Question: Question 1 -Prepare the schedule using effective-interest method to amortize bond premium or disount grouoer -Prepare the Journal Entry to record the issuance of the

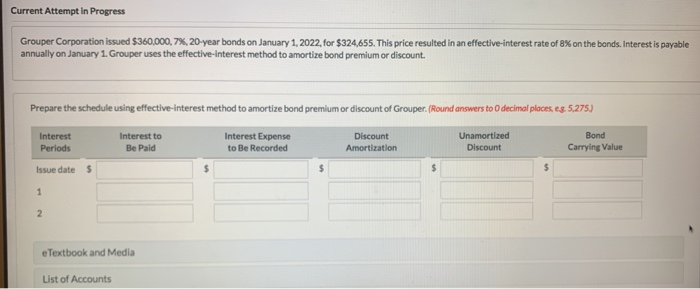

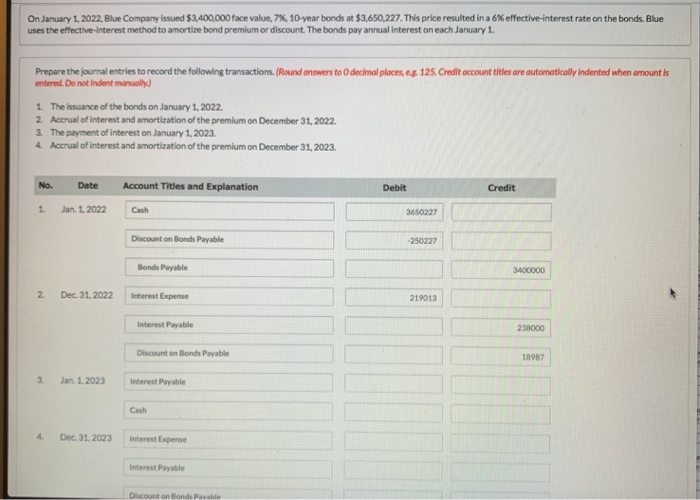

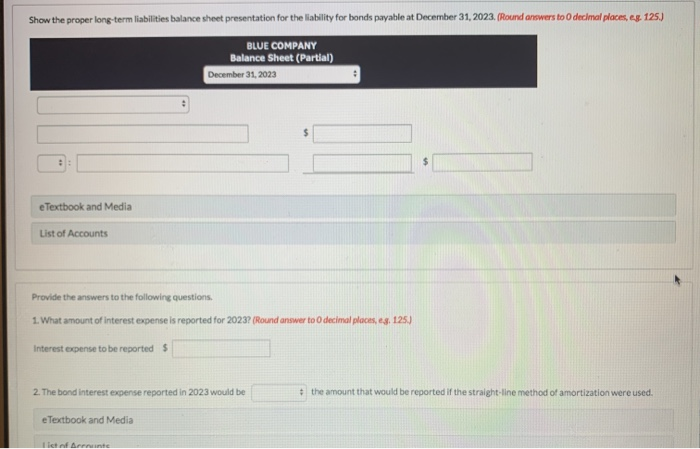

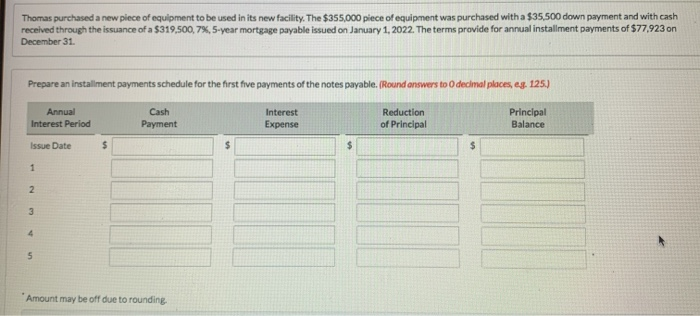

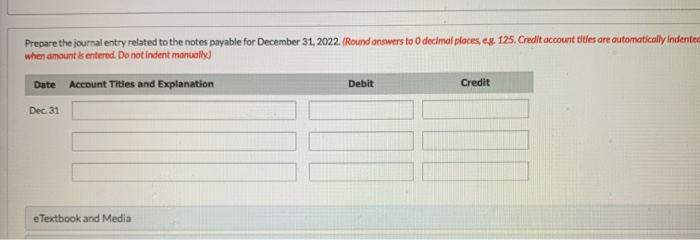

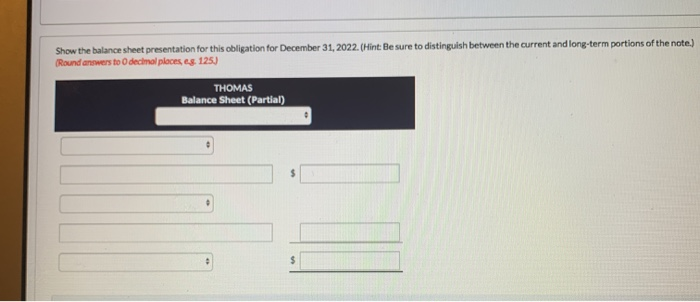

Current Attempt in Progress Grouper Corporation issued $360,000,7%, 20 year bonds on January 1, 2022 for $324,655. This price resulted in an effective interest rate of 8% on the bonds. Interest is payable annually on January 1. Grouper uses the effective interest method to amortize bond premium or discount Prepare the schedule using effective interest method to amortize bond premium or discount of Grouper. (Round answers to decimal places, eg. 5,275) Interest Periods Interest to Be Paid Interest Expense to Be Recorded Discount Amortization Unamortized Discount Bond Carrying Value Issue date $ e Textbook and Media List of Accounts On January 1, 2022, Blue Company issued $3,400,000 face value, 7%, 10-year bonds at $3,650,227. This price resulted in a 6% effective interest rate on the bonds. Blue uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on each January 1. Prepare the journal entries to record the following transactions. (Round answers to decimal placess. 125. Credit account titles are automatically indented when amount is entered. Do not Indent manually) 1. The issuance of the bonds on January 1, 2022 2 Accrual of interest and amortization of the premium on December 31, 2022. 3. The payment of interest on January 1, 2023 4. Accrual of interest and amortization of the premium on December 31, 2023. No. Date Account Titles and Explanation Debit Credit 1 Jan. 1, 2022 Cash 3650227 Discount on Bonds Payable -250227 Bonds Payable 3400000 2 Dec 31, 2022 Interest Expense 219013 Interest Payable Discount on Bonds Payable Jan. 1.2023 Interest Payable Cash 4. Dec 31, 2023 Interest Expense Interest Payable Discount on Bonds Pavabla Show the proper long-term liabilities balance sheet presentation for the ability for bonds payable at December 31, 2023. Round answers to decimal places, s. 125 BLUE COMPANY Balance Sheet (Partial) December 31, 2023 e Textbook and Media List of Accounts Provide the answers to the following questions 1. What amount of interest expense is reported for 2023? (Round answer to decimal places, s. 125.) Interest expense to be reported $ 2. The bond interest expense reported in 2023 would be the amount that would be reported if the straight-line method of amortization were used. e Textbook and Media let Thomas purchased a new piece of equipment to be used in its new facility. The $355,000 piece of equipment was purchased with a $35,500 down payment and with cash received through the issuance of a $319,500,7%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $77.923 on December 31 Prepare an installment payments schedule for the first five payments of the notes payable. (Round answers to decimal places, eg. 125.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue Date Amount may be off due to rounding. decimal places. 125. Creditoccount titles are automatically indente Prepare the journal entry related to the notes payable for December 31, 2022. Round answers to when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Dec. 31 e Textbook and Media Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.) (Round answers to decimal places, s. 125.) THOMAS Balance Sheet (Partial)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts