Question: Question 1: Practicing with Present Values Suppose that in our economy, there is an annual interest rate of 8%. First of all, consider a promise

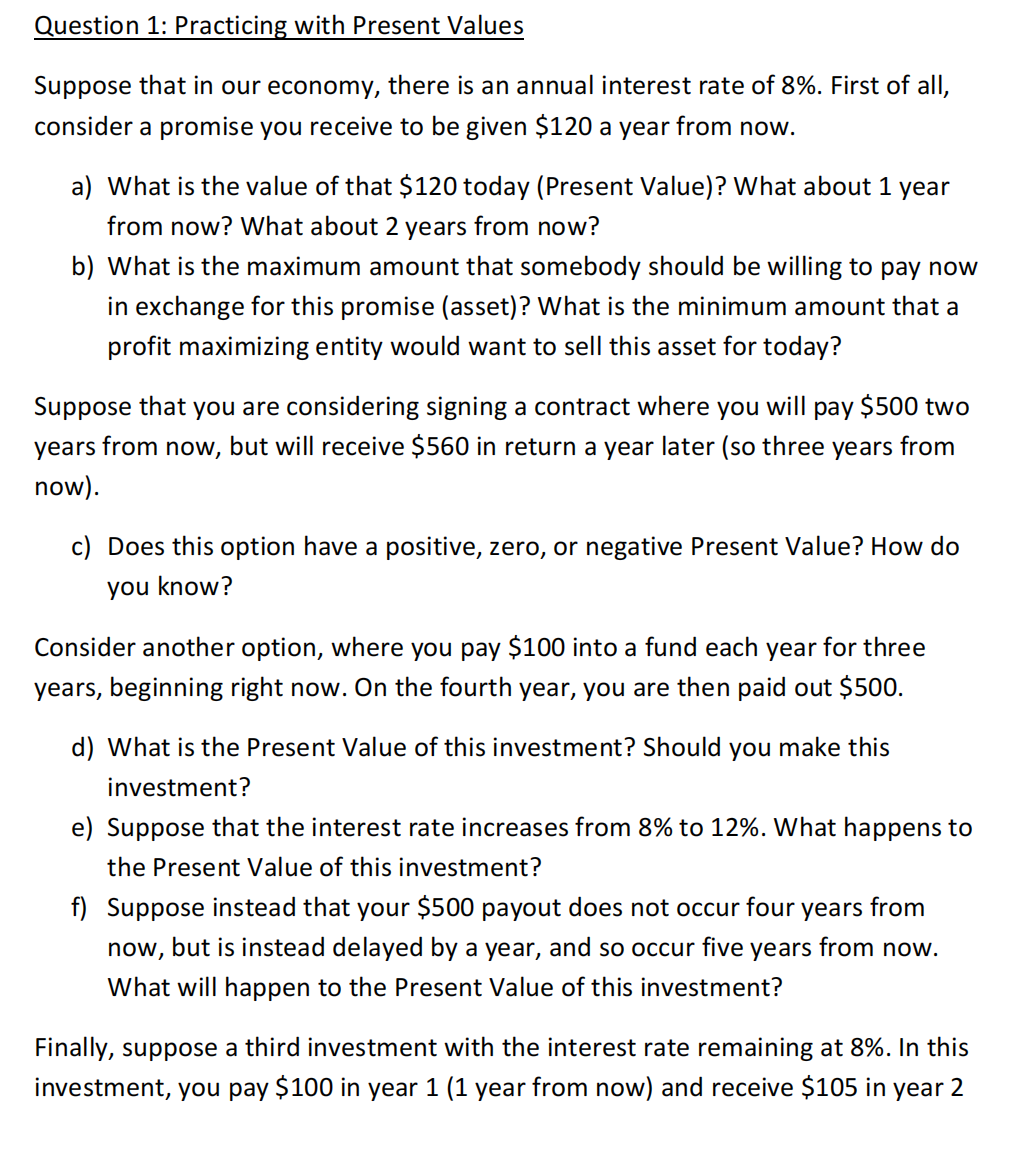

Question 1: Practicing with Present Values Suppose that in our economy, there is an annual interest rate of 8%. First of all, consider a promise you receive to be given $120 a year from now. a) What is the value of that 5120 today (Present Value)? What about 1 year from now? What about 2 years from now? b) What is the maximum amount that somebody should be willing to pay now in exchange for this promise (asset)? What is the minimum amount that a profit maximizing entity would want to sell this asset for today? Suppose that you are considering signing a contract where you will pay 5500 two years from now, but will receive $560 in return a year later (so three years from now). c) Does this option have a positive, zero, or negative Present Value? How do you know? Consider another option, where you pay 5100 into a fund each yearfor three years, beginning right now. On the fourth year, you are then paid out 5500. d) What is the Present Value of this investment? Should you make this investment? e) Suppose that the interest rate increases from 8% to 12%. What happens to the Present Value of this investment? f) Suppose instead that your 5500 payout does not occur four years from now, but is instead delayed by a year, and so occur five years from now. What will happen to the Present Value of this investment? Finally, suppose a third investment with the interest rate remaining at 8%. In this investment, you pay $100 in year 1 (1 year from now) and receive $105 in year 2 (2 years from now). Then, in year 3, you pay another $100 and receive $105 back in year 4. You repeat this cycle for 6 more years. g) What is the present value of the part of this investment that occurs in Years 3 8: 4 only? h) Doe this investment have a positive, zero, or negative Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts