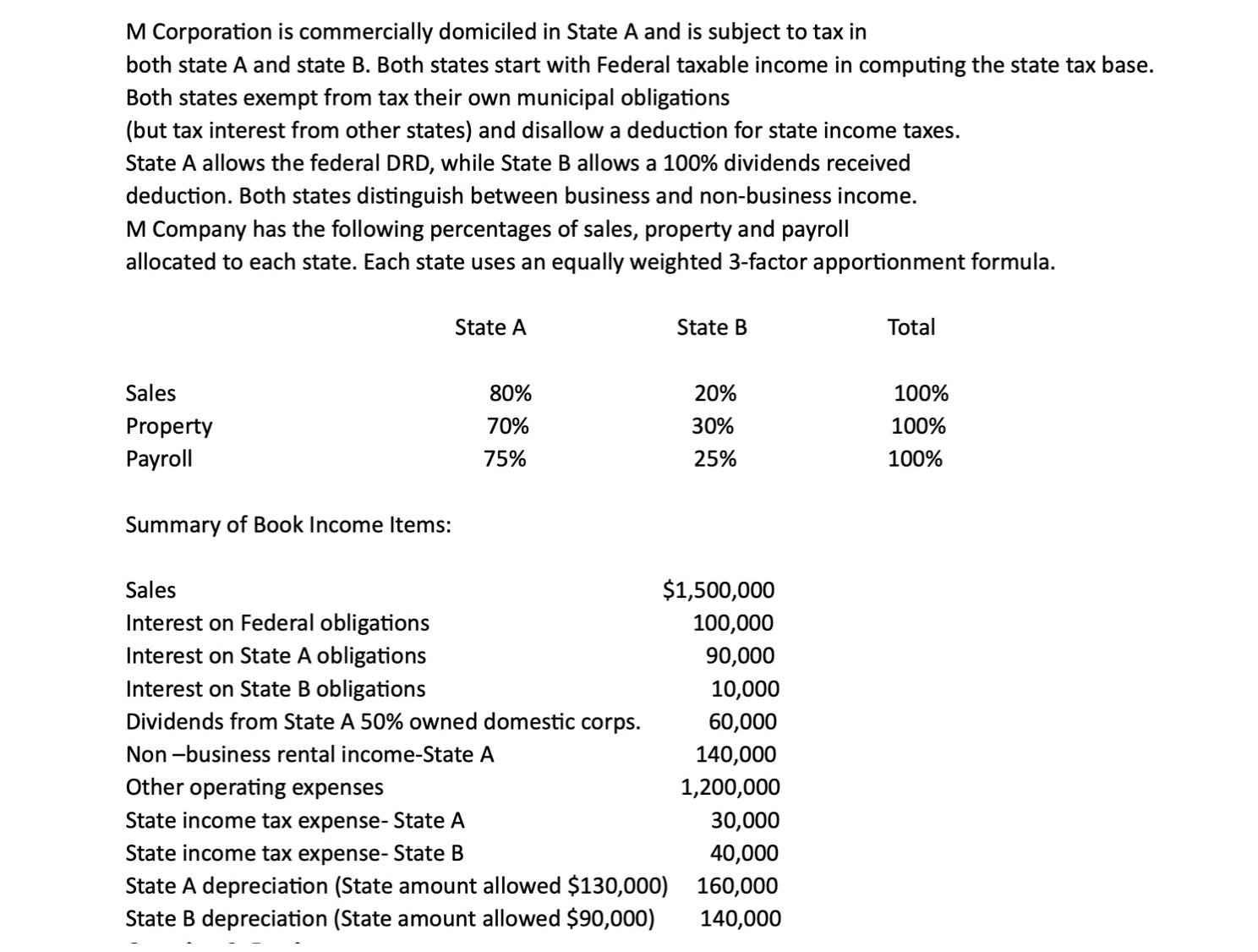

M Corporation is commercially domiciled in State A and is subject to tax in both state A and state B. Both states start with Federal taxable income in computing the state tax base. Both states exempt from tax their own municipal obligations (but tax interest from other states) and disallow a deduction for state income taxes. State A allows the federal DRD, while State B allows a 100% dividends received deduction. Both states distinguish between business and non-business income. M Company has the following percentages of sales. property and payroll allocated to each state. Each state uses an equally weighted 3-factor apportionment formula. State A State B Total Sales 80% 20% 100% Property 70% 30% 100% Payroll 75% 25% 100% Summary of Book Income Items: Sales 51,500,000 Interest on Federal obligations 100,000 Interest on State A obligations 90,000 Interest on State B obligations 10,000 Dividends from State A 50% owned domestic corps. 60,000 Non business rental income-State A 140,000 Other operating expenses 1,200,000 State income tax expense- State A 30,000 State income tax expense- State B 40,000 State A depreciation (State amount allowed $130,000) 160,000 State B depreciation (State amount allowed $90,000) 140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts