Question: Question 1:) QUESTION 1 Match the terms with the correct definition The resources a business or individual owns A. Accrued Expenses A promise to pay

Question 1:)

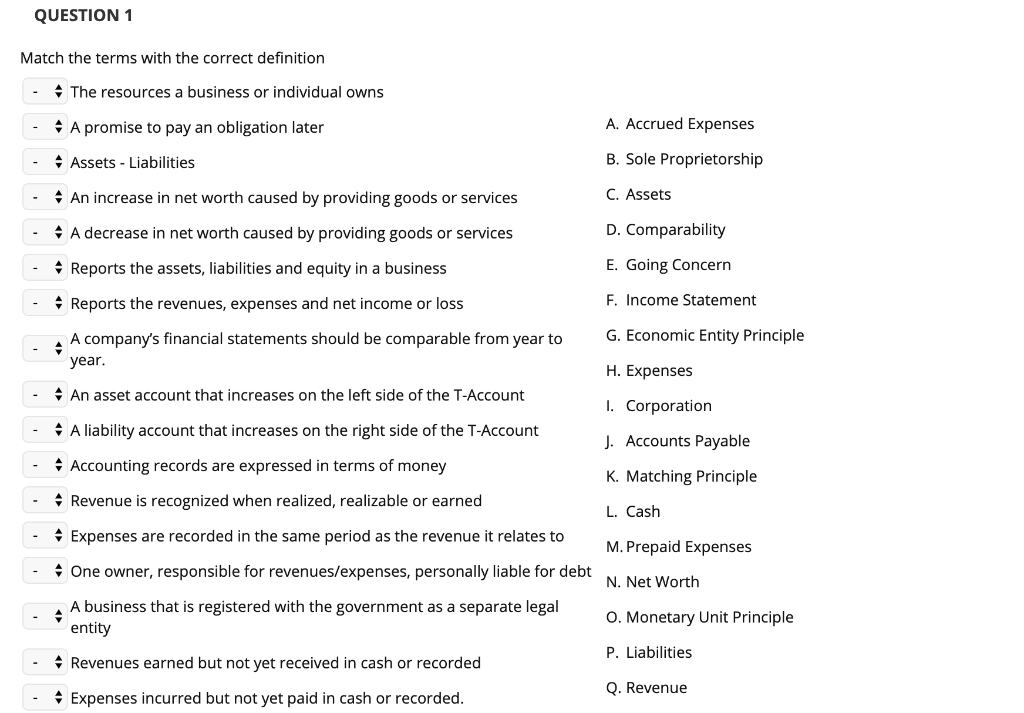

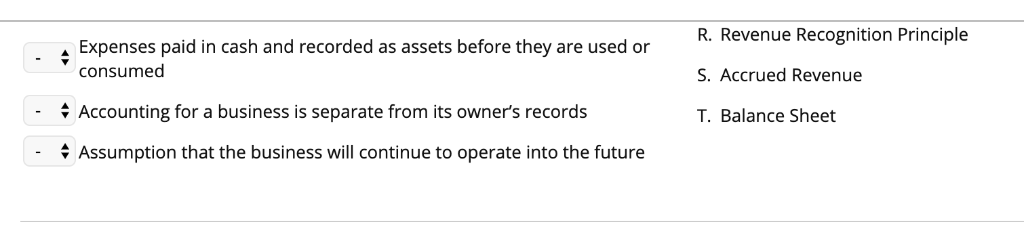

QUESTION 1 Match the terms with the correct definition The resources a business or individual owns A. Accrued Expenses A promise to pay an obligation later B. Sole Proprietorship Assets Liabilities C. Assets An increase in net worth caused by providing goods or services D. Comparability A decrease in net worth caused by providing goods or services E. Going Concern Reports the assets, liabilities and equity in a business F. Income Statement Reports the revenues, expenses and net income or loss G. Economic Entity Principle A company's financial statements should be comparable from year to year. H. Expenses An asset account that increases on the left side of the T-Account I. Corporation A liability account that increases on the right side of the T-Account J. Accounts Payable Accounting records are expressed in terms of money K. Matching Principle Revenue is recognized when realized, realizable or earned L. Cash Expenses are recorded in the same period as the revenue it relates to M. Prepaid Expenses One owner, responsible for revenues/expenses, personally liable for debt N. Net Worth A business that is registered with the government as a separate legal entity O. Monetary Unit Principle P. Liabilities Revenues earned but not yet received in cash or recorded Q.Revenue Expenses incurred but not yet paid in cash or recorded. R. Revenue Recognition Principle Expenses paid in cash and recorded as assets before they are used or consumed S. Accrued Revenue Accounting for a business is separate from its owner's records T. Balance Sheet Assumption that the business will continue to operate into the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts