Question: Question 1. Prduce spreadsheet model. 2. Experiment with solver to conclude the optimal solution. 3. provide algebraice form of model. 4. produce sentivity analysis report

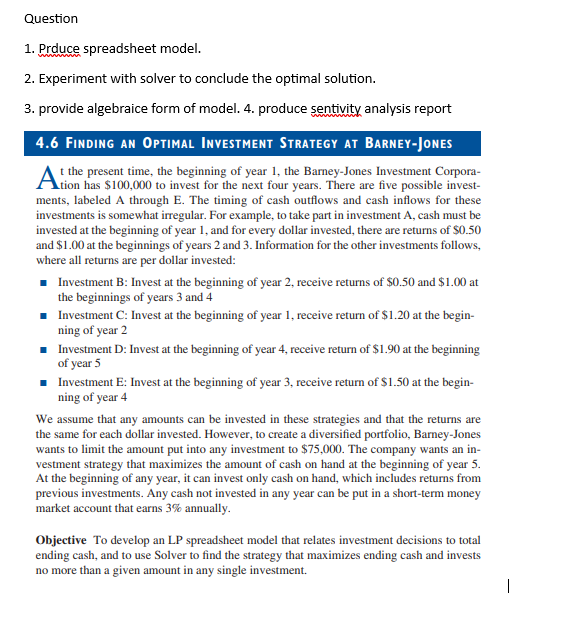

Question 1. Prduce spreadsheet model. 2. Experiment with solver to conclude the optimal solution. 3. provide algebraice form of model. 4. produce sentivity analysis report 4.6 Finding an Optimal Investment Strategy at Barney-Jones t the present time, the beginning of year 1 , the Barney-Jones Investment Corporation has $100,000 to invest for the next four years. There are five possible investments, labeled A through E. The timing of cash outflows and cash inflows for these investments is somewhat irregular. For example, to take part in investment A, cash must be invested at the beginning of year 1 , and for every dollar invested, there are returns of $0.50 and $1.00 at the beginnings of years 2 and 3 . Information for the other investments follows, where all returns are per dollar invested: - Investment B: Invest at the beginning of year 2, receive returns of $0.50 and $1.00 at the beginnings of years 3 and 4 - Investment C : Invest at the beginning of year 1 , receive return of $1.20 at the beginning of year 2 - Investment D : Invest at the beginning of year 4 , receive return of $1.90 at the beginning of year 5 - Investment E: Invest at the beginning of year 3, receive return of $1.50 at the beginning of year 4 We assume that any amounts can be invested in these strategies and that the returns are the same for each dollar invested. However, to create a diversified portfolio, Barney-Jones wants to limit the amount put into any investment to $75,000. The company wants an investment strategy that maximizes the amount of cash on hand at the beginning of year 5 . At the beginning of any year, it can invest only cash on hand, which includes returns from previous investments. Any cash not invested in any year can be put in a short-term money market account that earns 3% annually. Objective To develop an LP spreadsheet model that relates investment decisions to total ending cash, and to use Solver to find the strategy that maximizes ending cash and invests no more than a given amount in any single investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts